Advanced economies face a landscape fraught with challenges that demand attention — the most pressing of which is the talent shortage that threatens to cripple the global economy.

Labor markets in countries like the US, Germany, and Japan have steadily tightened for nearly two decades. Beyond just being a blip caused by the recent pandemic, this is a long-term shift that can significantly impact businesses, policymakers, and consumers.

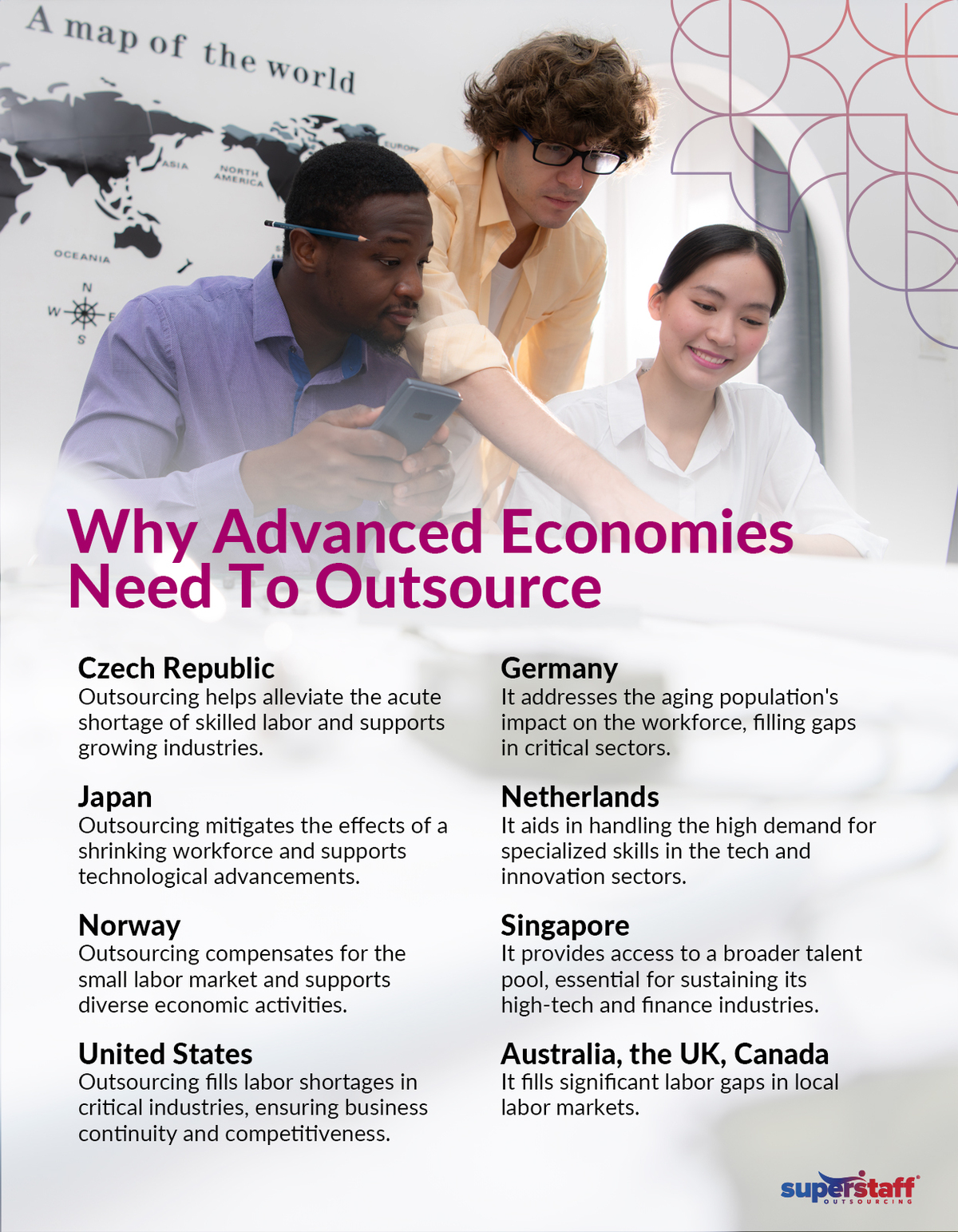

As advanced economies navigate the complexities of tightening labor markets, outsourcing emerges as a much-needed strategy for addressing workforce shortages and enhancing operational efficiency. Businesses can leverage outsourcing to access global talent pools, reduce costs, and maintain agility in an increasingly competitive landscape.

While it is not a one-size-fits-all solution, outsourcing’s potential to fill skill gaps and drive innovation makes it a valuable tool for companies aiming to thrive in challenging economic environments.

Behind the Labor Crisis in Advanced Economies

Job vacancies are overflowing, but there simply aren’t enough people to fill them. This imbalance isn’t just about finding warm bodies to occupy desks or job sites. It’s rooted in the economic engine itself. McKinsey estimates that if all these vacancies were filled, major advanced economies’ GDP could have been 0.5% to 1.5% higher in 2023 alone.

So, why are we in this situation? The roots trace back to the aftermath of the 2008 financial crisis. On average, it took these economies over eight years to rebound to pre-crisis labor market conditions. The recovery was sluggish, but the gap between job vacancies and available workers widened as economies grew.

Then came the COVID-19 pandemic, an epic disruptor. It temporarily swung labor markets wildly—from extreme looseness to unprecedented tightness—partly because generous government stimulus packages spurred rapid job recovery in some places.

As we navigate the post-pandemic era, labor markets remain historically tight, albeit cooling slightly from their peak. For example, the ratio of job vacancies to unemployed persons in the US dropped from 1.4 in late 2023 to 1.2 by April 2024. However, the overall trend of tightening persists across the board.

This tightening isn’t the same for all countries. Some, like the US, Germany, and Japan, face acute shortages, while others, like France and Italy, have it easier. Regardless of current conditions, the trend toward tighter labor markets is a wake-up call for action. Businesses of all sizes must innovate and adapt to survive and thrive in this environment.

Inside Czechia’s Labor Market: Opportunities and Challenges

Let’s take a closer look at one of these countries.

The Czech Republic is a significant player in the European market, boasting favorable economic conditions. With the lowest unemployment rate in the European Union at 3.7% and a robust labor participation rate of 77.13%, the country showcases a solid commitment to workforce engagement.

Its workforce population is approximately 5.07 million, reflecting a dynamic labor market environment. However, regional disparities and seasonal trends continue to influence its economic landscape.

Regional Disparities

The labor market situation in Czechia reveals substantial regional differences. For instance, the northern and eastern regions experience higher unemployment rates than Central Bohemia and Prague’s capital city. In March 2023, the unemployment rate in Prague stood at a relatively low 3.1%. In contrast, regions like Karlovy Vary and Ústí nad Labem faced unemployment rates of around 6%.

Seasonal Trends

Meanwhile, unemployment rates in the Czech Republic also exhibit seasonal fluctuations. Typically, unemployment rises during the winter months and falls as spring approaches. Additionally, tradesmen who had temporarily suspended their businesses during the winter began resuming their activities with the arrival of spring.

Foreign Workers

To address the labor shortage, the Czech government has approved a proposal to increase quotas for foreign workers from third countries by 20,000 as of 2024. This is in response to ongoing industry shortages, including healthcare, construction, and IT.

Key Points of the Government Proposal

- Increased Quotas: The annual recruitment of foreign workers will rise to 33,500.

- Focus Areas: The new quotas will primarily benefit sectors like IT, healthcare, and construction, facing acute labor shortages.

- Economic Impact: This measure is expected to boost GDP, strengthen the labor market, and increase state budget revenues.

The Czech Republic employs many foreign workers, mainly from neighboring EU countries. As of December 31, 2022, the workforce included large numbers of Slovakian (236,430) and Polish (52,072) citizens, along with substantial populations from Romania (49,269), Bulgaria (39,071), and Hungary (25,438). Non-EU countries also contribute notably to the labor force, with Ukrainian (300,889), Vietnamese (38,029), and Russian (24,923) nationals making up significant portions of the foreign worker population.

Ukrainian nationals play a crucial role in the Czech labor market. They primarily found employment in Central Bohemia, Plzeň, and South Moravia. They often took on roles as product and equipment assemblers, construction workers, production and transport helpers, or stationary machine operators. However, language barriers pose significant challenges, leading the government to offer Czech language courses to aid their integration.

Addressing the Labor Shortage: The Role of Outsourcing

Given these labor market challenges, outsourcing has emerged as a crucial strategy for addressing workforce shortages and enhancing operational efficiency. By leveraging global talent pools, businesses can access the necessary skills, reduce costs, and maintain agility in a competitive economic landscape.

Business Process Outsourcing (BPO) can also be a strategic tool for Czech companies looking to expand their global footprint or enter new markets. Partnering with outsourcing providers in other countries allows them to establish a presence and serve international clients more effectively.

These providers can help mitigate risks associated with local economic fluctuations, regulatory changes, or talent shortages as diversifying operations geographically spreads risk and enhances business continuity planning.

Germany’s Dynamic Labor Market: Navigating Workforce Shortages and Opportunities

Moving from Central Europe, Germany presents unique challenges and opportunities in the outsourcing landscape.

With a population of 84.3 million, this powerhouse is the largest economy in the European Union (EU) and the fourth largest globally, following the USA, China, and Japan. Known for its robust export sector, Germany is the world’s third-largest exporter, boasting major automotive, chemical, and electronics industries. Companies like Volkswagen, Daimler, BMW, BASF, and Siemens are renowned globally. Interestingly, 55.1% of the workforce in Germany is employed by small and medium-sized enterprises (SMEs), highlighting the significant role these businesses play in the economy.

The labor force participation rate in the country is notably high at 79.88%, reflecting a strong engagement in the workforce. However, despite its economic prowess, it contends with various labor market challenges and opportunities influenced by domestic policies and global economic trends.

Employment Statistics and Regional Disparities

In March 2023, Germany’s employment reached 45.72 million people, marking a 1.0% year-on-year jump. Meanwhile, the national unemployment rate in April 2023 was 5.7%, with a seasonally adjusted rate remaining at 5.6%.

Current Job Vacancies

As of April 2023, there were 773,000 reported job vacancies in Germany, a 9% decrease from the previous year. The country also employed around 237,929 cross-border commuters, highlighting its central position in Europe and the significant number of workers commuting from neighboring countries like Poland and France.

Labor Force Characteristics and Demand for Skilled Workers

Germany’s labor market demands well-educated individuals with professional qualifications, whether through academic studies or vocational training. The following sectors currently have a significant demand for skilled workers:

Healthcare Sector

- Doctors: Despite good earning opportunities and high social status, there’s a growing shortage of doctors, especially in rural areas. Foreign doctors with equivalent qualifications can obtain a national license to practice in Germany after undergoing a recognition procedure.

- Nurses: There is a high demand for qualified nurses in hospitals, retirement homes, and other care facilities. Foreign nurses can apply for qualifications recognized in Germany, provided they meet the medical fitness and language proficiency requirements.

Engineering Sector

- Engineers: Germany’s industrial sector offers abundant career opportunities for engineers, particularly in electrical and construction engineering, mechanical engineering, and vehicle manufacturing. Foreign engineers with qualifications equivalent to German standards are eligible for recognition and employment.

STEM Fields

- Scientists and Computer Scientists: The STEM fields (science, technology, engineering, and mathematics) have numerous vacancies, both in the private sector and public research institutes. The Central Office for Foreign Education (ZAB) can recognize foreign STEM graduates’ university degrees as equivalent to German diplomas.

Addressing the Labor Shortage: The Role of Outsourcing

Germany is a global leader in technology and innovation.

Outsourcing to countries with advanced technological capabilities can provide local companies access to cutting-edge expertise and innovation, helping them stay ahead in competitive markets. Recruitment Process Outsourcing (RPO) can help companies navigate complex international regulations and compliance requirements more effectively. Additionally, partnering with outsourcing providers specializing in specific regulatory environments can mitigate legal risks and ensure adherence to local laws.

While Germany maintains high labor standards and wages, outsourcing can still offer cost advantages in specialized, high-skill areas where local expertise may be scarce or expensive to acquire and maintain.

Japan’s Talent Crisis: Facing a New Tipping Point

As we shift our focus to Asia, Japan’s labor market dynamics present different outsourcing opportunities.

The country is experiencing significant shifts as the available pool of potential workers dwindles. The number of people aged 15 or older who are not employed or seeking work but still hope for a job has drastically decreased over the past two decades. In 2023, this number fell to 2.33 million, down from 5.3 million in 2003, according to the Ministry of Internal Affairs and Communications’ labor force survey. With the 1.78 million unemployed people actively seeking work, Japan had 4.11 million potential workers or 3.7% of the population aged 15 or older. This is less than half of the 2003 level of 8%.

Factors Contributing to the Labor Shortage

The decline in the number of people on the sidelines of Japan’s labor market is attributed to economic recovery and increased job opportunities for people past the traditional retirement age and women who had previously left the labor market to raise children. The National Institute of Population and Social Security Research noted that the working-age population (15 to 64) decreased by 15% from its peak in 1995 to 2023, while the number of workers increased by about 4 million over the same period. The M-shaped curve, which represented a dip in employment among women in their 30s due to marriage and childrearing, has almost disappeared in Japan.

Recent Labor Market Data

The country’s job market remained tight in January 2024, putting pressure on companies to offer solid wage increases during annual negotiations with labor unions. Meanwhile, the unemployment rate fell to 2.4% from 2.5% in February, marking the lowest since early 2020.

Strategies for Coping with Labor Shortages

To cope with the labor shortage, companies must focus on higher labor productivity, increased job mobility, and greater foreign participation in the workforce. By 2035, Japan will have nearly 8 million workers short of the level needed to match the economy’s potential growth rate of 0.5% per year.

Artificial intelligence and other technologies could play a crucial role in enhancing productivity. For example, Osaka has allowed around 20,000 municipal workers to use generative AI to translate and prepare meeting minutes. This initiative aims to free up employees for more valuable, human-centric tasks.

Addressing the Labor Shortage: The Role of Outsourcing

Japan’s labor market is critical, with significant implications for businesses and the economy. The country faces significant demographic challenges, including an aging population and low birth rates, resulting in a shrinking workforce.

Companies must innovate and adapt as the talent pool shrinks to maintain productivity and growth. By embracing technology, improving labor productivity, and facilitating greater job mobility and foreign worker participation, it can navigate these challenges and sustain its economic vitality.

One solution it can turn to is outsourcing. RPO allows Japanese companies to supplement their domestic labor force with skilled workers from other countries, helping to mitigate workforce shortages and maintain productivity. Delegating certain functions to countries with lower labor costs can help Japanese companies reduce operational expenses.

Moreover, since cultural factors, including work ethic, communication styles, and business practices, influence Japan’s labor market dynamics, outsourcing to culturally compatible countries can facilitate smoother collaboration and alignment of business goals, enhancing operational efficiency and effectiveness.

Employment in the Netherlands: A Snapshot

Continuing our exploration of advanced economies, the Netherlands offers a distinct perspective on outsourcing driven by its innovative economy.

In 2022, it maintained a low unemployment rate of 3.5%, corresponding to about 350,000 people. This rate is favorable both historically and compared to other European countries. However, youth unemployment (ages 15-25) is notably higher at 7.6%, while those over 45 have a lower rate of 2.5%. Despite the lower unemployment rate among older individuals, once they become unemployed, it is challenging for them to secure new employment. The CPB predicts a slight increase in the overall unemployment rate to 4.1% in 2024, affecting around 415,000 people.

Registered Jobseekers

At the end of 2022, the UWV registered 703,000 unemployed individuals. This group includes those entitled to various benefits; not all are immediately employable. However, among the registered jobseekers, those receiving unemployment benefits have the best prospects due to their recent work experience and immediate employability.

Addressing the Labor Shortage: The Role of Outsourcing

Outsourcing presents a strategic opportunity for the Netherlands amidst its strong focus on technology and innovation sectors.

With predictions indicating a slight uptick in unemployment, this strategy becomes increasingly relevant to leverage global talent pools and specialized skills. By outsourcing certain functions, Dutch companies can manage operational costs effectively and access advanced technological expertise crucial for sustaining their innovative edge. This approach supports economic resilience and fosters strategic growth opportunities in a competitive global landscape, aligning with the Netherlands’ reputation as a hub for technological advancement and business innovation.

Furthermore, RPO allows Dutch businesses to focus on core competencies and strategic initiatives. Companies can streamline operations, improve efficiency, and allocate resources strategically by delegating non-core functions such as customer service, IT support, or back-office operations to external providers. This streamlined approach enhances productivity and supports innovation and business growth, fostering a dynamic business environment in line with the Netherlands’ reputation as a leader in innovation and entrepreneurship.

Dissecting Employment and Unemployment in Norway

Shifting to Scandinavia, Norway’s labor market dynamics and outsourcing trends reveal unique challenges and opportunities.

Population and Employment Rates

As of the first quarter of 2023, Norway’s population was 5.49 million. The 20-44 age group forms the largest segment, comprising 1,824,740 people. By the start of 2023, Norway boasted an employment rate of 69.7%, one of the highest globally, with only the Netherlands and Iceland having higher employment rates within the EU/EEA area. The high employment rate is attributed to significant participation from both older and younger individuals and a relatively high employment rate for women. However, the prevalence of part-time employment reduces Norway’s ranking in terms of hours worked per week.

Unemployment Measures and Rates.

In March 2023, the country reported an unemployment rate of 1.8%. Including those in labor market initiatives, the rate was 2.2%. These figures represent the lowest unemployment rates since before the 2008 financial crisis. Despite the low unemployment, many job vacancies indicate intense competition for labor and a mismatch between available skills and those demanded.

Labor Market Challenges

The Norwegian labor market faces significant challenges despite low unemployment. There is a pronounced mismatch between the skills employers require and job seekers possess. For instance:

- Vocational Training: Individuals with vocational qualifications are virtually guaranteed employment in Norway.

- Skills Gap: Many companies struggle to find applicants with the needed skills, leading to some businesses closing due to recruitment difficulties.

- Open Job Advertisements: Responding to these challenges, some employers set open job advertisements to attract more applicants.

The Confederation of Norwegian Enterprise’s (NHO) Skills Barometer for 2023 indicates that 46% of companies faced recruitment difficulties over the past year, and the government projects a shortfall of around 70,000 employees, especially in the health, engineering, and manufacturing sectors.

Green Transition and Future Prospects

Norway is shifting towards green industries, with new projects such as battery factories, carbon capture plants, and offshore wind turbine production. However, local and national recruitment cannot meet the needs of these industries, and the U.S. Inflation Reduction Act (IRA) has slowed some projects as they await similar EU/EEA support schemes.

Addressing the Labor Shortage: The Role of Outsourcing

Outsourcing offers several strategic benefits to Norwegian businesses. First and foremost, it allows companies to manage high labor costs by accessing more cost-effective labor markets for specific functions. This is crucial for maintaining profitability and competitiveness in a challenging economic environment. Moreover, outsourcing provides access to specialized skills and expertise unavailable locally, addressing the skills gap and enhancing operational capabilities.

By delegating non-core functions to external providers, companies can streamline operations, improve efficiency, and allocate resources more effectively. This streamlined approach supports innovation and growth, particularly as Norway transitions towards green industries such as battery production and renewable energy projects.

Ultimately, outsourcing in Norway is a strategic imperative for businesses seeking to navigate tight labor markets, manage costs, access specialized skills, and drive growth in emerging sectors. These advantages position outsourcing as a pivotal strategy for Norwegian companies looking to sustain competitiveness and capitalize on opportunities in a rapidly evolving global economy.

Singapore’s Labor Market: An Ever-Changing Landscape of Employment Trends and Workforce Shifts

Moving to Southeast Asia, Singapore’s strategic position and robust economy make it a prime candidate for outsourcing.

This economic tiger continues to shine on the global stage with one of the highest employment rates, consistently outperforming many OECD countries. Yet, 2023 brought about nuanced shifts within the labor force that reflect its economic landscape’s strengths and evolving challenges.

Employment Rates and Trends

After peaking at 67.5% in 2022, the employment rate for Singaporeans aged 15 and over slightly dipped to 66.2% in 2023. This drop is not indicative of job scarcity but rather a rise in the number of people staying outside the labor force. Over the past decade, the employment rate has grown by 1.1%-points from 2018 to 2023, maintaining a steady increase similar to the previous five years.

Interestingly, Singapore boasts the fourth-highest employment rate among OECD countries, thanks partly to proactive policies encouraging women’s workforce participation and enhancing older workers’ employability. For instance, the employment rate for seniors (65 and over) remained robust despite a minor drop from 31.0% in 2022 to 30.6% in 2023.

Youth and Female Participation

The youth employment rate (aged 15 to 24) declined from its COVID-19 peak, settling at 33.2% in 2023 as more students returned to in-person classes and extracurricular activities. Conversely, female employment has steadily risen from 55.6% in 2013 to 60.3% in 2023, spurred by improved educational attainment and flexible workplace practices.

Labor Force Participation and Aging Workforce

The overall labor force participation rate among Singaporeans (15 years and over) fell from 70.0% in 2022 to 68.6% in 2023. This trend is influenced by Singapore’s aging population, with the median age of the resident labor force increasing from 42 in 2013 to 44 in 2023. The share of those aged 55 and over in the labor force has notably risen, reflecting longer working lives and higher life expectancy.

Educational Attainment and Income Trends

Educational levels within the labor force have improved significantly. In 2023, 62.8% of the labor force had tertiary qualifications, up from 49.9% in 2013. Degree holders, in particular, have maintained high employment rates and steady median incomes, although real income growth has been modest due to inflation and the economic impacts of COVID-19.

Underemployment and Self-Employment Trends

The time-related underemployment rate fell to a decade-low of 2.3% in 2023, reflecting increased demand for workers, particularly in consumer-facing sectors. Meanwhile, the share of self-employed residents declined, reaching a new low of 12.2%, as more individuals preferred the stability of employee roles amid economic uncertainties.

Singapore’s labor market continues to evolve, shaped by demographic shifts, economic restructuring, and policy interventions. Focusing on skills upgrading and inclusive growth, the nation aims to sustain high employment rates and ensure that all population segments can benefit from economic opportunities.

As Singapore navigates the complexities of an aging workforce and global economic challenges, maintaining its competitive edge will require continued adaptability and strategic planning.

Addressing the Labor Shortage: The Role of Outsourcing

The answer lies in outsourcing. By outsourcing tasks, Singaporeans firms can quickly adapt to market changes and scale operations without the overhead costs of expanding internal teams. This agility is vital for seizing emerging opportunities in dynamic sectors such as fintech and biotechnology.

Furthermore, outsourcing facilitates a strategic focus on core competencies and innovation. Delegating routine tasks to external providers allows firms to concentrate on strategic initiatives that drive growth and market leadership. This streamlined approach boosts productivity, accelerates innovation, and enhances time-to-market for new products and services.

Navigating the US Labor Market: Addressing the Worker Shortage Crisis

Finally, as a global economic leader, the United States presents unique outsourcing dynamics driven by its diverse and complex labor market.

The U.S. labor market faces a significant challenge: a persistent labor shortage. With workforce participation still below pre-pandemic levels, 1.7 million Americans are missing from the workforce compared to February 2020. The latest data reveals 8.5 million job openings but only 6.5 million unemployed workers to fill them.

Companies spanning various sizes and industries across nearly every state consistently report unprecedented difficulties in finding sufficient workers. Millions of positions would remain unfilled even if every unemployed person found a job. This imbalance highlights the complexity of the current labor market.

Key Insights from the U.S. Chamber of Commerce

Labor Force Participation

Although more Americans are participating in the workforce today than before the pandemic, the overall share of the population engaged in the labor force has declined. If the labor force participation rate matched February 2020, we would have over two million additional workers. However, this decline is part of a long-term trend. The participation rate has been falling for decades, driven by several factors.

Pandemic Impact and Worker Sentiment

A survey conducted by the U.S. Chamber in May 2022 provides insights into why many workers have not returned:

- Job Search Activity: Two-thirds of those who lost full-time jobs during the pandemic are only somewhat active or not very active in job searching.

- Remote Work Preference: Approximately half are unwilling to accept jobs without remote work options.

- Permanent Exit from Workforce: Over a quarter believe returning to work is no longer essential.

- Life Changes: Many have altered their livelihoods, with some retiring, becoming homemakers, or transitioning to part-time work.

Factors Contributing to the Labor Shortage

- Early Retirements and Aging Workforce: The pandemic drove over three million adults into early retirement, increasing the share of retirees in the population. The aging demographic is expected to continue impacting workforce numbers.

- Decline in Immigration: Net international migration has significantly decreased, contributing less to population growth than in previous decades.

- Childcare Accessibility: The lack of high-quality, affordable childcare remains a barrier. The pandemic exacerbated this issue, with many childcare providers closing or reducing operations.

- New Business Starts: A record number of new businesses were started, with many workers leaving employment to pursue entrepreneurship.

- Increased Savings: Enhanced unemployment benefits and stimulus checks led to higher savings, allowing some individuals to delay re-entering the workforce.

The Great Reshuffle

The labor market has also experienced the “Great Reshuffle,” in which workers are not merely resigning but actively seeking better opportunities. Despite high quit rates, the hiring rate has outpaced quits, indicating that many are finding new roles and industries that better align with their needs and goals.

Addressing the Labor Shortage: The Role of Outsourcing

Outsourcing provides U.S. companies access to a diverse global talent pool, crucial for industries like technology, healthcare, and finance, where specialized skills are in high demand. This access fosters innovation and agility, enabling firms to stay ahead in competitive markets and swiftly adapt to technological advancements.

It also helps manage operational costs effectively by leveraging lower wage structures in other regions for non-core functions such as customer service and back office support. Additionally, outsourcing supports scalability and flexibility, enabling companies to expand operations swiftly without the logistical constraints of scaling internal teams.

Furthermore, recruitment and HR outsourcing enhances strategic focus by allowing firms to redirect resources and talent toward core competencies and high-impact initiatives. Beyond being a cost-saving measure, outsourcing is a strategic imperative that empowers businesses to navigate labor shortages, accelerate innovation, and capitalize on global opportunities. By embracing it as a tool for growth and resilience, U.S. companies can effectively navigate the complexities of a dynamic labor market and emerge more robust in a rapidly evolving global economy.

Unlock Industry Insights with SuperStaff

In today’s rapidly evolving business landscape, flexibility and adaptability are key. Our extensive range of customizable Business Process Outsourcing (BPO) services is designed to help you develop an outsourcing strategy tailored to your unique business needs.

As your reliable partner during times of disruption and uncertainty, we provide the expertise and support necessary to navigate challenges and seize opportunities. Our solutions are crafted to enhance operational efficiency, reduce costs, and drive growth.

By leveraging our BPO services, you can focus on your core competencies while we handle the rest. From customer service to back-office service solutions, we are committed to delivering excellence and innovation. Let us help you position your brand for global success and achieve your business goals with confidence.

Choose us as your BPO partner and experience the difference that customized solutions can make.