Customer trust is the foundation of the financial industry, but for many institutions, it is cracking. Mounting scandals, hidden fees, and impersonal service have disillusioned customers, driving them to seek alternatives that prioritize transparency and care.

In an era of higher consumer expectations than ever, financial institutions must find new ways to rebuild relationships and restore confidence. Outsourcing has emerged as a powerful strategy to bridge the growing trust gap. By leveraging outsourced support teams, banks, credit unions, and fintech firms can deliver more responsive, personalized, and cost-efficient service—without sacrificing quality.

In this blog, we explore how outsourcing can help financial institutions enhance customer experiences, strengthen loyalty, and ultimately regain the trust of their clients. Keep reading to uncover actionable insights on how outsourcing can be the key to a stronger, more customer-centric financial future.

Exploring the Rise and Fall of Customer Trust in Financial Institutions

Trust has always been the backbone of the financial industry. Customers rely on banks, credit unions, and other financial institutions to safeguard their assets, provide sound financial advice, and facilitate secure transactions.

However, this trust has eroded in recent years due to industry-wide challenges. According to a Statista survey, the percentage of U.S. respondents expressing trust in financial institutions decreased from 28% in 2021 to 20% in 2023. This downward trend highlights growing skepticism toward banks and financial entities among the American public.

As trust declines, institutions must adopt new strategies to rebuild credibility and enhance customer satisfaction. One increasingly effective solution is outsourcing. By leveraging experienced offshore customer service teams, financial institutions can improve service quality, boost transparency, and foster long-term client loyalty.

Historical Context of Trust in Finance

Trust in financial institutions has long been a delicate balance. Banks have played a pivotal role in economic stability for centuries, yet their reputation has often been tested.

- The Great Depression (1929): The stock market crash and widespread bank failures left millions of Americans without savings, leading to regulatory changes such as the Federal Deposit Insurance Corporation (FDIC).

- 2008 Global Financial Crisis: The collapse of major financial institutions due to risky lending and mortgage-backed securities shattered public confidence, prompting government bailouts and regulatory overhauls.

- The Digital Age: As banking services shifted online, institutions faced new challenges, from cybersecurity threats to growing consumer demand for personalized digital experiences.

While financial institutions have recovered from past crises, trust remains fragile. Any customer service, compliance, or operations misstep can quickly undermine decades of reputation-building.

Recent Scandals and Operational Failures

The past decade has seen several high-profile financial scandals, reinforcing consumer skepticism toward banks and financial service providers. Some of the most notable include:

- Wells Fargo Account Fraud Scandal (2016): Employees created millions of unauthorized accounts to meet aggressive sales targets, leading to massive fines and widespread public distrust.

- Credit Suisse and Archegos Collapse (2021): Poor risk management led to billions in losses, exposing weaknesses in oversight and due diligence.

- Silicon Valley Bank Collapse (2023): A combination of mismanaged liquidity risks and poor regulatory adherence resulted in the second-largest bank failure in U.S. history, shaking confidence in the banking system.

Beyond these headline-grabbing scandals, operational failures—such as long customer wait times, unresponsive support teams, and opaque fee structures—have fueled consumer frustration. Many customers seek alternatives, including fintech solutions and community banking, to regain control over their financial relationships.

Consumer Expectations for Transparency and Accountability

The modern financial consumer is more informed and empowered than ever before. With easy access to online reviews, comparison tools, and digital banking alternatives, customers will no longer tolerate subpar service or hidden fees. Instead, they demand:

- Clear Communication: Customers expect upfront disclosure of fees, interest rates, and policies without fine-print surprises.

- Personalized Service: Generic interactions are no longer acceptable. Clients seek tailored financial advice and proactive customer support.

- Fast and Efficient Problem Resolution: Customers are frustrated by long hold times and automated responses. They expect quick, human-centered solutions.

- Ethical Business Practices: Consumers prefer to engage with financial institutions that demonstrate strong corporate social responsibility and ethical decision-making.

Banks and financial service providers that fail to meet these expectations risk losing customers to more transparent, customer-centric competitors.

The Erosion of Consumer Trust in Financial Institutions: Key Contributing Factors

Trust in financial institutions is eroding due to operational, regulatory, and technological challenges. Hidden fees, poor customer service, and a history of financial scandals have alienated consumers.

As banks and financial service providers navigate an evolving landscape, they must address these trust deficits to rebuild credibility and foster stronger client relationships. Understanding these challenges is essential before exploring potential solutions.

Inconsistent Service Quality

Customers expect seamless and reliable service, but many financial institutions struggle with maintaining consistency. Long wait times, automated responses that fail to address concerns, and a lack of personalized support create frustration.

While large institutions focus on scaling operations, service quality often suffers—particularly for smaller account holders. When customers feel undervalued or receive conflicting information from different representatives, their confidence in the institution diminishes. Consistency in communication, problem resolution, and customer care is essential to restoring trust.

Regulatory and Compliance Issues

Repeated regulatory violations and compliance failures have significantly damaged the reputation of financial institutions. From the mismanagement of consumer data to unethical lending practices, violations have led to billion-dollar fines and legal battles.

Consumers, now more informed than ever, expect banks and financial service providers to operate with integrity and transparency. When institutions fail to comply with regulations, they face monetary penalties and risk losing customer confidence. Strengthening compliance frameworks and prioritizing ethical banking practices can help rebuild trust.

The Impact of Digital Transformation and Cybersecurity Breaches

The rapid shift to digital banking has introduced both opportunities and risks. While online banking and mobile apps provide convenience, they expose customers to cybersecurity threats. Data breaches, account hacks, and identity theft have made consumers wary of entrusting their financial data to institutions with weak security measures.

Additionally, while efficient, the rise of AI-driven interactions sometimes lacks the human touch needed to build strong client relationships. Banks and financial institutions must balance innovation and security, ensuring customers feel empowered and protected in the digital age.

The Business Impact of Declining Customer Trust in Financial Institutions

The erosion of trust in financial institutions affects customer sentiment and has direct and measurable consequences on client relationships and overall business performance. When trust declines, customer loyalty weakens, leading to lower retention rates and lost revenue.

Consumers who feel underserved or deceived are likelier to take their business elsewhere, and their dissatisfaction can spread rapidly. Financial institutions that fail to address these concerns risk long-term reputational damage, reduced market share, and increased pressure from emerging competitors.

Declining Customer Retention

Loyal customers are the foundation of any financial institution’s success. However, when trust is compromised, customer retention drops significantly. Studies show that retaining an existing customer is far more cost-effective than acquiring a new one, making loyalty a key driver of profitability.

Hidden fees, poor service, or perceived unethical practices can push long-term clients to seek alternatives, whether through smaller banks, credit unions, or fintech solutions that emphasize transparency and customer-first approaches. Without proactive efforts to rebuild trust, institutions risk losing valuable clients to competitors that offer better customer experiences.

Negative Word-of-Mouth and Reputational Damage

In today’s digital landscape, customer dissatisfaction doesn’t stay private—it spreads quickly through online reviews, social media, and industry watchdog reports. A single negative experience can escalate into a viral complaint, damaging an institution’s reputation and influencing potential customers.

Financial institutions that fail to address complaints or respond inadequately to crises face long-term brand deterioration. Rebuilding a tarnished reputation requires a commitment to customer-centric practices, transparent policies, and exceptional service.

Increased Competition from Non-Traditional Financial Players

Fintech companies, digital banks, and decentralized finance (DeFi) platforms are rapidly gaining traction by offering streamlined, transparent, and customer-friendly financial services. These non-traditional players capitalize on the trust gap left by legacy institutions, attracting consumers with lower fees, enhanced digital experiences, and greater accessibility.

As more consumers explore alternative financial solutions, banks and traditional institutions must evolve to remain competitive. Addressing trust issues, improving service quality, and leveraging outsourcing for enhanced customer support can help financial institutions retain their market position and win back disillusioned clients.

How Do You Gain Trust in the Financial Service Sector? Here’s How Outsourcing Becomes a Strategic Response

As financial institutions grapple with declining customer trust, outsourcing has emerged as a strategic solution to enhance service quality, improve operational efficiency, and rebuild credibility. By partnering with specialized external providers, banks, credit unions, and fintech firms can streamline customer support, strengthen compliance, and deliver more personalized financial experiences.

Outsourcing enables institutions to refocus on their core functions while ensuring clients receive consistent, high-quality service. In an industry where trust is paramount, leveraging outsourcing effectively can be a game-changer in restoring consumer confidence.

Definition and Scope of Outsourcing in Financial Services

Financial service outsourcing involves delegating specific functions—customer support, compliance management, fraud prevention, and back-office operations—to a back-office service provider in the Philippines. These partners offer expertise, technology, and scalability, allowing institutions to maintain high service standards without overextending internal teams.

Whether through offshore or nearshore outsourcing, financial institutions can optimize operations while maintaining strict regulatory compliance. The scope of outsourcing extends beyond cost savings; it is a strategic move to enhance efficiency, security, and customer engagement.

Benefits of Partnering With Financial Service Outsourcing Providers

Outsourcing allows financial institutions to leverage the expertise of specialized service providers equipped with industry-specific knowledge, advanced technologies, and trained personnel. Key benefits include:

- Enhanced Customer Service: Outsourced teams offer 24/7 support, multilingual assistance, and faster issue resolution, improving the overall customer experience.

- Regulatory Compliance and Risk Management: Leading outsourcing providers ensure strict adherence to financial regulations, reducing the risk of non-compliance and penalties.

- Operational Cost Efficiency: Institutions can reduce overhead costs by outsourcing non-core functions while maintaining high-quality service.

- Access to Cutting-Edge Technology: Service providers invest in AI, automation, and security technologies that enhance fraud detection, data security, and process optimization.

How Outsourcing Can Free Up Internal Resources for Innovation

In a highly competitive financial landscape, institutions must continuously innovate to stay ahead. However, internal teams often get bogged down with time-consuming, repetitive tasks that limit their ability to focus on strategic initiatives. Outsourcing helps alleviate this burden by shifting routine functions—such as call center operations, loan processing, and document verification—to external teams.

With these tasks handled efficiently, in-house teams can focus on:

- Developing New Financial Products and Services: Innovation in digital banking, mobile payments, and AI-driven financial solutions.

- Enhancing Cybersecurity and Fraud Prevention: Strengthening internal systems against evolving threats.

- Building Stronger Client Relationships: Shifting focus from transactional interactions to personalized financial advisory services.

Strengthening Client Relationships Through Outsourcing

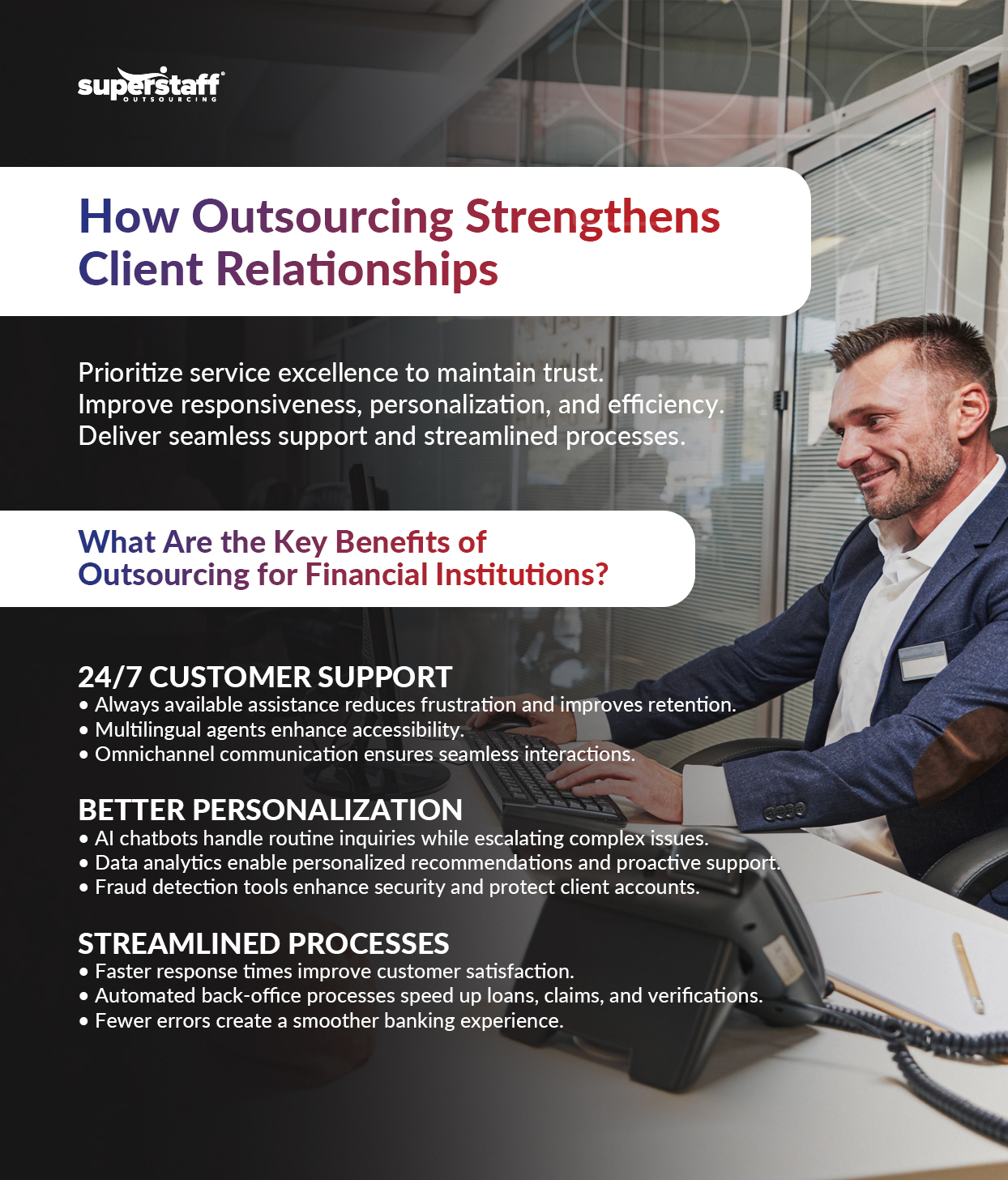

In an era of fragile customer trust and loyalty, financial institutions must prioritize service excellence to maintain strong client relationships. Outsourcing provides a powerful way to enhance service delivery by improving responsiveness, personalization, and operational efficiency.

By leveraging external expertise, financial institutions can offer seamless customer support, integrate advanced technology, and streamline processes—ensuring a more reliable and satisfying client experience. These improvements foster trust and drive long-term loyalty in an increasingly competitive financial landscape.

Enhanced Customer Support Through 24/7 Call Centers and Chat Services

One of the most immediate benefits of outsourcing is providing round-the-clock customer support. Financial institutions that partner with offshore call centers gain access to highly trained agents who can assist customers across different time zones.

Key advantages include:

- 24/7 Availability: Clients can resolve urgent banking issues anytime, reducing frustration and improving retention.

- Multilingual Support: Serving diverse customer bases with native language assistance enhances accessibility.

- Omnichannel Communication: Seamless integration of phone, chat, email, and social media support ensures customers can engage on their preferred platform.

By offering consistent, professional, and always available support, outsourcing partners help financial institutions maintain high service standards, ultimately reinforcing trust.

Advanced Technology and Analytics for Personalized Service

Customers expect tailored financial experiences, and outsourcing enables institutions to meet this demand through advanced technology. Leading outsourcing providers utilize:

- AI-Driven Chatbots and Virtual Assistants: Automating routine inquiries while ensuring seamless escalation to human agents when necessary.

- Customer Data Analytics: Identifying behavioral patterns to offer personalized product recommendations and proactive support.

- Fraud Detection and Risk Monitoring: Enhancing security measures and providing real-time alerts to protect client accounts.

Streamlined Processes That Reduce Wait Times and Errors

Long hold times, delayed transactions, and processing errors frustrate customers and erode trust. Outsourcing mitigates these issues by optimizing financial workflows:

- Faster Response Times: Dedicated support teams ensure inquiries are resolved efficiently.

- Automated Back-Office Processing: Loan applications, claims, and verifications are handled faster and more accurately.

- Error Reduction: Trained outsourcing teams minimize manual mistakes, ensuring a smoother banking experience for customers.

By eliminating bottlenecks and enhancing efficiency, outsourcing empowers financial institutions to deliver reliable, hassle-free service, strengthening client relationships and loyalty.

Case Study: Casey State Bank

Several financial institutions have successfully leveraged outsourcing to restore customer trust and enhance service quality. Here is one notable case:

Casey State Bank decided to outsource its core processing to CSI NuPoint, marking a pivotal shift in its operational strategy. The strategic move addressed critical inefficiencies that hindered its ability to deliver seamless financial services. Managing in-house core processing required significant IT investments, frequent system updates, and extensive compliance monitoring—all of which strained internal resources and increased operational risks.

By transitioning to a cloud-based core processing system, the bank eliminated these burdens, allowing for greater agility, real-time data access, and enhanced security protocols. Compliance, a key concern in the highly regulated banking industry, became more manageable with automated updates and built-in regulatory safeguards, reducing the risk of penalties and ensuring adherence to evolving financial laws.

Most importantly, outsourcing freed up internal staff to focus on customer-centric initiatives, improving response times and personalizing financial services. With a more efficient, secure, and compliant infrastructure, Casey State Bank streamlined its operations and reaffirmed its commitment to reliability and customer trust—key factors in maintaining long-term client relationships.

Overcoming Outsourcing Challenges to Boost Customer Trust

While outsourcing offers significant benefits for financial institutions, its success depends on proactively addressing key challenges such as data security, service quality, and seamless communication. Clients entrust financial institutions with sensitive personal and financial data, making security breaches a significant concern.

Additionally, outsourced operations must maintain the same level of service excellence as in-house teams to avoid disruptions that could further erode customer trust.

Finally, effective collaboration between internal teams and outsourcing partners ensures a smooth, customer-focused service experience. By implementing the proper safeguards, financial institutions can maximize the advantages of outsourcing while preserving trust, compliance, and operational efficiency.

Ensuring Robust Data Security and Compliance Protocols

One of the primary concerns in financial outsourcing is data security. Financial institutions handle vast amounts of confidential information, making them prime targets for cyber threats. To mitigate risks, outsourcing partners must:

- To ensure strict data protection, adhere to industry regulations such as GDPR, PCI DSS, and GLBA.

- Implement end-to-end encryption, multi-factor authentication, and secure access controls to prevent unauthorized data breaches.

- Regularly audit and monitor outsourced processes to maintain compliance and identify potential security gaps.

Financial institutions can safeguard customer information while maintaining regulatory compliance by choosing outsourcing providers with proven security credentials and regulatory expertise.

Maintaining Consistent Service Quality Through SLAs

Service quality is another critical factor in ensuring outsourcing success. Financial institutions must establish clear and measurable Service Level Agreements (SLAs) with their outsourcing partners to define:

- Response times for customer inquiries and issue resolution.

- Quality benchmarks for accuracy, compliance, and customer satisfaction.

- Escalation procedures for handling complex or sensitive client concerns.

Regular performance evaluations, real-time reporting, and continuous training help maintain service consistency and ensure that outsourced teams meet or exceed customer expectations. A well-structured SLA serves as a contractual safeguard that aligns external service providers with the institution’s standards, preventing disruptions that could damage client relationships.

Effective Communication Between In-House Teams and External Partners

A seamless integration of in-house teams and outsourced providers is essential for a unified customer experience. Financial institutions must:

- Establish clear lines of communication to facilitate smooth collaboration between internal and external teams.

- Use shared platforms and real-time reporting tools to ensure alignment on service objectives and compliance requirements.

- Conduct regular meetings and training sessions to reinforce company culture, customer service standards, and best practices.

Transparent and well-coordinated communication prevents misunderstandings, enhances problem-solving, and ensures that outsourced teams act as a seamless extension of the brand.

Supercharge Customer Trust with Strategic Financial Service Outsourcing

Rebuilding trust in financial services requires more than policy changes—it demands a proactive, customer-first approach. As consumer expectations rise and competition intensifies, strategic outsourcing has become a powerful tool for enhancing service quality, ensuring compliance, and delivering personalized customer experiences.

By integrating outsourced financial service solutions, institutions can restore credibility, strengthen client relationships, and gain a competitive edge in today’s evolving market.

SuperStaff offers specialized financial service outsourcing solutions to help banks, credit unions, and fintech companies optimize operations, enhance customer interactions, and drive long-term loyalty.

Let’s discuss how outsourcing can transform your financial institution—contact SuperStaff today.