Sending and receiving invoices is a crucial point of contact between customers and their chosen brands. How buyers receive their billing statements, the ease of making payments, and how billing disputes are handled can influence how they view your business.

U.S. businesses must view the billing and collections process as integral to the customer experience to foster and maintain good buyer relationships. Doing so involves familiarizing themselves with today’s consumer challenges, from high debt levels to the complex healthcare billing system.

Addressing challenges in billing and collecting from individuals facing financial difficulties involves incorporating empathy and exceptional customer service into the approach.

By understanding and acknowledging the financial struggles of customers, businesses can cultivate a more positive relationship. Offering flexible payment plans, clear communication, and personalized assistance can ease the burden on individuals experiencing financial hardships.

Compelling Statistics About US Consumer Debt (and How It Affects Billing and Collection Services)

One of the most pressing challenges your billing and collection department may face is finding a balance between speeding up the invoicing process and showing empathy toward customers with financial struggles. Studies have found that American consumers have taken on more debt than ever.

Skyrocketing Household Debt

According to a Forbes study, U.S. families have accrued $17.06 trillion in household debt, with over $1 trillion owed to credit cards, as of the 2nd quarter of 2023. These sky-high figures show record-high debt levels, suggesting that many consumers are stretching their budgets too thin and may soon struggle to keep up with payments.

The U.S. consumer debt crisis mainly affects young adults, who face lower wages and much shorter credit histories. An Urban Institute report found that about one in five Americans between 18 and 24 struggle to pay debts incurred from credit cards.

Growing Medical Debt

Healthcare is among the sectors with the highest level of consumer debt, with over 73% of Americans owing money to hospitals. An Urban Institute report found that 63% of patients incurred past-due medical debt despite having health insurance, and 16% initially had coverage but lost it.

Today’s more expensive healthcare system may cause growing medical debt. According to a recent study, average family health insurance premiums have increased by 47% since 2011, outpacing wage increases (31%) and inflation (19%).

More consumers are also paying medical bills with their savings. In 2021, consumer out-of-pocket healthcare spending rose to $491.6 billion, growing 10% more than the previous year. Industry experts foresee this figure rising through 2026, gaining a continued growth of 9.9% annually.

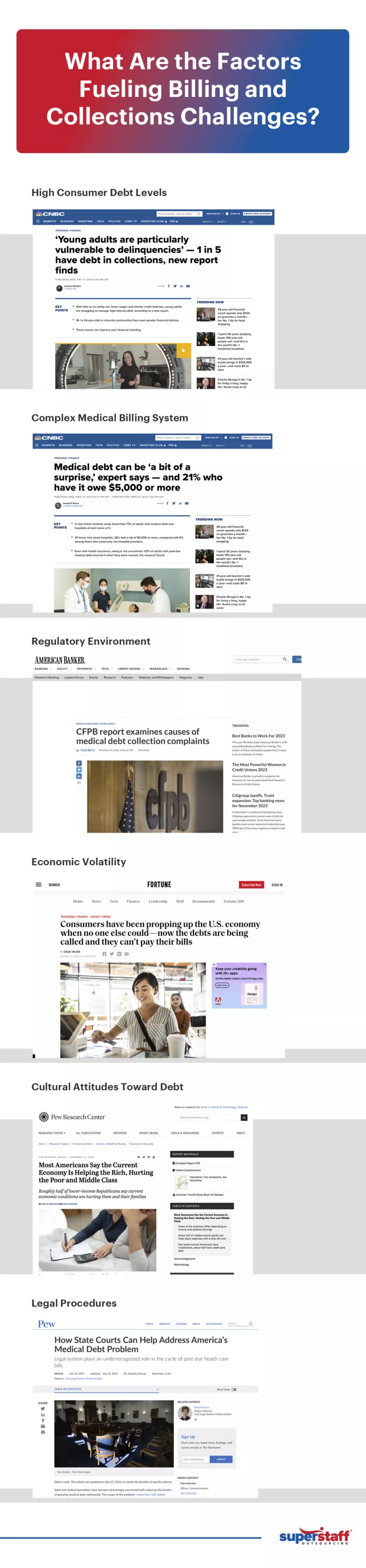

Top 6 Factors Fueling Bills and Collections Challenges

➡️ How Do I Start With My Outsourcing? Book A Free Call

Navigating billing and collections in the United States proves challenging due to the intricate landscape of its debt economy. High levels of consumer debt, compounded by the complexity of healthcare billing systems and stringent regulatory frameworks, create hurdles for businesses aiming to collect payments efficiently.

High Consumer Debt Levels

In previous sections, we mentioned that the U.S. has substantial consumer debt, including credit card debt, student loans, mortgages, and more. The record-high debt levels have created significant challenges for even the most experienced billing and collection specialists since more and more buyers have struggled to pay their bills on time.

According to the Quarterly Report on Household Debt and Credit, total household debt in the U.S. reached $17.29 trillion in Q3 of 2023, growing by 1.3%. The highest unpaid balances belong to mortgages ($12.14 trillion), credit cards ($1.08 trillion), and student loans ($1.6 trillion).

Complex Medical Billing System

Another factor complicating the billing and collections process is the country’s medical billing system. Previously, we mentioned how more than half of all Americans have unpaid medical bills due to rising healthcare costs, but another issue complicating the medical debt crisis is the rise in billing errors.

The Medical Billing Advocates of America estimates that 8 out of 10 hospital bills contain errors. Inaccurate billing statements, often caused by improper data entry, cost the healthcare industry $68 billion annually.

Medical billing in the U.S. is notoriously complex, so having dedicated professionals handle this process is critical. Ideally, a hospital, clinic, or healthcare institution’s billing and collections department must work closely with medical billing and coding specialists to avoid billing errors, disputes, and delayed payments.

Regulatory Environment

Beyond sending invoices on time, complying with government regulations is among businesses’ billing and collection duties and responsibilities. The U.S. has stringent regulations governing debt collection practices to protect consumers. While these rules are essential for consumer rights, they add complexity to collecting debts.

One regulation your billing and collections department must follow is the Fair Debt Collection Practices Act (FDCPA). This regulation aims to protect consumers from abusive or deceptive debt collection practices. It limits what a debt collector can do when attempting to collect payments and gives customers the right to dispute the debts listed in their credit reports.

Economic Volatility

Changes in the economy can also create challenges for billing collections specialist jobs. Economic downturns, recessions, and job losses can significantly affect individuals’ ability to pay bills, leading to higher delinquency rates and difficulties in collections.

Studies have found that most American adults (82%) own a credit card, but not everyone can pay their balance on time, especially amid a volatile labor environment. Economists attribute the recent rise in credit card delinquencies to widespread job losses during and after the COVID-19 pandemic, averaging near the 2007-2009 global financial crisis.

Technology and Infrastructure

While technology has advanced, some industries or businesses still use outdated billing systems or lack the infrastructure to streamline collections effectively.

The truth is that many executives prioritize front-end innovations when accelerating digital transformation, neglecting core systems like billing and collections. However, the invoicing process is a core part of the customer experience, and overlooking it can limit business growth and lead to billing disputes and delays.

According to an Ernst & Young study, companies lose 1% to 5% of earnings before interest, taxes, and amortization (EBITA) due to inefficient invoicing and payment follow-up processes. By investing in technological advancements and infrastructure for the debt collection service, companies can improve their bottom line while providing more consistency and better customer service.

Cultural Attitudes Towards Debt

In the U.S., there are prevalent negative attitudes toward credit and debt, which can impact payment behaviors. Some may prioritize certain debts over others, leading to challenges in collecting outstanding balances.

Studies have found that a person’s attitude toward debt may be related to their household’s debt levels. Consumers who reported being uncomfortable with debt were shown to have significantly lower debt levels, regardless of socioeconomic status.

Among households with lower incomes, people reported higher levels of anxiety over paying their bills (65%), saving for retirement (60%), their amount of unpaid debt (58%), and healthcare costs (55%). In comparison, only 4 out of 10 middle-class and higher-income households have those same worries.

Legal Procedures

Another challenge faced by billing and collections specialists is the complex U.S. legal system. Often, the legal process for debt collection can be time-consuming and expensive. Businesses might face hurdles in recovering debts through legal channels, further complicating the collection process.

Transforming Billing and Collections Services With Empathetic Customer Care

➡️ Not Sure Whether You’re Ready To Outsource? Send Us an Email

Now that we’ve discussed the challenges consumers face that affect billing and collections, let’s discuss how focusing on customer service can help businesses optimize their invoicing processes.

Many business owners think of the billing process as a one-time transaction, but the truth is that it should be a critical part of your overall customer experience strategy. Investing in billing and collections can help nurture client relationships and improve loyalty and retention.

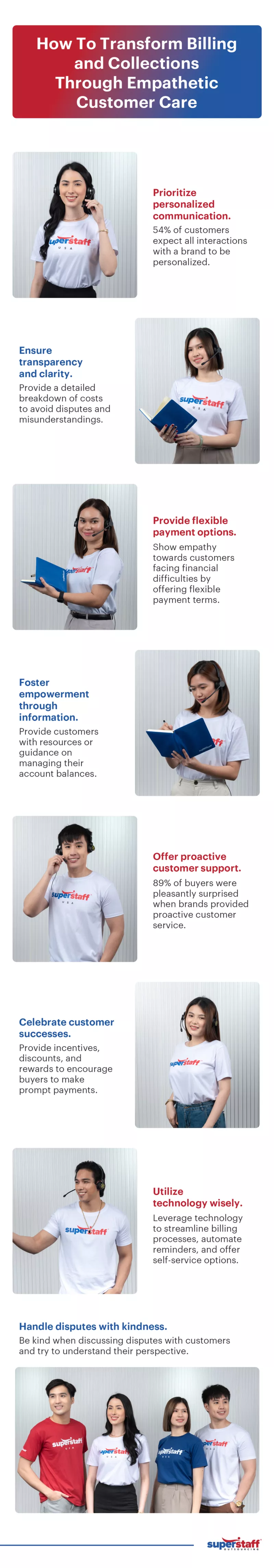

Prioritize Personalized Communication

Standardized reminders often get lost in the clutter of emails. Think about how often you delete spam messages without glancing at their content.

If you send all customers the same automated emails, many might overlook your message and send it straight to the trash folder. To avoid this problem, personalize your payment reminder and follow-up emails, tailoring your communication strategy to each customer’s unique situation.

According to a Zendesk report, 54% of customers expect all brand interactions to be personalized – and the billing and collections process should be no different. Personalization shows your buyers that you value them as individuals and want to build a relationship with them beyond the surface level.

A personal touch can go a long way in nurturing goodwill. Understand your customers’ needs and circumstances and communicate with them in a personalized, empathetic manner.

Show them that you recognize what they’re going through and that you are committed to working together to resolve payment issues. And as much as possible, use precise language, avoid jargon, and offer various communication channels (phone, email, chat) to accommodate preferences.

Ensure Transparency and Clarity

Transparency is crucial for billing and collections because it prevents disputes, misunderstandings, and confusion. Provide a detailed breakdown of costs when sending invoices and compile it in an easy-to-read format that explains all complex terms and upfront charges.

Once you’ve received payment, ask for feedback from customers about their billing \ and collections experience. Then, use this feedback to refine and improve systems continually. Actively listen to suggestions for improvement and implement changes accordingly.

Provide Flexible Payment Options

As mentioned earlier, many customers may have unpaid balances because of temporary financial difficulties caused by factors beyond their control. In these cases, businesses should show empathy by providing more flexible payment terms.

For example, companies can ask buyers to send in smaller, partial payments over a certain period instead of asking for a large upfront sum. Providing greater flexibility in your payment plan can show customers, especially those with challenging financial circumstances, that you are willing to work with them and care about their well-being.

Remember: Billing and collections are not just about completing a one-off transaction. By providing more flexible and convenient payment options, you can nurture customer relationships and earn loyalty.

Foster Empowerment Through Information

Sometimes, the best way to encourage timely payments is by providing the correct information upfront. Ensure your buyers understand the cost of goods and services, payment timelines, late fees and penalties, and other relevant charges.

Educate customers about their billing and payment options. Provide resources or guidance on managing their accounts, understanding charges, and utilizing available support services.

By communicating this information openly, you can avoid confusion, frustration, and potential conflicts while ensuring a smoother and hassle-free collection process.

Offer Proactive Customer Support

A lot of people may not see debt collection as part of customer service, but the truth is that billing and collection should be part of a holistic CX strategy. According to a Helplama study, 89% of customers were pleasantly surprised when their chosen brands provided proactive customer service.

So, billing and collection specialists shouldn’t wait until the last minute to send reminders about overdue balances. Instead, they should proactively address potential billing issues, contact clients before payment is due, and offer assistance and information.

Suppose there are any unexpected changes, sudden additional costs, or other urgent problems concerning their billing status. In that case, specialists must also be proactive in notifying customers about them and listening to their feedback and concerns.

Handle Disputes With Empathy

For some customers, unpaid bills may be caused by a simple miscommunication. Perhaps, they weren’t told about certain miscellaneous charges and were confused about the extra cost. Maybe they didn’t know which payment methods were available, or, in many cases, they didn’t receive an invoice and forgot.

As much as possible, be empathetic when following up with customers about their unpaid balances. Handle disputes or discrepancies with kindness and a willingness to understand the customer’s perspective. Make sure to promptly address concerns and aim for fair resolutions, prioritizing maintaining the customer relationship.

Utilize Technology Wisely

Another strategy to optimize the invoicing process is by utilizing the right technologies. Many businesses still use legacy billing systems that lack flexibility, don’t seamlessly integrate with more advanced networks, and create numerous inefficiencies.

Instead of sticking with these outdated systems, companies can leverage technology to streamline billing processes, automate reminders, and offer self-service options for customers to manage their accounts. They must also ensure these tools are user-friendly and complement human interaction rather than replace it entirely.

Celebrate Customer Successes

Finally, the best way to encourage timely payments and foster brand loyalty is by rewarding customers who settle balances early or on time. You can provide incentives, such as discounts or extended credit terms, to encourage buyers to make prompt payments and help them develop a more positive association with your business.

By acknowledging and celebrating customers for meeting their financial obligations, you show an appreciation for their efforts and express that you value their business. In turn, you reinforce positive behaviors and strengthen the overall customer-brand bond.

Discover the Power of Exceptional Customer Service in Billing and Collections

➡️ SuperStaff Is Trusted By Thousands of Partners. Get To Know Us Too! Book A Free Call

Are you hoping to revolutionize your billing and collections processes? Partner with the outsourcing professionals at SuperStaff.

Here at SuperStaff, we are dedicated to helping you provide better customer care by developing a seamless, hassle-free billing and collection system. We have a team of specialists who can handle various financial services, including billing and collections, accounts payable, accounts receivable, and more.

Our BPO company also provides 24/7 customer support so your clients can inquire about their balance or resolve billing disputes no matter the time or day. Contact us to learn more about our comprehensive solutions.