In a world governed by strict regulatory standards, compliance is a top priority for businesses across industries. Complying with relevant industry requirements and legislation enables companies to avoid hefty fines and penalties, build consumer trust, and ensure greater transparency, security, and safety for all stakeholders.

Thankfully, with the right BPO, compliance can be made easier for businesses. Having an outsourcing partner can help companies implement advanced processes and technologies to meet global standards and maintain compliance amid the changing regulatory landscape. In this article, we’ll outline how BPOs keep client data secure and operations compliant with industry-specific laws.

The Role of BPOs in Compliance With Global Regulatory Standards

Global regulatory standards, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), mandate rigorous data protection, transparency, and accountability. These standards are vital for companies handling sensitive information, and the same is true for their business process outsourcing partners.

In addition to data privacy, businesses must comply with global labor laws, workplace safety requirements, and other legislation. This helps build a healthy work environment that fosters employee engagement, nurtures loyalty and cooperation, and enhances your reputation among customers. On the other hand, non-compliance may lead to a loss in consumer trust, lower employee morale and productivity, and even a negative impact on the bottom line.

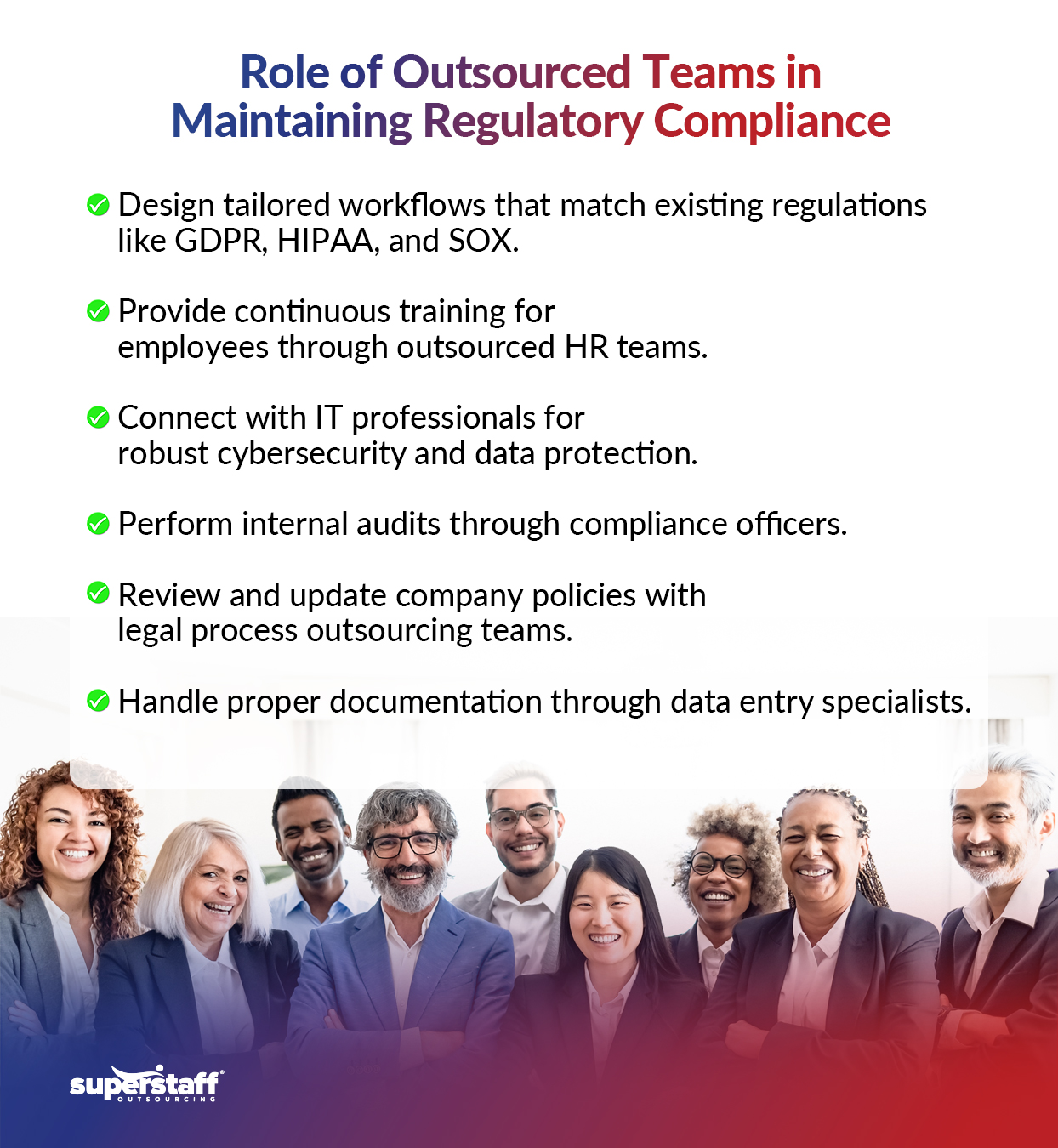

When you partner with an outsourcing provider, you can rest assured that your offshore team will follow relevant standards and requirements, regardless of their job titles. How? Here are the particular steps BPO outsourcing companies take to ensure regulatory compliance:

Tailored Compliance Programs

Different industries follow unique regulations, standards, and requirements. For instance, healthcare providers must follow HIPAA guidelines to protect patients’ sensitive medical information, while financial institutions comply with the Sarbanes–Oxley Act (SOX) for transparent record-keeping.

Partnering with a BPO in the Philippines that’s intimately familiar with these sector-specific regulations is crucial to ensuring compliance with relevant industry standards. Ideally, the right outsourcing partner will create customized compliance frameworks and programs to meet your business’s needs.

Industry Standards Guide BPOs in Designing Compliant Workflows

You may wonder, “What is compliance in BPO?” It starts with studying existing regulations, such as GDPR, HIPAA, and SOX, and using these to design company workflows and processes that comply with relevant legislation.

Outsourcing companies create comprehensive regulatory compliance policies based on global industry standards and requirements. This blueprint establishes the practices, procedures, and workflows that affirm the firm’s commitment to following industry regulations, including details about the relevant technologies, structures, reporting mechanisms, and other requirements put in place to maintain compliance.

Having a detailed regulatory compliance framework helps BPOs build a culture of compliance within their organization, establishing transparency and accountability right from the outset. Since these use existing regulations as a reference, they must be regularly reviewed and updated to match shifting requirements and standards.

Customized Frameworks Ensure Sector-Specific Regulatory Needs Are Met

As mentioned above, different industries have unique requirements and standards. As such, outsourcing companies must create tailored solutions that meet their client’s particular needs.

For example, a healthcare provider may outsource medical billing and coding to a specialized BPO in the Philippines. These offshore professionals handle sensitive patient information, such as medical records, procedures, credit card information, insurance coverage, etc.

Because of this, the BPO company’s regulatory compliance framework must comply with HIPAA guidelines. Following these protocols and standards will ensure that the outsourced healthcare team safeguards these confidential data and preserves patient privacy and security.

Continuous Training and Certification

With a framework in place, continuous training ensures employees understand these compliance requirements. One of the biggest challenges in maintaining regulatory compliance is ensuring that all workers are aware of relevant industry standards, stay updated on changes, and adapt to evolving laws and guidelines.

To keep outsourced teams up-to-date on regulatory requirements and industry standards, BPO companies often provide regular training and continuous education programs. They also pursue internationally recognized certifications to reflect adherence to global industry standards.

Employees Participate in Frequent Compliance Training

BPO companies conduct regular compliance training to familiarize all offshore employees with industry-specific legislation, regulatory requirements, and mandates. This type of employee training informs workers of the laws regulating how the organization handles hiring, data protection, cybersecurity, and other crucial requirements. These mandatory training initiatives help ensure workplace safety, uphold customer data protection, and minimize business risks.

One example is Occupational Safety and Health Administration (OSHA) compliance training, which educates employees about the potential hazards to watch out for in the workplace and how to avoid them. Particularly critical for industries where physical risks commonly occur, such as manufacturing and distribution, OSHA training includes lectures on the proper use of equipment, step-by-step safety protocols, and emergency procedures.

Beyond workplace safety, outsourced employees must also be trained in cybersecurity and data protection. With proper training, offshore teams will better understand the importance of protecting sensitive and confidential information and follow best practices in cybersecurity. Some of the most commonly discussed topics in these types of training include using secure passwords, limiting access to sensitive documents, recognizing and avoiding phishing attempts, and reporting potential fraud.

Certifications Reflect Adherence to Global Standards

In addition to ensuring employees receive necessary compliance training, BPO companies also invest in certifications, such as those from the International Organization for Standardization (ISO) and the Payment Card Industry Data Security Standard (PCI DSS).

These globally recognized organizations provide certifications that help add business credibility while meeting legal and contractual requirements. Being recognized as ISO-certified also allows companies to prove to customers that they meet specific international standards and requirements, helping build a more trustworthy public perception.

For financial institutions and other industries that process credit and debit card transactions, PCI DSS certifications are crucial to winning consumer trust. This international certification sets stringent policies and procedures to prevent cybersecurity breaches targeting payment card information and reducing the risk of fraudulent transactions. Although PCI DSS is not a legal requirement, adhering to these standards helps companies establish a more secure payment system for their clients while fulfilling contractual obligations with relevant stakeholders.

Advanced Compliance Technology

Having established the importance of training and certifications for compliance, let’s move forward to the role of technology in following global regulatory standards. Leveraging advanced technology and embracing new developments and innovations allows companies and their BPO partners to establish and execute more secure and compliant operations.

Outsourcing firms leverage advanced tools and software to monitor compliance programs and initiatives. These compliance technologies help companies automate employee monitoring to prevent non-compliance, enable encryption for sensitive data, provide access control options, and minimize cybersecurity breaches.

Compliance Management Software Tracks Adherence in Real-Time

To ensure compliance in BPO companies, these firms use compliance management systems (CMS) for real-time tracking. CMS software integrates applications used by outsourcing teams and helps compliance professionals monitor whether employees are following internal policies, regulatory requirements, and industry standards.

With CMS tools, companies can more easily monitor compliance efforts and elevate their broader risk management strategy. These technologies ensure that business processes and internal controls follow internationally recognized requirements and guidelines, helping companies avoid disruptions, lower the risk of data breaches, and prevent non-compliance penalties and fines.

Automation Reduces Human Error and Simplifies Audits

In addition to using CMS software, many outsourcing companies also leverage compliance automation. This is when BPOs use technology, such as artificial intelligence (AI) and machine learning (ML) software, to automate compliance monitoring and checking. These automated solutions streamline workflows and processes while tracking compliance procedures.

For example, e-commerce companies worldwide must adhere to General Data Protection Regulation (GDPR) standards to protect buyers and sellers from fraud and secure sensitive data such as addresses, credit card information, and payment details. Automated compliance software can help outsourced e-commerce staff optimize data entry and order processing tasks while securing customer data in compliance with GDPR requirements.

Besides reducing the risk of fraud and human error, automated compliance tools can simplify audits by providing an easy-to-track record of all workflows, processes, and transactions. This helps internal and external auditors identify cybersecurity lapses or provide necessary improvement suggestions.

Data Security and Privacy Protocols

While technology helps safeguard data, strict information security protocols are necessary to reinforce compliance. From data encryption to access restrictions, BPO companies design and implement comprehensive and robust security and privacy protocols to protect sensitive client information and safeguard their processes and systems from malicious actors.

Access Controls Ensure Only Authorized Personnel Handle Sensitive Data

Businesses across industries handle a wide range of confidential and sensitive data, particularly healthcare and financial institutions. As such, all companies must work with a BPO partner that safeguards and secures private client information. One way to do this is by implementing strict access controls.

Through access control tools, outsourcing companies can restrict access to essential corporate data and resources and enable them to manage which roles and workers are allowed to handle crucial assets and assignments. With the proper access control policies, BPOs can ensure users have appropriate access levels relevant to their tasks and responsibilities and that only company members can view and use these resources.

Data Encryption and Secure Storage Limit Data Breach Risks

Besides access control tools, BPO firms use data encryption and secure storage limits to minimize breaches and protect company information, assets, and resources from unauthorized use. By translating confidential data into a code known as ciphertext, data encryption ensures that information can only be read by users with access to a secret key or password.

Data encryption helps outsourcing companies protect their data from unauthorized access, keeping sensitive information from being stolen, compromised, or changed by malicious actors. Meanwhile, secure storage solutions provide a safe mechanism for keeping confidential data. These technologies protect company assets from tampering even when being transferred over a network or kept in a fixed location.

Audit and Monitoring Systems

Data security and privacy protocols safeguard company assets and information, but proactive monitoring and audits add another layer of compliance protection. To ensure ongoing compliance, BPOs in the Philippines conduct internal and external audits to detect and address compliance issues, leveraging advanced monitoring tools and software to streamline the process. Here’s how:

Third-Party Audits Verify Adherence to Standards

To ensure strict compliance with global regulations and standards, third-party audits are crucial for maintaining impartiality and providing unbiased observations. Conducting these audits allows BPO companies to gain valuable insights into potential gaps in their operations, minimize risks and disruptions, and secure the integrity and reliability of their workflows and processes. These external audits also help clients feel more at ease about partnering with an outsourcing provider, helping them make informed decisions about their BPO arrangements.

External auditors examine the outsourced vendor’s operations through an on-site visit and evaluate whether the firm’s policies and procedures comply with relevant industry regulations and standards. Although a third-party audit’s objectives may differ depending on the BPO company’s specific requirements (and those of their clients), the most common goals include evaluating quality control (QA) processes, identifying risks and vulnerabilities, and verifying compliance with local and international legislation.

Monitoring Tools Identify Non-Compliance Risks Early

Aside from conducting both internal and external audits, BPO companies use compliance monitoring tools to identify risks and prevent non-compliant actions. Leveraging internal monitoring software, outsourcing firms can keep track of employee tasks across different applications, allowing them to ensure compliance with internal policies and global regulatory standards.

These monitoring tools also notify users in case of a data breach, workplace safety violation, or other non-compliant actions so they can quickly spot and address the issue. By using compliance monitoring technologies, companies can streamline processes, keep an accurate record of compliance programs and initiatives, and ensure all departments are reminded of relevant regulations and guidelines.

Compliance Officers and Legal Teams

Compliance management and monitoring technologies are essential, but the goal should not be to rely solely on these tools. To navigate complex regulations, BPO companies also employ dedicated compliance officers and legal teams. These outsourced professionals stay updated on local and international regulatory changes, translate complex legal requirements into easy-to-understand guidelines, and help companies modify and update their compliance policies and procedures.

Compliance Officers Oversee Adherence to Standards

Compliance officers are specialists responsible for ensuring companies operate in compliance with relevant industry laws and regulations by monitoring internal processes and workflows. They work closely with human resource professionals and executives to design and implement employee compliance policies, procedures, and protocols.

After creating robust compliance policies, these specialists conduct regular internal audits to review whether the company’s procedures and operations work as intended and remain compliant with changing rules and regulations. Their audit reports typically include assessing the effectiveness of security policies and measures, monitoring user access controls, preparing compliance documents, and observing risk management processes.

A thorough compliance audit evaluates how well a company adheres to internal and external regulations, standards, and codes of conduct. These internal audits also help BPO firms prepare for future third-party evaluations and maintain existing certifications.

Legal Teams Handle Regulatory Updates and Liaise With Governing Bodies

To further ensure BPO compliance, outsourcing firms have dedicated legal teams responsible for coordinating with regulatory bodies and updating company policies to match changing legislation. In the Philippines, corporate lawyers are pivotal for keeping track of local and international regulations, guiding businesses in crafting and updating internal policies and procedures, and preventing or addressing legal disputes and penalties.

These legal professionals provide executives with crucial advice and guidance regarding business requirements and relevant legislation. In addition to policy development, they help conduct training sessions for employees to update them on new compliance programs and evolving standards. They may also assist compliance officers in conducting regular internal audits to monitor how well all departments comply with applicable laws and guidelines.

Documentation and Reporting

Finally, ensuring proper regulatory compliance involves thorough documentation and reporting. Keeping accurate records of compliance efforts, including internal policies, standards, and contracts, helps BPO companies build client trust and navigate interactions and audits with regulatory agencies. In addition to detailed documentation, outsourcing teams conduct regular reporting sessions to reinforce accountability and transparency.

Comprehensive Documentation Aids Regulatory Audits

To ensure smooth audit processes, outsourcing firms maintain transparent records that support compliance management and verification. They collect, organize, and maintain documents of all policies, procedures, and materials that showcase how the company complies with industry regulations and legal standards.

With properly managed compliance documents, BPO providers can ensure continuous monitoring and improvement of compliance initiatives, reduce legal risks and disruptions, and respond quickly to shifting regulatory landscapes. These records are essential to securing transparency and accountability, making it easier for internal and external auditors to evaluate the company’s policies and procedures and assess whether they meet global regulatory standards.

Transparent Reporting Builds Trust With Clients and Regulators

Beyond detailed documentation, regular reporting is also essential for compliance management. It helps companies communicate their workflows and processes with clients and regulators, ultimately building trust and transparency. Proper compliance reporting contributes to a company’s long-term success by fostering a culture of accountability and promoting responsible practices.

During compliance reports, BPO teams must provide tangible evidence of their compliance management practices by gathering and sharing relevant operational data, compiling verified worker records from monitoring tools, and submitting reports to the appropriate regulatory agencies. A comprehensive report will ideally include key performance indicators (KPIs), key risk indicators (KRIs), and other critical metrics showing the outsourcing provider’s commitment to maintaining regulatory compliance.

Compliance reporting allows BPO companies to provide a clear and transparent record of their adherence to relevant regulations, standards, and guidelines. This process not only satisfies legal requirements but also objectively evaluates how the firm performs against industry benchmarks, further increasing its competitive edge.

By managing compliance risks, BPO companies proactively protect their operations against legal consequences. They achieve this by employing specialized programs, providing regular employee training, and investing in advanced technologies to meet global regulatory standards and requirements.

From tailored frameworks to rigorous documentation, outsourcing firms ensure their operations align with industry laws. If you’re looking for a BPO compliance partner, make sure to find a provider that understands and adheres to global regulatory standards.

Did this article help you understand BPO compliance requirements? Follow SuperStaff for more helpful business content.

As a global BPO company, SuperStaff is committed to staying updated on international regulatory standards, requirements, and legislation. Follow us on LinkedIn or browse our website to keep yourself up-to-date on industry trends and gain valuable business insights and expert advice.

For more tailored guidance, contact us for a quick consultation. Let’s discuss what our outsourcing solutions can do for you!