A debt trap happens when you borrow money and then take out more loans to repay the original debt, creating a cycle of increasing debt.

Are loans bad? Not at all!

Loans can help you update gadgets, travel, buy a house or car, start a business, or pay for education.

The problem starts when your debts spiral out of control.

How Does a Debt Trap Begin?

Let me start with a fun comic strip to illustrate the points clearly.

Meet Aimee.

Aimee was first in line when a leading tech company announced the release of a new, high-end smartphone. The store offered a financing plan with 0% interest.

Since the 0% interest plan seemed low, Aimee also bought accessories, an extended warranty, and device insurance. Now, her monthly payment would be about 60% of her salary.

She believed she could manage with the remaining 40%. Or so she thought.

A few months later, after consecutive late-night work sessions for a project, Aimee decided she deserved a vacation. She booked a 5-star resort, splurged on fine dining, and even enjoyed a “once-in-a-lifetime” spa experience.

Since her smartphone already consumed most of her salary, she used her credit card for vacation expenses.

A few months later, Aimee encountered unexpected expenses, including a medical emergency for her aging parents. As a result, Aimee struggled to pay her smartphone and credit card bills.

The accumulating interest on missed payments made it even harder for Aimee to keep up. A few more months passed, and Aimee started using another credit card to cover monthly groceries and other expenses.

Aimee’s credit cards neared their limits. She then decided to take out payday loans, which were credited to her account within the day. However, she neglected to see the high interest rates of these loan types.

Her debts grew with more late fees, and increased interest rates continued.

What happened to Aimee is a classic debt trap: She spent more than she earned and used credit to keep up with her expenses.

Was she wrong to buy that smartphone?

Was she wrong to treat herself to a much-needed vacation?

Definitely not!

Her mistake was taking out credit after credit, which led her to depend on high-interest payday loans and left her without means to spend for daily and emergency needs.

There is an “Aimee” in each of us. Who doesn’t have debt? We all have it in different ways.

What I mean to address here is the problem of debt traps.

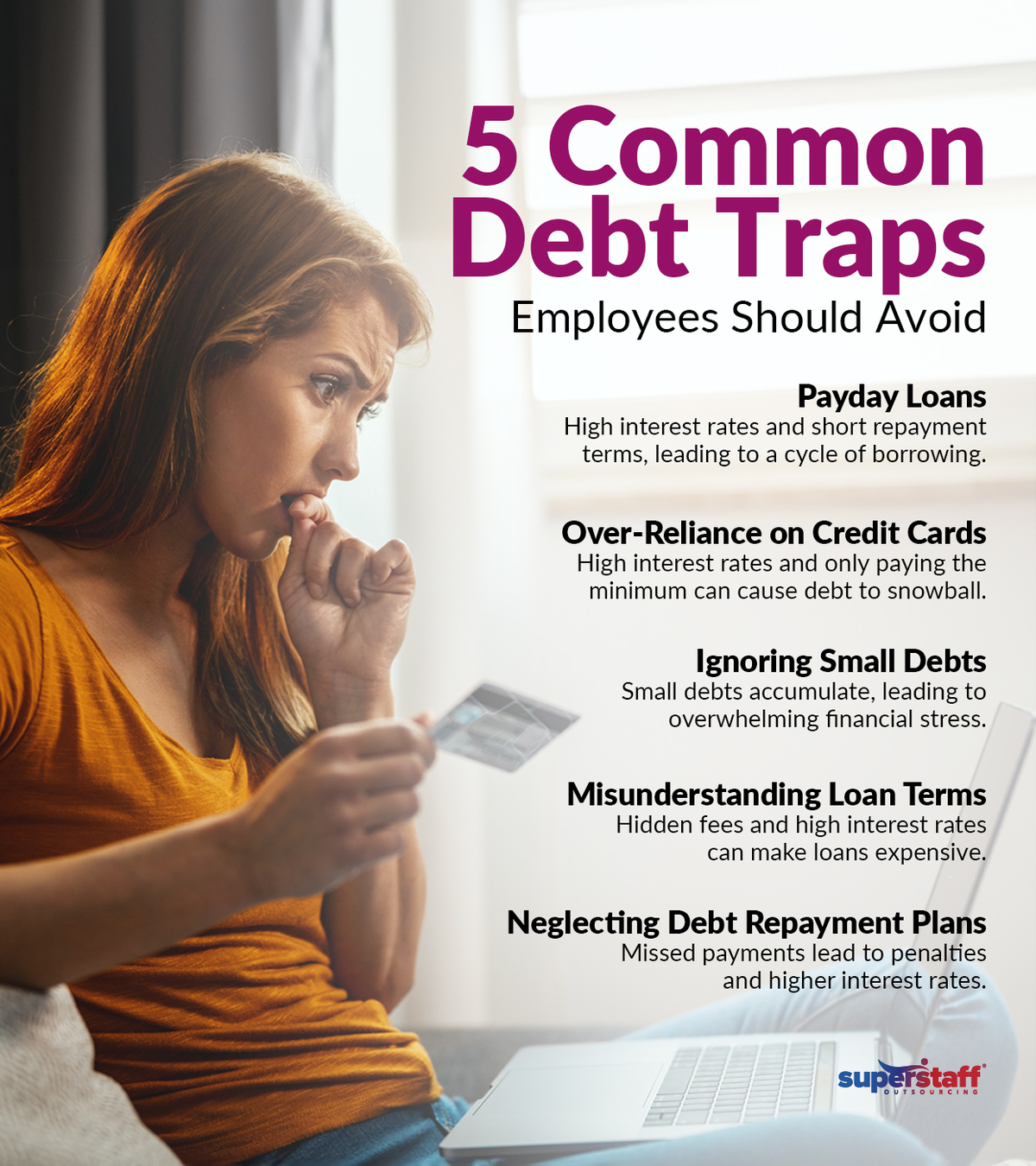

5 Common Debt Traps and How To Avoid Them

-

Taking Out Payday Loans

Payday loans can seem like a lifesaver when other options aren’t available for those living paycheck to paycheck, dealing with debt, or having bad credit. However, payday loans have earned quite a bad rap.

These loans are now known for being “predatory,” with their short-term, high-interest rates that offer quick cash when you’re in a bind. It feeds on the borrower’s “desperation.”

In fact, in 2021, the Bangko Sentral ng Pilipinas (BSP) limited interest rates, fees, and penalties for late or missed loan payments under PHP10,000.

This decision came after the SEC saw a big jump in borrowing rates for payday and personal loans. BSP Governor Benjamin Diokno said the aim is to protect consumers from unfair lending practices while ensuring that small borrowers can still get credit when needed.

How To Avoid Debt Traps From Payday Loans

Instead of taking out a payday loan, consider these safer alternatives:

Choose Personal Loans From Banks or Credit Unions

Banks and credit unions usually offer personal loans with lower interest rates and better repayment terms than payday loans. They’re a more affordable option and often come with flexible repayment plans.

SSS & Pag-IBIG Loans

SSS and Pag-IBIG loans can provide quick cash without the high interest rates and fees of payday loans. These government-backed loans are designed to help members in times of need.

Borrowing From Family or Trusted Friends

Borrowing from family or trusted friends can be a lifesaver. It’s often interest-free and comes with more flexible repayment terms. Just remember to approach this option with caution to avoid straining relationships.

Negotiating With Your Creditors

If you’re struggling to pay the bills, talk to your creditors. You might be able to negotiate a debt relief plan or get a temporary reduction in payments. Most creditors prefer to work with you rather than have you default on your debt.

By exploring these alternatives, you can avoid the high costs and debt traps associated with payday loans. Making smart financial choices and seeking help when needed can lead to a more secure and stress-free financial future.

-

Over-Reliance on Credit Cards

Relying too heavily on credit cards can quickly lead to financial trouble. It’s easy to swipe for purchases. But the problem starts when it’s time to pay.

Debt traps from credit cards often start innocently. You make purchases, planning to pay them off quickly. However, you pay only the minimum amount due when the bill arrives. This leaves a balance that accrues interest, typically at a high rate.

Next month, you might add more purchases, leading to a larger balance and more interest. Over time, this balance grows, and more of your payment goes towards interest rather than reducing the principal.

This cycle continues, making it harder to pay off the original debt. If unexpected expenses arise, you might rely on your credit card again, deepening the cycle.

The result is a revolving debt that can be challenging to escape, leading to financial stress and limited credit availability.

How To Avoid Debt Traps From Credit Cards

- Always Pay Your Balance in Full

Always pay your balance in full each month to avoid interest charges. Paying only the minimum amount can lead to high-interest accrual.

Fortunately, as of August 2023, the central bank kept the maximum interest rate on a cardholder’s unpaid outstanding balance at 3% per month or 36% a year.

- Set a Budget

Create a monthly budget and stick to it. Track your spending to ensure you don’t exceed your limit.

- Use Credit Sparingly

Use your credit card for essential purchases only. Avoid using it for non-essential items or impulsive buys.

- Understand Your Terms

Know your credit card’s interest rates, fees, and terms. This knowledge helps you avoid unnecessary charges.

- Build an Emergency Fund

Save money for emergencies to prevent relying on your credit card for unexpected expenses.

-

Ignoring Small Debts

Small debts can quickly pile up and become overwhelming. It often starts with a small loan or a few purchases on a credit card.

At first, the payments seem manageable. But those small debts can add up if you’re not careful. Interest rates and fees make the debt grow faster than you realize.

Missing a payment can lead to late fees, increasing your debt. Over time, juggling multiple small debts becomes stressful. It’s easy to lose track and fall behind.

Before you know it, small debts can snowball into large, unmanageable amounts. This situation can also lead to constant stress and financial strain.

How To Avoid Debt Traps From Small Debts

List every debt you owe, including credit cards, loans, and other borrowings. Knowing your total debt helps you plan better.

Prioritize repayment by focusing on high-interest debts first. These cost you the most over time. Pay more than the minimum if you can. It speeds up repayment and saves money on interest.

Set up automatic payments to ensure you never miss a due date and to avoid late fees.

-

Misunderstanding Loan Terms

Not fully understanding loan terms and conditions can be a costly mistake. Loans come with many fine print, and missing something important could lead to big problems.

One significant danger is hidden fees. Lenders might charge fees for late payments, early repayments, or even just processing your loan. If you don’t know about these, they can add up quickly and make your loan much more expensive than you expected.

High interest rates are another issue. Some loans have variable interest rates that can change over time.

If you’re unaware of this, your payments might suddenly increase, making it harder to keep up. Fixed rates can also be high if you don’t shop around for the best deal.

Loan terms also include the length of the loan. A longer loan might mean lower monthly payments, but you’ll pay more interest over time.

A shorter loan might have higher payments, but you’ll pay less overall. Not understanding this balance can lead to picking a loan that doesn’t fit your financial situation.

Default clauses are critical too. If you miss a payment or break the loan terms, the lender might demand full repayment immediately. This can be financially devastating if you’re not prepared.

How To Avoid Misunderstanding Loan Terms

Read the Fine Print

The fine print contains important details, such as hidden fees, interest rates, and repayment terms. Skipping this can lead to unpleasant surprises. So, always take the time to read it thoroughly.

Ask Questions

Never hesitate to ask questions. If something is unclear, ask the lender to explain.

It’s your right to understand every aspect of your loan. This will help you avoid misunderstandings and ensure you know what you’re signing up for.

Seek Professional Advice

Sometimes, loan terms can be complex. In such cases, seeking professional advice is wise.

Financial advisors can help break down the terms and conditions. They provide clarity and guidance on how to get out of debt.

-

Neglecting Debt Repayment Plans

Not sticking to a repayment plan can lead to severe consequences. It might seem like missing a payment or two isn’t a big deal, but it adds up quickly.

First, you’ll face late fees. Every missed payment usually comes with a penalty, and these fees can make your debt grow faster than you realize.

Second, your interest rates might go up. Some lenders increase your rate if you miss payments. Higher interest means more money out of your pocket.

Third, you might receive collection calls. Lenders will start calling to get their money back. This can be stressful and embarrassing.

Fourth, legal action is possible. Lenders can take legal steps to collect the debt if you keep missing payments, such as wage garnishment or property liens.

Lastly, your stress and anxiety may increase. Debt can be overwhelming, and not sticking to your plan can make you feel out of control.

How To Avoid Neglecting Debt Repayment

Automate Your Payments

Set up automatic payments through your bank. This way, you’ll never forget to pay on time. It’s easy and convenient. You can set it and forget it. Plus, it helps you avoid late fees and penalties.

Set Reminders

Use your phone or a calendar to set reminders. Get alerts a few days before your payment is due.

This gives you a heads-up to ensure enough funds are in your account. You can also set reminders for other financial tasks, like reviewing your budget or checking your bank balance.

Review Your Progress Regularly

Take a few minutes each month to review your repayment progress. Check your balances and see how much you’ve paid off. This will help you stay motivated and allow you to make adjustments if needed.

You might find extra money to put toward your debt or notice areas where you can cut back.

Should You Avoid Taking Out Loans?

Taking out loans isn’t always bad. It can be quite smart.

As I said, loans can help you buy a house, start a business, or pay for education. They give you access to funds when you need them most.

Loans can also help build your credit score. Regular, on-time payments show lenders that you’re responsible, making it easier to get bigger loans in the future.

Not all loans are high-interest nightmares either. Many have reasonable rates and terms. Personal loans, mortgages, and student loans often come with fair conditions.

Using loans wisely can actually improve your financial health. They can consolidate high-interest debt into one manageable payment, saving you money in the long run.

So, don’t fear loans.

Instead, understand and use loans wisely because they can be a valuable financial tool.

Just remember: Only borrow what you can afford to pay back! Avoid debt traps at all costs.

Like What You Read?

SuperStaff publishes articles from executives and industry thought leaders to give our readers expert insights and valuable perspectives. These articles cover various topics, offering in-depth analysis, innovative ideas, and practical advice from those at the forefront of their fields.

By featuring content from experienced professionals, we aim to keep our audience informed about the latest trends, challenges, and opportunities within various industries.

Join us on this journey of mutual growth and success. Follow us on LinkedIn and Facebook for insightful content and tips to help you lead your business more effectively.