Remember, the journey towards exceptional customer experiences begins with a well-designed CX ROI model.

The logic behind customer experience (CX) is straightforward: When customers are satisfied, they tend to spend more, stay loyal to your brand, advocate your offerings, and interestingly — it often requires less money to serve them.

Indeed, CX reigns supreme in today’s landscape. However, it’s surprising that financial stakeholders still overlook a critical aspect: a well-defined Return on Investment (ROI) model for their CX.

This framework is essential for quantifying the direct impact of your CX strategy on your financial success. Without a clear CX ROI model in place, businesses risk missing out on opportunities to optimize investments and make informed decisions that drive sustainable growth and profitability.

The crux of the matter was thoroughly discussed in a comprehensive study by Gartner. Titled Calculating the ROI of Customer Experience Initiatives, the research is aimed at helping stakeholders understand the correlation between CX and business ROI.

Building a Strategic CX ROI Model

In a previous article, we delineated formulas for calculating five key CX metrics.

Now, with the insights from Gartner’s study at hand, we embark on a deeper exploration of the specific variables involved in these formulas. Our goal is to construct a sample CX ROI Model, which will serve as a practical tool for organizations seeking to quantify the impact of their customer experience initiatives on their bottom line.

For this exercise, we will be zooming in on the NPS.

What is the NPS?

Net Promoter Score (NPS) is a widely used metric that gauges customer loyalty and overall customer satisfaction. It was introduced by Fred Reichheld in 2003 and has since become a standard tool for assessing customer sentiment.

It is rooted in one key question:

How likely is it that consumers would recommend a brand to a family member, friend or colleague?

Customers respond to this question on a scale of 0 to 10, with 0 being most unlikely and 10 being extremely likely. They can be categorized into three groups based on their responses:

- Promoters (9-10)

Highly satisfied and loyal customers; likely to recommend your business.

- Passives (7-8)

Somewhat satisfied, but not overly enthusiastic; may consider switching brands.

- Detractors (0-6)

Dissatisfied customers; unlikely to recommend your business and may even spread negative feedback.

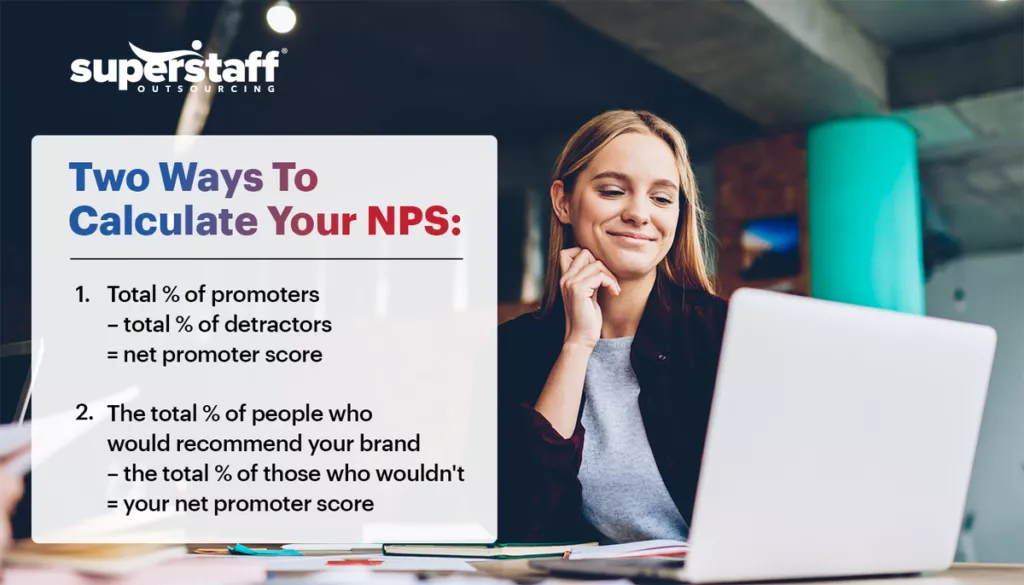

The NPS formula can be calculated in two ways:

The resulting score can range from -100 to +100. A higher NPS indicates stronger customer advocacy and loyalty, while a lower score suggests a need for improvement in customer satisfaction and loyalty-building efforts.

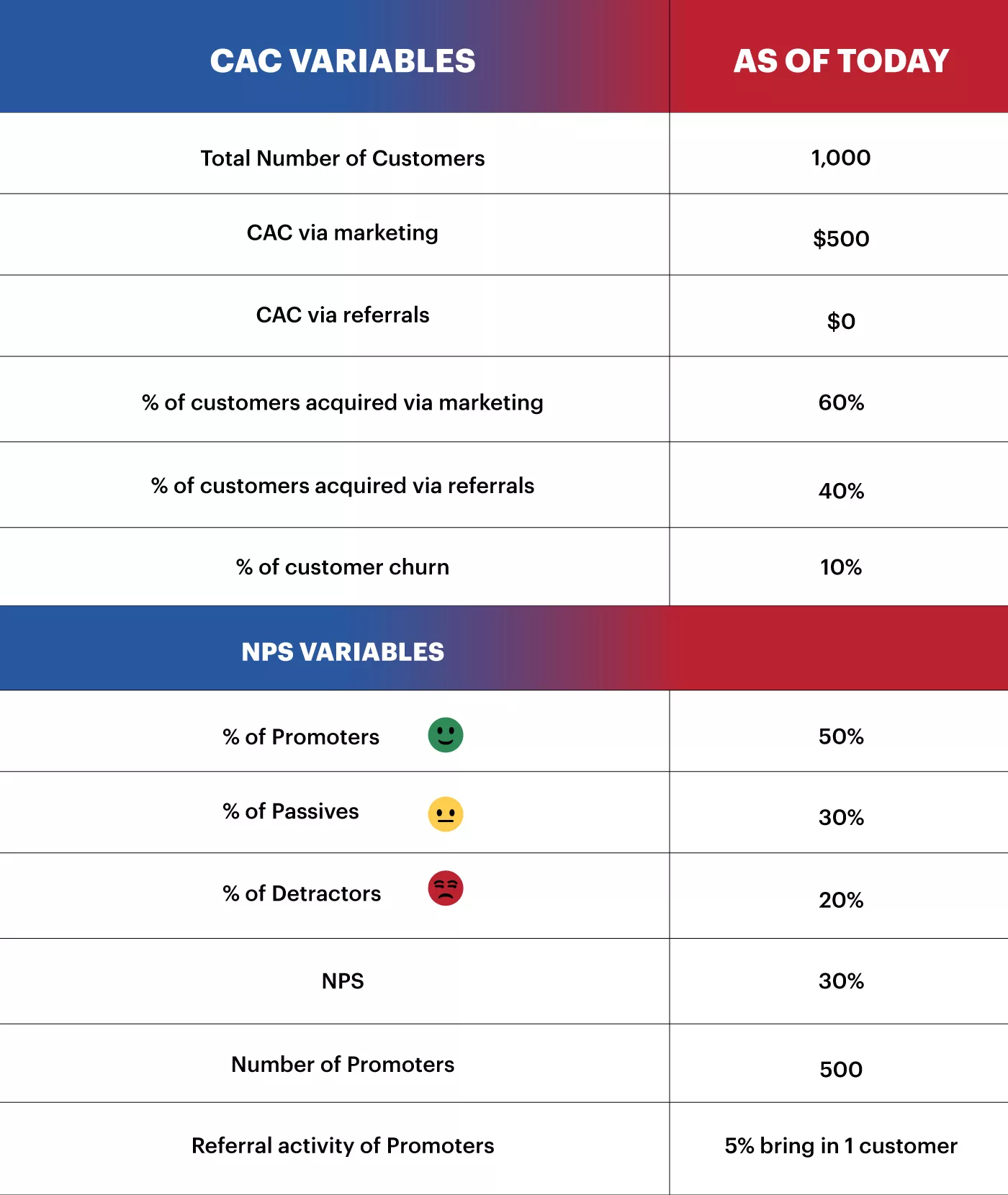

[Featured Charts] The Fundamentals of Calculating Your CX ROI

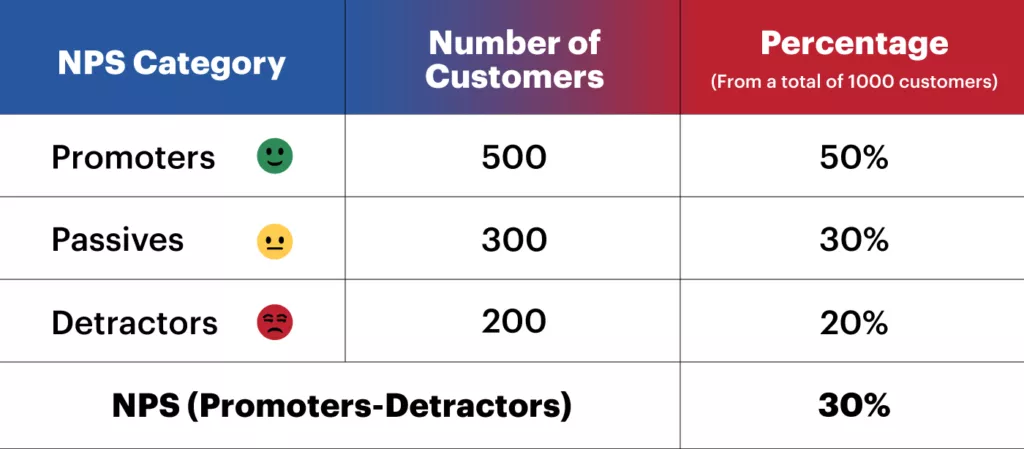

The first crucial step in calculating your ROI involves choosing a pertinent metric. In this case, we’ll take on the Net Promoter Score (NPS).

Since it’s clear that people are more inclined to endorse companies where they have exceptional experiences, CX is critical. Positive touch points will inevitably translate to tangible financial metrics — ultimately leading to accelerated growth, lower customer churn, increased customer lifetime value, and a significant drop in the cost of customer acquisition.

Critical NPS Variables

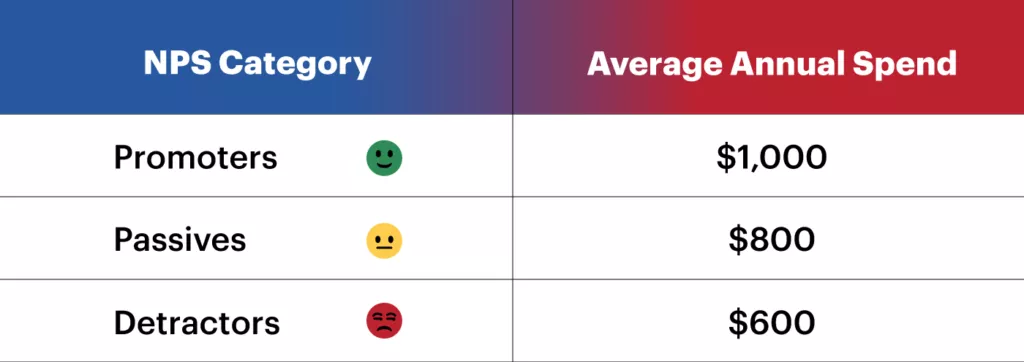

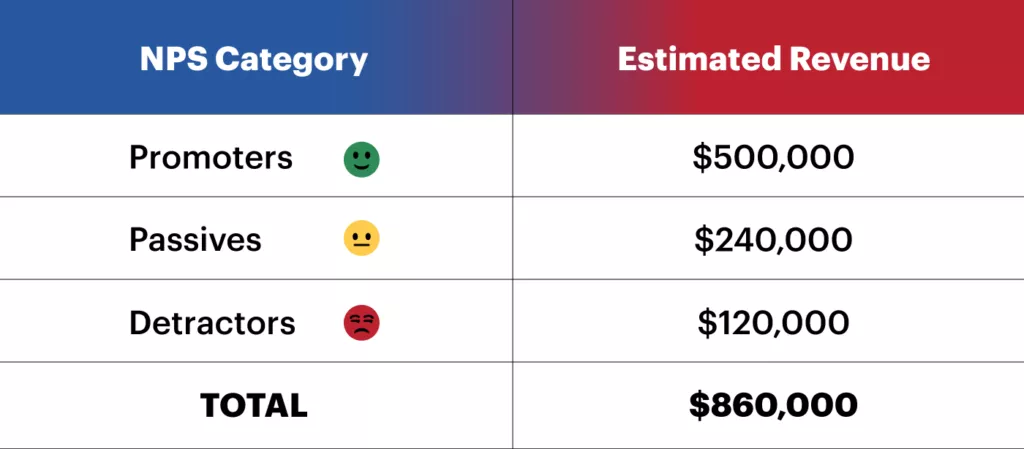

Now to further dissect your NPS, we will be looking at two sets of metrics: the average annual expenditure and the average number of referrals per NPS category. Consider the following data:

This will give us insight into how much we’ve invested into our CX and how many new customers we’ve gained through it.

While tracking referrals may present certain challenges, it’s still a critical component of the calculation process. As such, we need to think outside of the box to measure this accurately. In a B2C context, this can involve linking customer IDs through referral codes. Meanwhile, in a B2B setting, this could entail asking new customers for information about who referred them.

NPS Pattern

While specific figures may vary, this pattern of spending is generally true and should also hold true in your case:

- Promoters tend to spend more than Passives.

- Passives typically spend more than Detractors.

If your numbers deviate from this pattern, it may indicate an issue with how the NPS is being measured. Common pitfalls in NPS measurement include offering financial incentives for survey completion, which can skew results towards higher scores rather than honest feedback.

Moreover, making NPS a Key Performance Indicator (KPI) for individual employees or departments can lead to problematic practices, such as pressuring respondents for high scores. Since this is particularly prevalent in certain industries, such as automotive dealerships — it is imperative to address these issues for the accuracy and integrity of the CX ROI calculation.

Calculating the Impact of NPS on Your Bottom Line

To help you determine your CX ROI through NPS, we’ve broken down this complex process into a few simple steps.

- Categorize Customers by NPS

Start by getting the total number of customers and categorizing them based on their NPS scores. This provides insights into customer sentiment.

- Determine Average Annual Spend per NPS Category

Gather data on the average annual spend for customers in each NPS category. This can help quantify the value associated with different sentiment levels.

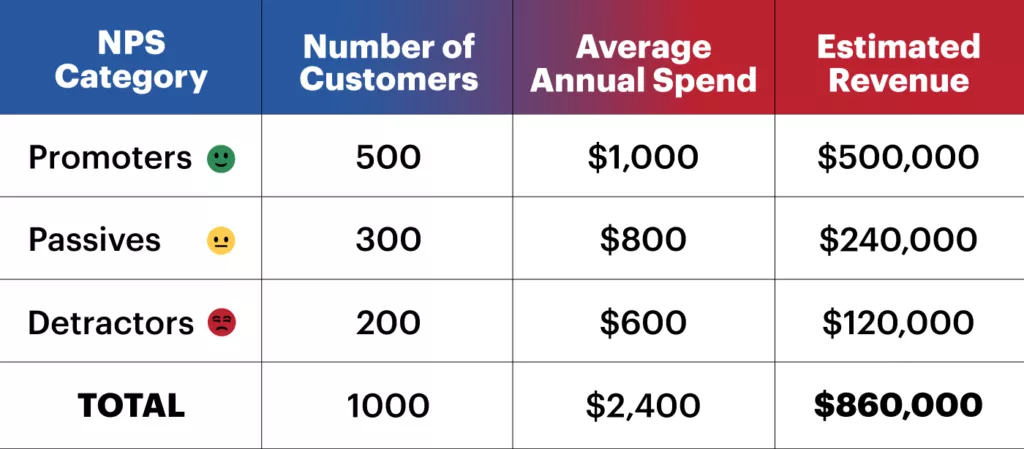

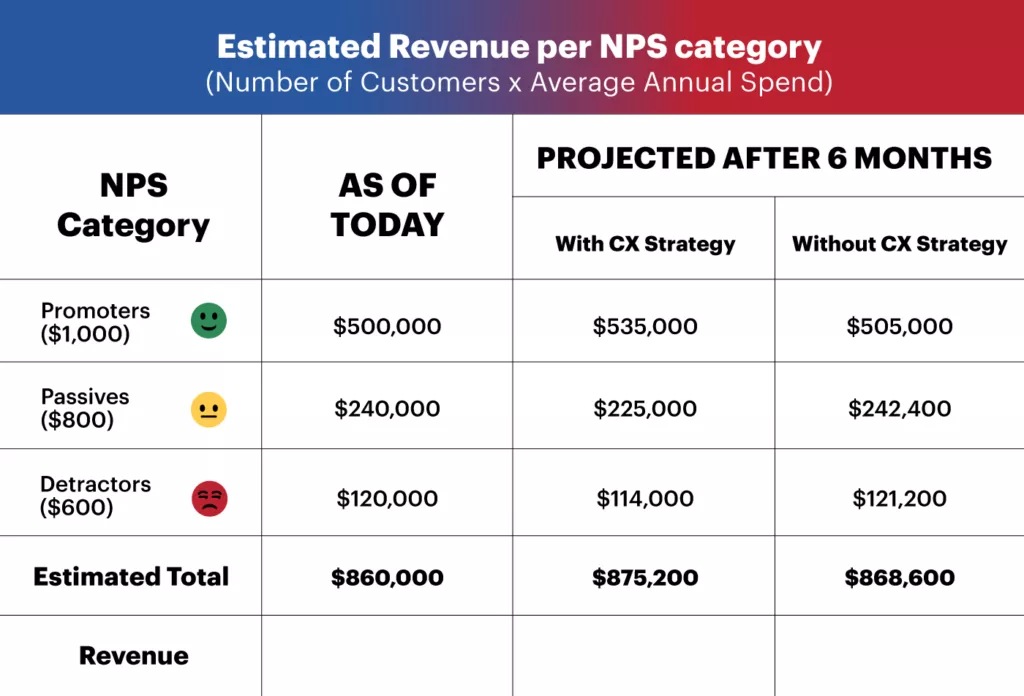

- Calculate Total Revenue per NPS Category

Multiply the number of customers in each NPS category by their respective average annual spend. This yields the estimated total revenue generated by customers in each sentiment category.

- Estimate Total Company Revenue

Sum up the revenue from all NPS categories to get the estimated total revenue for the company.

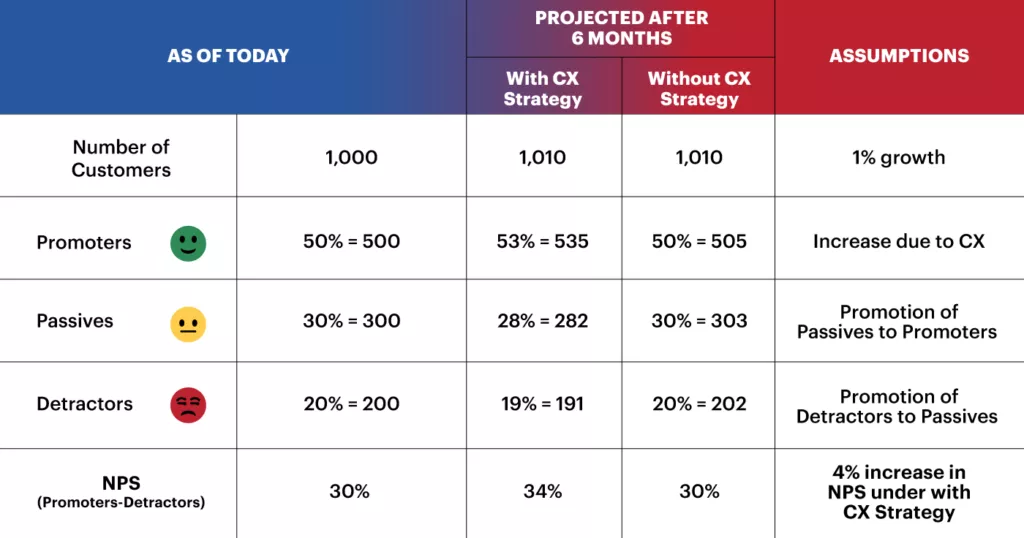

- Impact of NPS Increase

For this part, consider two scenarios: one where you leveraged a CX strategy resulting in an increase in NPS, and one without a strategy, and hence no increase in NPS.

Assuming the average spend per NPS category is constant, you can gauge NPS’ impact by multiplying the number of customers per category to their respective average annual spend.

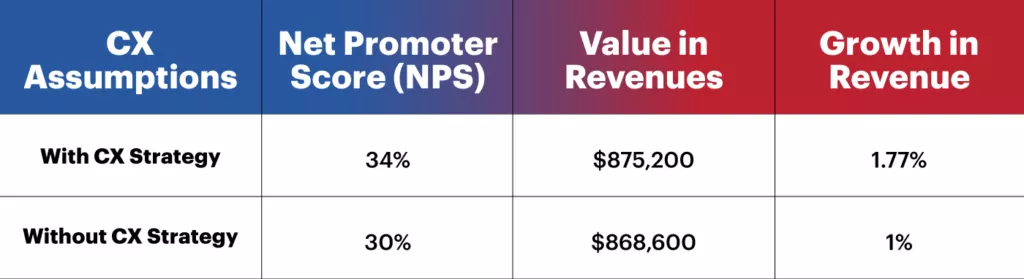

- Calculate the ROI of your CX

Assess the growth in revenue with and without the CX program for a comparison that highlights the impact of your CX strategy on business growth.

In this scenario, we recorded a 4% net increase in NPS and $6,600 growth in revenue under the “With CX strategy” category.

While these numbers may seem small in context, keep in mind that we are also working with a relatively small hypothetical value (1,000 customers). When scaled up, this net increase can make a significant difference on your bottom line.

Calculating the Impact of NPS on Customer Acquisition Costs (CAC)

Investing in a CX program also brings with it the benefit of reduced customer acquisition costs (CAC) — to dissect this further, let’s take a look at this quick example of what the numbers look like.

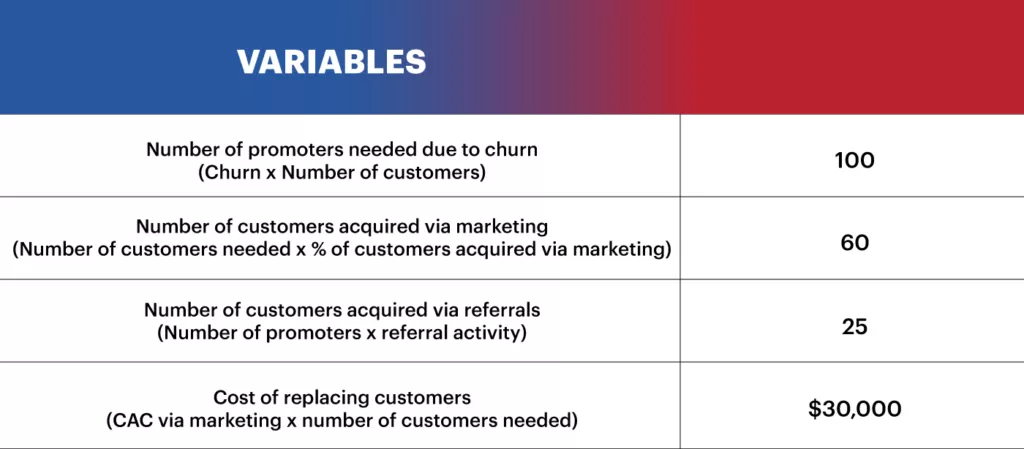

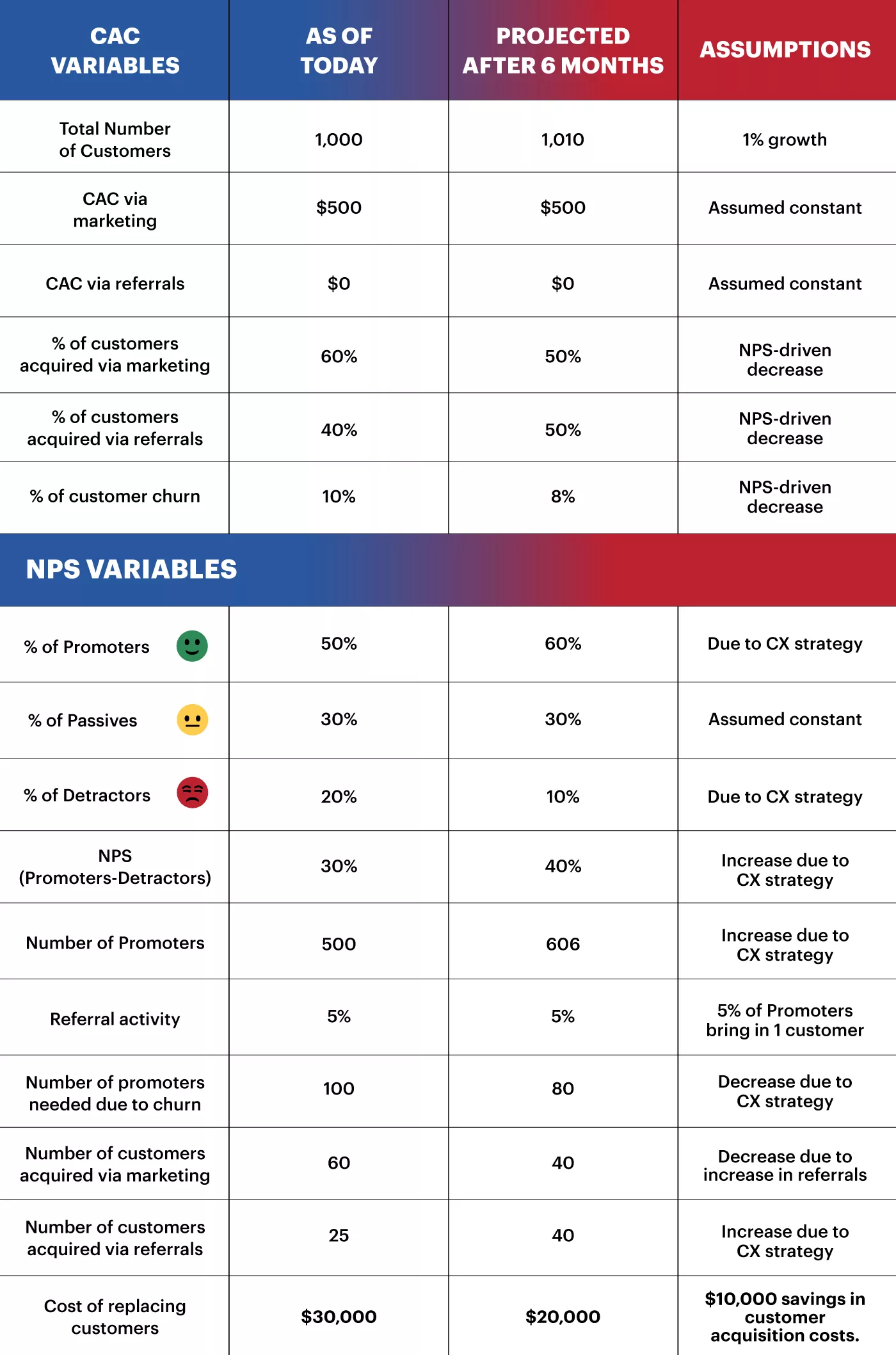

Now, with these numbers, let’s try to balance out churn with customer acquisition programs.

By making simple tweaks in your CX strategies you can drive down customer churn and increase your profit margins. Here’s how:

Now, let’s break down the calculation and what it means for businesses.

- Estimating Churn

It’s crucial to measure this to determine the customer acquisition programs necessary to offset the loss of customers.

In this case, a churn rate of 10% means a hundred customers were lost from an original customer base of 1,000.

- Projected Churn Reduction with Improved NPS

One strategic way to offset customer loss is with a higher NPS.

In this example, we see a 10% increase in NPS. With that comes a 2% drop in churn (from 10% down to 8%). This means the total percentage of customers needing replacement through marketing is 8% of 1,000, which equates to 80 customers (from 100).

- Increase in Referrals from Promoters

As the NPS increases, Passive customers move on to becoming Promoters.

In this case, we recorded a +110 increase from 500. With 606 promoters, businesses can now generate 30 referrals (606 x 5% referral activity).

- Cost Reduction

The decrease in churn rates and increase in referrals ultimately leads to a significant reduction in customer acquisition costs — with the value of the CX program amounting to $10,000 in CAC savings.

It’s important to note that without taking action, it’s unlikely that your CAC will naturally decrease. As demonstrated in this case study, a strategic CX program can substantially fuel cost savings and improve acquisition efficiency.

Strategic Initiatives That Will Drive Your Net Performance Score

In a dynamic market where consumer expectations and behaviors are in constant flux, quantifying the investment in Customer Experience (CX) is crucial for businesses striving to stay ahead.

Unlike the swift returns often seen through social media advertising, CX ROI’s trajectory demands more patience. As such, businesses need to set a reasonable timeframe of at least six months — and to fully grasp their ROI, companies also need to consider these key areas:

- Gauging Net Promoter Scores (NPS)

This involves assessing customer sentiment at various touchpoints, with a keen focus on identifying potential underperforming areas.

- Benchmarking Against Competitors

By comparing their own NPS against their peers, companies gain valuable insights into their performance relative to a cohort of competitor firms.

Pro Tip: This offers invaluable insights into effective strategies and potential pitfalls from your competitors.

- Conducting Driver Analyses

This critical exercise helps identify the key factors influencing NPS, quantifying their impact — whether positive or negative.

Key Strategies to Boost Your NPS

Now, let’s delve into the actionable strategies that can significantly boost your Net Promoter Score.

- Elevated Product Evaluation Experience

Ensuring that your website and marketing materials offer a seamless and informative experience for potential customers is pivotal. This entails delivering clear and persuasive content, user-friendly navigation, and a compelling presentation of your products or services.

- Streamlined Onboarding and Delivery Processes

A smooth onboarding experience is the bedrock of any positive customer relationship.

Investing in onboarding and delivery processes is key. To further build customer trust and confidence, businesses should also optimize payment and billing procedures.

- Improved User Experience (UX) for Digital Products

In this tech-fueled landscape, ease of use and functionality of digital products are absolutely critical.

With user-centered design, intuitive navigation, and responsive interfaces, businesses can craft a positive user experience that drives revenues.

- Comprehensive Staff Training and Customer-Centric Culture

Your employees are the frontline ambassadors of your business. Equipping them with the knowledge and skills to prioritize customer needs and desired behaviors is paramount. Ongoing training programs and fostering a customer-centric culture create an environment where employees are attuned to delivering exceptional experiences.

- Investment in Employee Experience

Recognizing the value of a positive employee experience is integral to driving improvements in NPS. Engaged and motivated employees are more likely to go above and beyond to meet customer expectations, resulting in higher satisfaction levels.

By adopting this approach, businesses can quantitatively evaluate their CX investments and strategically adapt to evolving consumer dynamics. Embracing these initiatives not only elevates your NPS but also fosters a customer-centric culture that lays the foundation for long-term success. Ultimately, mastering CX investment is a journey, not a destination.

Why Your CX ROI Computation Should Be Tailored?

Financial leaders recognize the paramount importance of delivering exceptional experiences to their customer base. Nevertheless, without a clear understanding of its ROI, many still find themselves reluctant to invest substantial resources towards enhancing their CX.

Gartner’s findings underscore that simply demonstrating the overall ROI of a robust CX won’t be enough to provide the necessary guidance for decision-making. Rather than solely focusing on overarching drivers of company performance, effective CX ROI models provide a direct link between consumer behavior and operational variables.

Another crucial revelation from Gartner’s research is the importance of challenging the conventional model for computing the CX ROI investments which assumes that all customers are affected by CX improvements in the same way. In reality, this is far from the truth.

Since every business operates in a unique environment with distinct customer behaviors, industry standards, and competitive landscapes, Gartner proposes that business leaders pivot towards employing targeted ROI models which are designed to discern the specific value of CX investments. This approach provides a compelling rationale for prioritizing particular initiatives, ultimately leading to a more effective allocation of resources and a superior overall customer experience.

Ultimately, a tailored CX ROI computation ensures that your analysis is aligned with the distinct characteristics and goals of your business. It provides a more accurate and actionable understanding of how customer experience investments directly impact your bottom line.

Unlock the Potential of Your CX Strategy with a Tailored ROI Model

While the landscape of business continues to evolve, one thing remains constant: the pursuit of exceptional customer experiences. Crafting experiences that resonate and drive loyalty is a key differentiator in today’s competitive market. But how do you measure the impact of these experiences on your bottom line? The answer lies in designing a tailored ROI model for your CX strategies.

With more than a decade of success in the customer service field under its belt and a strong presence in the Philippines — the Call Center Capital of the World, SuperStaff has established itself as a trailblazer in CX excellence. Through a combination of cutting-edge technology, highly skilled professionals, and a client-centric approach, SuperStaff has consistently helped businesses across industries achieve their CX goals.

Reach out to us today and elevate your business through unparalleled customer experiences.