Managing payroll is one of small businesses’ most complicated and time-consuming tasks. With countless regulations, ever-changing tax law, and complex employee classifications, payroll management is a challenge that requires razor-sharp precision.

Even one small mistake in calculating wages, filing taxes or ensuring compliance can lead to costly penalties and financial risks. The IRS found that nearly 40% of small businesses in the US get hit with an average penalty of $845 each year for payroll errors.

As a business owner, your time is gold. That’s why outsourced payroll services for small businesses are non-negotiable. With the help of expert service providers, you can streamline your financial operations, avoid costly mistakes, and free up valuable time to focus on more strategic initiatives.

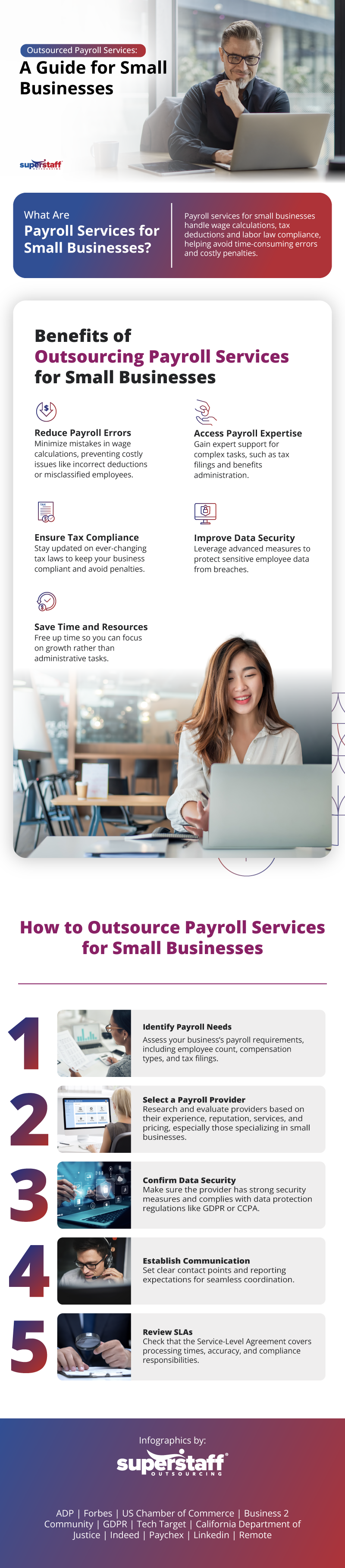

If you’re looking to enhance your operations with accounting and payroll services tailored for small businesses, be sure to check out the guide in the infographic below!

What Are Payroll Services for Small Businesses?

Small business accounting and payroll services handle tasks like wage calculations, tax deductions, and labor law compliance. Leveraging cutting-edge AI and automation, service providers streamline tax filings and direct deposits, helping you pay your employees accurately and on time.

Managing this in-house can be challenging, especially with manual processes, complicated tax filings and compliance risks. Any mistake can easily lead to costly penalties that could damage employee trust.

Without dedicated HR or accounting departments, handling payroll in-house can distract from what truly matters—growing your business. Outsourcing payroll provides a cost-effective solution and expert guidance that will keep you compliant, minimize errors, and free up your time to focus on success.

Benefits of Outsourcing Payroll Services for Small Businesses

Online payroll services for small businesses can give you several advantages when you partner with the right provider. With this service, you can:

Reduce Payroll Errors

Payroll mistakes are not only frustrating but also expensive. Even minor errors can lead to substantial financial consequences. Fortunately, outsourcing to specialized providers who use automated, precise systems can drastically reduce the likelihood of such errors.

Small business online payroll services often integrate advanced technology to automatically calculate taxes and ensure accurate payroll computations.

Ensure Tax Compliance

Compliance with payroll tax laws is a common concern for small businesses, mainly because regulations change frequently. Each year, the IRS issues millions of employment tax penalties due to mistakes in reporting, depositing or filing payroll taxes.

A specialized payroll provider helps ensure compliance with local, state and federal laws, avoiding costly penalties and legal repercussions. According to a National Small Business Association survey, 45% of small businesses outsource payroll to alleviate administrative burdens and improve accuracy.

With payroll small business services, you benefit from up-to-date expertise and the assurance that they file all forms correctly and on time.

Save Time and Resources

Managing payroll in-house can be laborious, especially for small businesses with limited administrative staff. According to the National Small Business Association, one-third of small business owners spend more than six hours monthly on payroll-related tasks.

Small business payroll service providers allow you to reclaim this time and focus on core activities like growing your business, improving customer service, or developing new products. Not only does this save time, but it also reduces overhead costs associated with hiring and training staff to manage payroll.

Access Payroll Expertise

When you outsource payroll, you gain a team of professionals with specialized knowledge in payroll management. Their expertise can change the game for small businesses lacking the resources to hire in-house experts.

Payroll providers that offer back-office outsourcing services work with experts who deeply understand tax law, benefits administration and wage regulations. This helps keep payroll operations smooth and prevents potential issues from escalating.

Improve Data Security

Data security is critical for any business that handles sensitive employee information such as social security numbers, bank details, and personal contact information. Unfortunately, many small businesses don’t have the means to provide security to protect this data from breaches or cyberattacks.

It’s a good thing they can rely on payroll service providers for small businesses. These providers invest in robust security measures, including encryption and multi-factor authentication, to defend this data. By outsourcing payroll, you can rest assured that industry-leading security protocols protect your sensitive information.

Now that you know the benefits that payroll service providers give your small business, how do you find the right one for you? The following section tackles guidelines on how you can outsource your payroll.

How to Outsource Payroll Services for Small Businesses

Outsourcing payroll doesn’t end with handing off administrative tasks; it also involves selecting the right partner and ensuring you align with your plans and expectations. Here’s how to get started:

1. Identify Payroll Needs

Start by taking stock of your specific payroll requirements. You must consider many factors, such as the number of employees, pay frequency, and specific tax obligations. Understanding these factors helps you choose a provider that can handle your business’s unique demands, whether it’s multi-state tax compliance or employee benefits administration.

If your business offers different payment structures, such as hourly wages or commissions, make sure the provider can accommodate those needs. Consider whether you need full-service payroll management or targeted assistance with tasks like tax filing. Getting this clarity upfront ensures your partnership is set up for success.

2. Select a Payroll Provider

Choosing the right payroll provider is crucial for a smooth partnership. Look for payroll services with a demonstrated track record in your industry and experience working with businesses your size. Testimonials and case studies are a strategic way to measure their performance compared to rival companies and assess customer satisfaction.

Pricing is another important consideration—choose a provider that offers packages within your budget, such as SuperStaff.

As a trusted outsourced customer service provider in the Philippines, we can help you find a payroll partner that fits your company’s needs, including tax filing, direct deposit options and employee self-service portals.

3. Confirm Data Security

Payroll involves handling sensitive employee data, like social security numbers and bank account details, so security is non-negotiable. Make sure your provider complies with data protection regulations like GDPR or CCPA.

Scrutinize their security measures, including the use of encrypted systems, multi-factor authentication, and other safeguards to protect sensitive data. Many payroll companies now use cloud-based systems with enhanced security protocols, reducing the risk of data breaches.

4. Establish Communication

Open communication is the backbone of any successful outsourcing partnership.

You should set up designated contact points for your business and the payroll provider and clearly define reporting timelines. Regular updates, whether through emails or messaging applications like Slack, help address issues before they escalate so payroll runs smoothly.

Routine check-ins with the provider can also help you stay informed of any payroll discrepancies or regulation changes that may affect your business.

5. Review SLAs

Before finalizing your partnership, it’s important to review and sign a Service-Level Agreement (SLA). The SLA outlines critical aspects such as service timelines, accuracy guarantees, penalties for non-compliance and data security protocols.

Reviewing SLAs ensures that both parties clearly understand their expectations and responsibilities, helping to prevent potential misunderstandings.

FAQs About Outsourced Payroll Services for Small Businesses

How Much Do Payroll Services Cost for a Small Business?

Payroll services for small businesses can cost about $30 to $100 per month, depending on the provider and specific services you need. If your payroll needs are more complex—like handling frequent payrolls, tax filings, or a larger team—you may see additional costs. But the convenience and peace of mind are ultimately worth it!

Is Payroll Outsourcing Safe?

Yes, payroll outsourcing is generally safe. When you outsource to a reputable payroll provider, your data is in safe hands. Top providers follow strict security protocols, including encryption and multi-factor authentication, to secure sensitive employee information.

Look for services that comply with regulations such as GDPR or CCPA to safeguard sensitive employee information.

Can Payroll Services Handle Multi-State Taxes?

Yes, many payroll service providers specialize in multi-state tax filings, which can be particularly complex for small businesses with employees in different states. When looking for a partner, be sure to check their website or inquire directly about this service. Be sure also to check whether they offer multilingual customer support for smoother communication.

Take the Stress Out of Payroll

Managing payroll is one of those must-do tasks that can drain your time and energy. But it doesn’t have to be a burden. Outsourcing payroll services can help reduce errors, ensure compliance with complex tax laws, save valuable time and resources, provide expert guidance and improve data security.

This strategic approach allows small business owners to focus on their core competencies while leaving payroll management to professionals.

If you’re ready to streamline your payroll process and allocate more time to business activities, consider outsourcing to the Philippines with a trusted provider like SuperStaff. We can match you with nearshore call centers that specialize in back-office functions, including payroll services, helping your business stay compliant and efficient.

Contact us today to explore how outsourcing can support your growth and success.