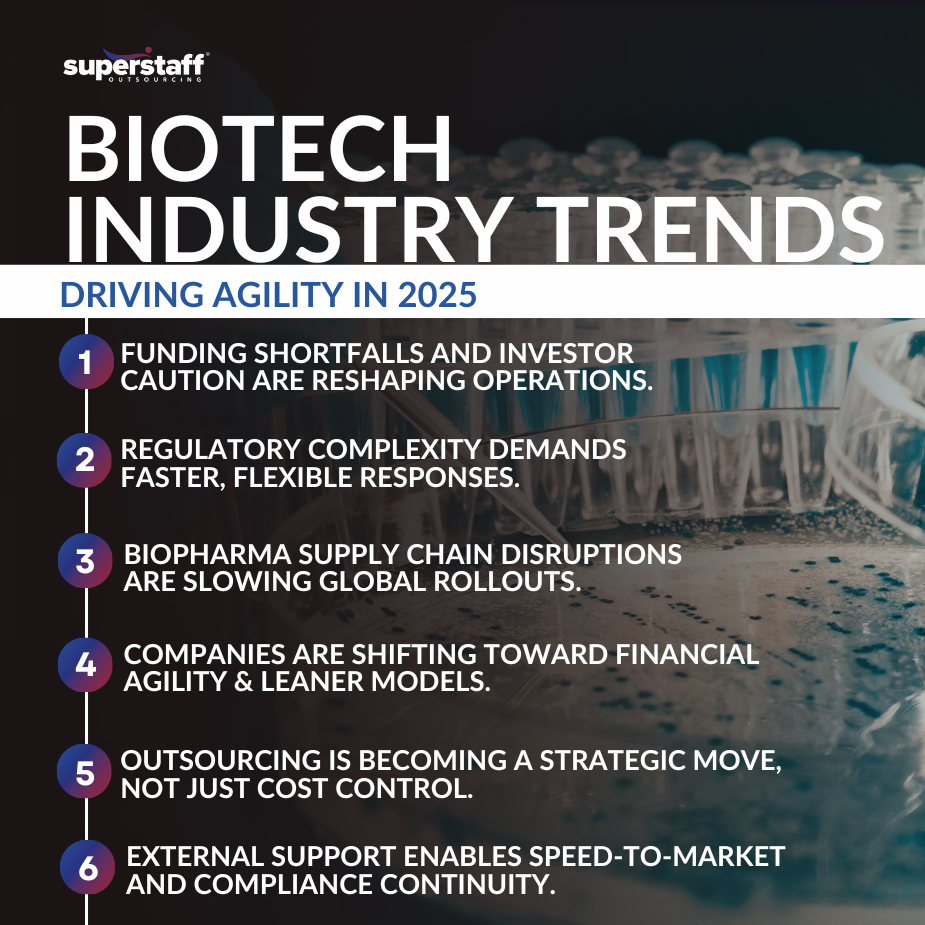

Among the most critical biotech industry trends in 2025 is the need for agility in the face of disruption.

With funding pressures, biopharma supply chain disruptions, and scientific hurdles, companies are under immense strain to keep moving forward — without derailing innovation.

This blog explores how companies can maintain agility amid disruption, and how outsourcing in the pharmaceutical industry supports stability, speed, and scalability.

Market volatility is forcing biopharma companies to re-evaluate their business models.

The biopharmaceutical industry, long known for its high-stakes innovation and rigorous development timelines, is facing mounting pressure from two directions: unstable markets and unpredictable scientific outcomes. While innovation remains at the core, the way companies operate and scale must evolve to match the unpredictability of the current climate. And at the heart of this evolution is the need for operational agility.

A Shifting Economic and Policy Environment

Biopharma is no stranger to navigating change, but 2025 has introduced a particularly volatile mix of political, economic, and regulatory forces. Companies that once relied on predictable funding cycles, strong public-private partnerships, and global market access now find themselves in uncharted territory.

Trade restrictions are tightening, reshaping global supply chains and making cross-border operations more complex. Political shifts are causing sudden policy changes — including reduced support for science and healthcare innovation — which are further destabilizing the industry’s operating environment.

At the same time, investor sentiment has grown more cautious. Once a magnet for capital, biopharma startups and mid-stage firms are now facing higher scrutiny and longer funding timelines. Venture capital, private equity, and even corporate investment arms are pulling back, demanding more proof-of-concept before committing to major funding rounds.

Delayed IPOs and Frozen Funding Pipelines

The most immediate consequence of this investor hesitancy? Delayed IPOs and stalled fundraising efforts.

Startups that were planning to go public or scale rapidly through late-stage funding are now hitting pause, unable to secure the capital they need. For companies in the discovery or early clinical trial stages, this means stretching existing resources thin while trying to maintain momentum — a difficult balancing act when time-to-market is everything.

As access to capital becomes more limited, biopharma leaders are being forced to rethink how they structure operations. Many are turning inward, examining ways to reduce overhead, streamline decision-making, and prioritize projects that have the highest probability of near-term success. In other words, they’re learning why financial agility is critical for biotech firms in 2025.

R&D Incentives Are Shrinking

Another critical blow is the reduction in government incentives for research and development.

For decades, tax credits, grants, and cooperative agreements played a key role in encouraging early-stage innovation. In many countries, these supports are now being scaled back — part of broader budget reallocations and shifting government priorities.

Without this safety net, discovery-stage projects that were already high-risk become even riskier. The result is a more conservative R&D pipeline, with companies hesitant to invest in long-term, uncertain science. Many are opting instead to focus on incremental innovation, repurposing existing compounds, or advancing biosimilars that offer more reliable regulatory pathways.

This shift not only impacts innovation but also narrows the future treatment landscape — especially for rare or complex diseases that require bold, exploratory science.

Global Distribution Rollouts Are Slowing Down

Even for companies that manage to push products through trials and into approval, the next hurdle is getting those therapies into the hands of patients across the globe.

Historically, biopharma firms have relied on efficient global distribution networks to scale quickly. But in 2025, supply chain fragility and unpredictable customs regulations are slowing down international rollouts. Border controls, inconsistent regulatory timelines, and regional political instability are all adding friction to global launch strategies.

For companies that built business models around rapid international growth, this represents a major challenge. Speed-to-market — once a competitive advantage — is now being compromised by external factors beyond a company’s control.

Scientific and regulatory setbacks can derail even the most promising pipelines.

It’s not just the market that’s shaky. Scientific outcomes remain highly uncertain, with even late-stage trials vulnerable to failure. Regulatory scrutiny has intensified, and agencies like the FDA are demanding more robust data across all phases.

- Phase III trial delays are among the most expensive setbacks, costing millions per month in extended timelines.

- Regulatory data gaps or rejection risks can delay or kill product launches altogether.

- Extended development cycles cause team fatigue, burnout, and turnover.

Biopharma leaders can’t control scientific results, but they can control how their organizations adapt to setbacks. That’s where operational agility, especially through outsourcing, becomes essential.

Outsourcing allows biopharma companies to flex operations without compromising quality.

Outsourcing enables companies to scale support functions in lockstep with R&D priorities. Rather than hiring and onboarding internal staff for every peak in activity, companies can tap specialized external talent to fill gaps fast — without sacrificing compliance.

- Outsourced teams can handle data entry, document processing, and clinical site support during peak trial activity.

- Global regulatory researchers can keep submissions moving across jurisdictions.

- Multilingual regulatory teams ensure accurate, localized documentation for diverse markets.

Strategic outsourcing helps companies respond in real time to new opportunities or setbacks, moving faster while keeping fixed costs under control.

Outsourcing enhances resilience during market or research turbulence.

When internal teams are stretched thin or restructured due to market pressures, outsourcing helps preserve continuity. It’s a buffer against disruption that also opens up strategic advantages.

- Remote teams keep mission-critical workflows running even during downsizing or leadership transitions.

- Companies can access niche expertise (like regulatory affairs or pharmacovigilance) without making long-term commitments.

- During periods of high volume (such as data submission deadlines), external partners help clear backlogs.

In other words, outsourcing allows biopharma companies to respond quickly to the unexpected — whether that’s a positive pivot or a crisis.

The right outsourcing partner brings regulatory fluency, scalability, and sector experience.

Of course, not all outsourcing is created equal. Biopharma companies need partners who understand the unique operational and compliance landscape of life sciences.

- Experience with FDA, EMA, and ICH guidelines ensures outsourced work meets global regulatory standards.

- Seamless collaboration with CROs (Contract Research Organizations), CDMOs (Contract Development and Manufacturing Organizations), and internal teams is essential.

- Data security and intellectual property protection must be airtight, particularly for sensitive clinical and discovery-stage information.

When these boxes are checked, outsourcing becomes more than a cost-saving tactic. It becomes a growth strategy that supports innovation while mitigating risk.

Biotech Industry Trends in 2025: Stay Ahead of the Curve With SuperStaff

Volatility and scientific uncertainty don’t have to halt progress — biopharma companies can stay agile through strategic outsourcing.

From handling clinical trial support to navigating complex global compliance requirements, outsourcing enables speed, focus, and resilience when it matters most.

Ready to strengthen your operations while focusing on innovation? Discover how outsourcing can help your biopharma business stay adaptive and ahead.