As the owner of a small or medium enterprise (SME), you may find yourself constantly wondering about the effectiveness of your business strategy. You may have set milestones and goals at the beginning of the year but haven’t looked back to check whether you’ve met or surpassed them.

It’s understandable. Running a business is hard work, requiring you to wear multiple hats and juggle countless tasks and responsibilities. However, the path to continuous business growth and success starts with improving your operations – and this can only be accomplished if you understand what you’re doing right and what you’re doing wrong.

Now that we’ve approached the middle of 2024, it’s the perfect time to conduct a mid-year strategy evaluation. Assessing your company’s performance and pivoting when needed will allow you to realign your business objectives, adapt to market changes and new opportunities, and enhance organizational agility.

In this article, we’ll guide you through how you can assess your overall financial growth and your employees’ performance. Then, we’ll help you determine whether it’s time to develop a brand-new operational strategy.

Mid-Year Review of Your Financial Performance: How Assessing and Adjusting Business Strategies Can Safeguard Your Bottom Line

Studies have found that 77% of companies succeed by building a business strategy and translating it into everyday operational mechanisms that they continually monitor, measure, and evaluate.

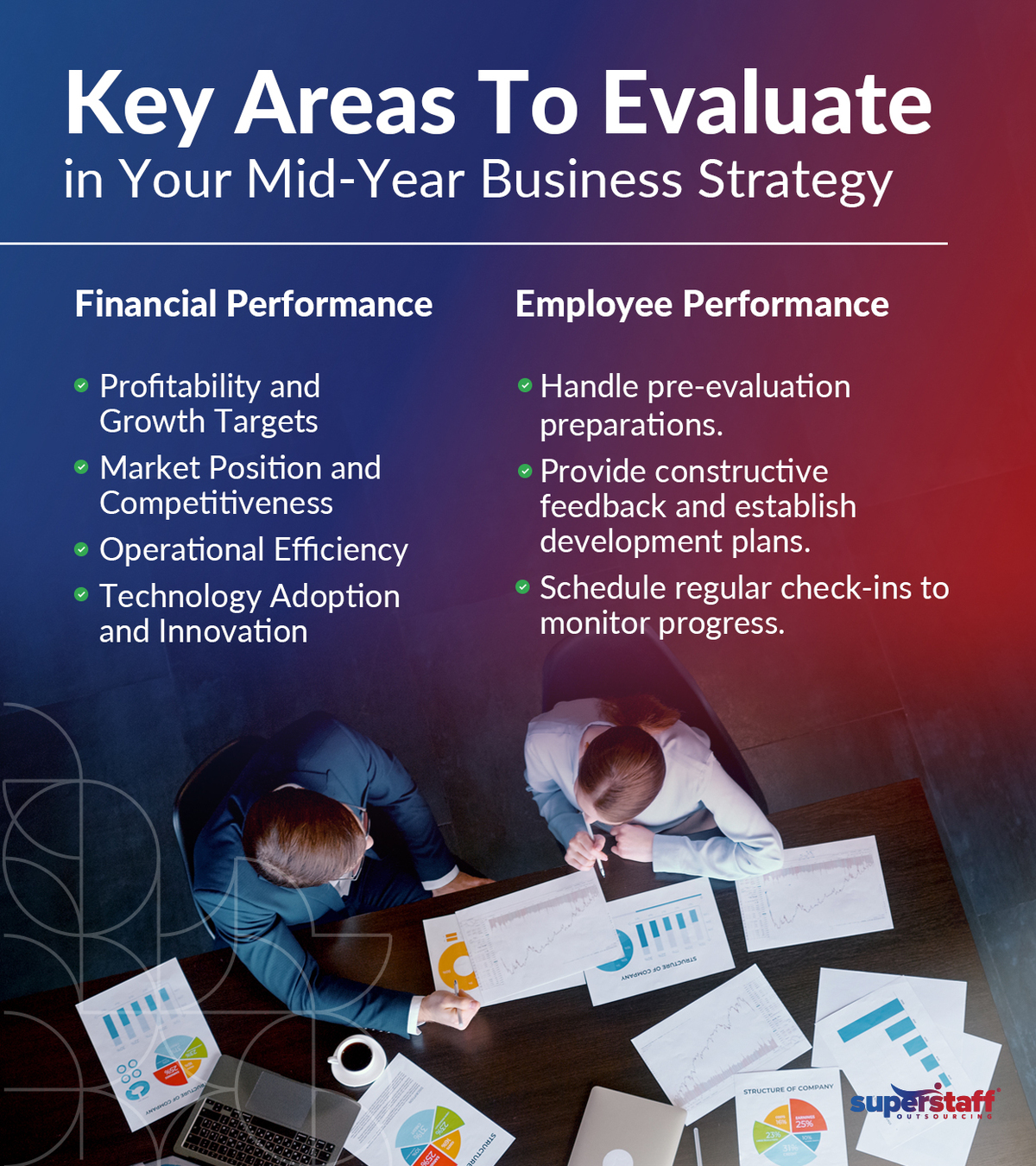

The middle of the year is the ideal time to take stock of your organization’s financial performance. A comprehensive evaluation will help you better understand your financial health and make more informed decisions. Here are the specific areas you should pay close attention to:

Profitability and Growth Targets

Comparing your revenue and profits against your set financial targets can allow you to make projections for the rest of the year and assess whether you need to pivot strategically, make adjustments, or continue your current course.

Review your income statements and ask yourself, “If nothing changes, will the business meet my annual revenue expectations?” Take a closer look at these financial KPIs before taking any action:

- Revenue to Date: How much have you made so far, and are you on track to meet your goals?

- Profit Margins: How much is your return on investment for the midway point? Do the profits justify expenses?

- Cost Management: Have you stayed within your budget, allocated resources effectively, and are on the road to profitability?

- Growth Analysis: How is your business growth compared to the previous years, and what are the factors shaping it?

Once you’ve reviewed the numbers and compared them against your financial targets at the beginning of the year, the next step is to assess any differences and determine their root causes. You should dig into all possible factors that may affect your financial performance.

For instance, market trends may have changed, or the cost of acquiring raw materials and supplies has increased significantly. Perhaps your customer acquisition and sales strategies may need to be improved, or your core operations aren’t as efficient as you need them to be.

Missing some of your targets isn’t always a cause for concern, but you’ll still have to analyze and account for the differences. Understanding what might have changed or what can be enhanced will help you align financial targets and projections with your ongoing strategic goals for the rest of the year.

Market Position and Competitive Landscape

Beyond profitability and growth, you should also evaluate your market position and competitiveness in the current business landscape. Knowing how you fare against your competitors can directly impact your company’s financial health, determining whether you are on the path to continued growth or facing stagnation and decline. Here’s how you can measure and analyze your competitive position:

- Market Share: How much of the total sales in your industry are generated by your company?

- Market Growth: Has your sales volume increased or decreased over the past year?

- Competitive Advantage: What specific value proposition does your company provide, and what do you do better than others in your industry?

- Brand Recognition: Is the average consumer aware of your brand, especially compared to direct competitors?

In addition to reviewing your competitiveness, you should also look into the ROI of your customer experience (CX). By evaluating how well consumers respond to your products and services, you can strengthen your competitive edge and establish your brand as a long-term industry player. Here are some metrics you can use to evaluate your CX initiatives:

- Customer Lifetime Value: What is a customer’s total revenue throughout their relationship with your business?

- Customer Satisfaction Score: How satisfied are your customers with your products and services, and which areas could use improvement?

- Customer Health Score: Are your customers at risk of abandoning your brand, or are they more likely to stay loyal?

- Net Promoter Score (NPS): Are your existing customers willing to recommend your business to their family and friends?

- Customer Effort Score: How easy or difficult is it for your customers to do business with you?

Operational Efficiency

Your operational efficiency and performance should also be critical to your business development strategy. Optimizing and streamlining your operations enables you to reduce costs, allocate resources effectively, and improve overall profitability.

The formula for measuring operational efficiency is reasonably straightforward. To calculate the percentage, divide your total operating expenses by your total revenue. Then, multiply that sum by 100.

Operating Expenses / Total Revenue x 100 = Operational Efficiency Ratio

For example, Company A spent $100,000 on its overall operating costs. By the middle of the year, they earned a revenue of $1 million. In this case, the business has achieved an operational efficiency ratio of 10%. The lower the percentage, the higher your operational efficiency. This means that your business is more sustainable in the long run, and you’re on the right track to meeting (or exceeding) your profitability goals.

No matter how high or low your score, we recommend reviewing all internal processes and workflows and asking yourself, “Are there ways to make this process more efficient than it already is?” Ask each department to give you a thorough breakdown of their daily workload, estimate the average timeline for completing each task, and determine how often they face significant disruptions.

To improve your operational efficiency, identify all bottlenecks in your systems and processes and determine how to optimize or enhance them. For instance, is there a new piece of equipment or technology you can integrate into your operations to lighten your team’s workload and speed up their processes? Perhaps you could outsource back office services to provide crucial administrative support for your core business.

Innovation and Technology Adoption

Regarding improving operational efficiency, your technology infrastructure is another factor you should consider when performing your mid-year business strategy evaluation. Review your current technology stack and digital initiatives to check whether they are enough to meet your business needs or if you’ll need to change or upgrade any of your equipment, networks, and systems.

We also suggest looking forward and keeping an eye on emerging technology trends and innovations. Always perform a cost-benefit analysis when making new technology investments and set KPIs at the beginning of adoption so you can check whether it is optimizing your operations. Here are the factors you should consider when deciding whether or not to integrate a new piece of technology into your business:

- Hardware and Software Costs: How much will you spend on the infrastructure and equipment?

- Development Costs: Will you need to customize or upgrade your software and applications to match the new tech?

- Implementation Costs: How much will you spend deploying and integrating the new systems?

- Training and Upskilling Costs: How will you ensure your workforce can effectively use these new technologies?

- Downtime Costs: How much will you lose during the downtime of the implementation phase?

- System Maintenance: Will you need to hire someone to maintain, repair, and upgrade your system continuously?

Calculate the costs mentioned above and compare them against the benefits of implementing the new system and technologies, such as:

- Operational Efficiency: Will the new system speed up your operations significantly?

- Employee Experience: Will these help lighten your team’s workload and simplify their jobs?

- Customer Satisfaction: Will the new technologies help improve your customer experience?

- Profitability: How much will you earn back after investing in this technology?

Mid-Year Employee Performance Reviews: A Guide for Effective Feedback and Growth

Having discussed the importance of evaluating mid-year financial results, let’s move to another important factor affecting your business strategy: employee performance.

In the era of low employee engagement, paying attention to your workforce’s happiness and satisfaction is necessary to maintain productivity, quality, and overall performance. Think about it: No matter how well you allocate resources or how efficiently you’ve set up your operations, it won’t matter if your employees are disengaged, putting in subpar work, or leaving your company in droves.

Employee engagement is more than just throwing the occasional office pizza party or adding a ping-pong table to the rec room. According to the industry experts at Gallup, investing in workers’ personal and professional development is the most effective way to keep them connected to your company. This means taking an active interest in their career, providing meaningful feedback, and helping them meet their goals.

Knowing this, you must include mid-year employee performance reviews in your business growth strategies. These evaluations can help you align your goals with your workers, assist them in identifying and addressing their areas for improvement, and show them that you care about their career growth.

Preparing Employees for the Review

Before conducting the review, thoroughly prepare your employees by collecting performance metrics, including self-assessments and feedback from their direct supervisors and team members. Outline the critical points for discussion, such as their achievements, strengths and weaknesses, areas for improvement, and future goals, to set a clear agenda.

Above all else, it’s crucial to nurture a positive environment and company culture that welcomes constructive feedback and respectful dialogues. Assure your employees that a performance review is not an accounting of their faults but an honest two-way conversation to align your objectives and work together to boost their development and experiences in your company.

Conducting the Review

Now, what’s the best way to execute a performance review that builds up your employees’ confidence while motivating them to improve their performance? We recommend starting with the positives. Highlight their strengths, skills, and accomplishments before going straight to constructive feedback.

Remember that we’re conducting the review to improve performance, so offer specific examples and actionable advice when giving feedback. Being too vague or focusing too much on past mistakes can cause confusion and negatively impact motivation, so prioritize telling your employees what your expectations are moving forward and giving practical tips that they can easily apply to their daily jobs.

Performance reviews should include providing feedback and establishing clear, achievable goals for the rest of the year. Discussing opportunities for learning, training, upskilling, and mentorship is also beneficial to show your employees that you care about their growth and development. Ask them about their career dreams and work with them to create a realistic development plan, including new projects, timelines for promotions, or other crucial milestones.

Post-Review Actions

Finally, once you’ve finished performing the evaluation and communicating it to your employee, the next step is to document the discussion, summarize the review, and jot down all agreed-upon goals in writing. Then, schedule regular check-ins to monitor their performance and progress, adjusting plans when necessary.

To motivate your workers and ensure their success, praise their accomplishments, provide regular feedback and encouragement, and connect them with the resources they need to continue improving. Your ongoing support will help boost engagement and forge stronger relationships, ultimately enhancing employee productivity, satisfaction, and loyalty.

Shaping New Operational Strategies With Mid-Year Performance Reviews

Beyond assessing financial health and employee performance, mid-year reviews are also critical for identifying the need for new operational strategies. Evaluating your overall business strategy can help you stay competitive, enhance processes, and put you on the path to achieving your long-term goals. Here’s how you can gain a holistic view of your company’s operational performance:

- Analyze all operational KPIs. As mentioned above, financial health, operational efficiency, employee performance, and customer satisfaction are all crucial factors that shape business growth. Don’t just look at one or two factors. Measure and analyze all of them to get a clear picture of your overall performance.

- Establish feedback mechanisms for all stakeholders. Ask your employees, customers, and all other relevant stakeholders about what you can do to improve. They may have insights, perspectives, or ideas that you have not yet considered and would benefit from implementing into your operations.

- Monitor emerging trends or patterns in your industry. No business lives in a vacuum. To stay competitive, you have to study the best practices in your industry and keep an eye on changing market conditions and consumer preferences. Work with a data science specialist to spot patterns and trends before strategically adjusting your operations.

- Address operational pain points. Are there any bottlenecks hindering operational efficiency in your business? What about recurring issues and disruptions impacting your employees’ productivity? Identify these pain points and look for ways to address them.

- Welcome opportunities for innovation. If new technologies or processes can enhance or optimize your operations, study them, perform a thorough cost-benefit analysis, and find innovative ways to integrate them into your business. As always, take calculated risks when changing your operating models.

The Role of Outsourcing in Mid-Year Strategic Adjustments: What Should Be Your Business Strategy?

So, you’re finally done evaluating your mid-year performance. Now, you want to update your existing business strategy. For business owners hoping to take action and improve overall operational performance, outsourcing can be the ideal solution for enhancing efficiency and streamlining processes.

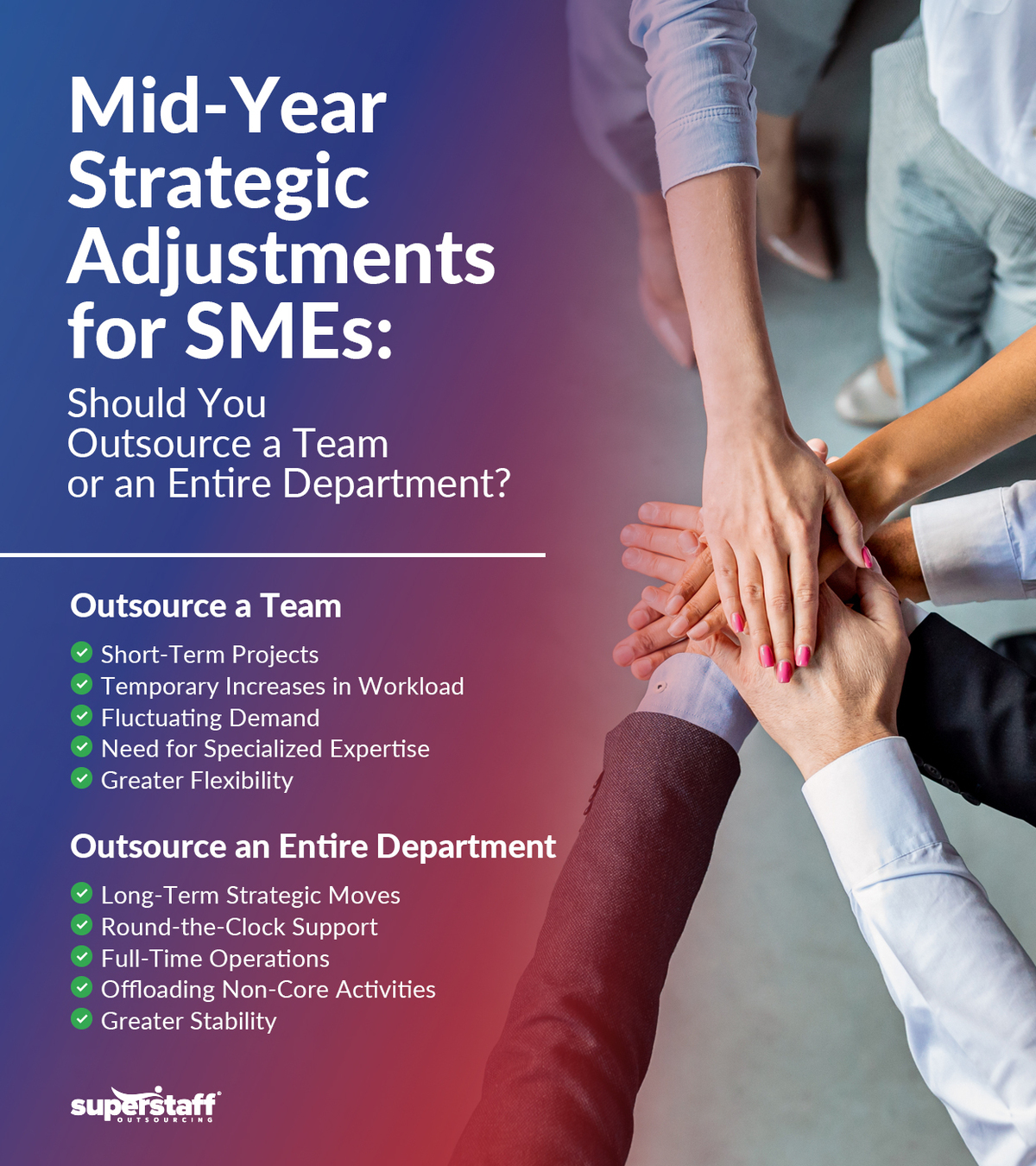

With the right outsourcing partner, you can access specialized expertise and increased flexibility, allowing you to expand your capabilities quickly, respond to market fluctuations, and pivot strategies. The key to fully optimizing your operations is understanding when to outsource a team or an entire department.

When to Outsource a Team

Start by identifying your needs and goals. Consider outsourcing a specialized team if you only need help with specific, short-term projects.

For instance, you don’t have the in-house capability to design, develop, and execute an artificial intelligence and machine learning project you’ve been eyeing for years. Working with an offshore or nearshore AI and ML development support team will allow you to leverage specialized expertise and boost project completion.

Outsourcing a team can also be beneficial for addressing temporary spikes in sales volumes or increases in workload. For example, law firms may hire offshore legal process outsourcing specialists to assist attorneys during tax season, addressing urgent demand without long-term commitments.

Compared to hiring temporary staff, outsourcing gives you the flexibility to upgrade or downgrade your operations easily, speed up deployment without disrupting your core business, and keep costs under control simultaneously.

When to Outsource an Entire Department

What if you need full-time, round-the-clock operational support? In this case, outsourcing an entire department may be the better option for you in the long run.

Many businesses outsource entire departments to fortify their core operations while improving business focus. For instance, instead of hiring in-house support, you can outsource customer service to a call center for 24/7 coverage and omnichannel capabilities. Offloading this department can allow you to prioritize other revenue-driving aspects of your operations while knowing that experienced professionals will give your customers the service they deserve.

Outsourcing an entire department can also be beneficial when making long-term strategic moves, navigating significant changes, or expanding your operations globally. For example, some companies opt for recruitment process outsourcing because they foresee that they will be upgrading their operations shortly and need help hiring qualified employees to fill in the gaps.

Strengthen Your Business Growth Strategies With the Right Outsourcing Partner

SuperStaff is a BPO company with years of experience helping companies of all sizes enhance their operational efficiency and productivity. Trust us to be your dedicated outsourcing partner when you need help retooling your business strategy for the rest of the year. We offer flexible and scalable solutions that can be customized to meet your needs.

Browse our website or follow us on LinkedIn to stay updated on our in-depth guides and other helpful B2B content. Or, if you want more information on what we do, don’t hesitate to contact us for a quick consultation!