The reason employees come to work is to make a living. If companies can’t keep their promises to pay on time, employees will likely quit their jobs.

Companies suffer more significant revenue losses to rectify missed salaries. That’s why businesses should adopt a system that pays workers promptly.

With that, payroll becomes one of the most crucial business functions. However, suppose payroll management isn’t part of your core business function. In that case, it can get complicated, especially if many other segments of your company require just as much attention from business owners.

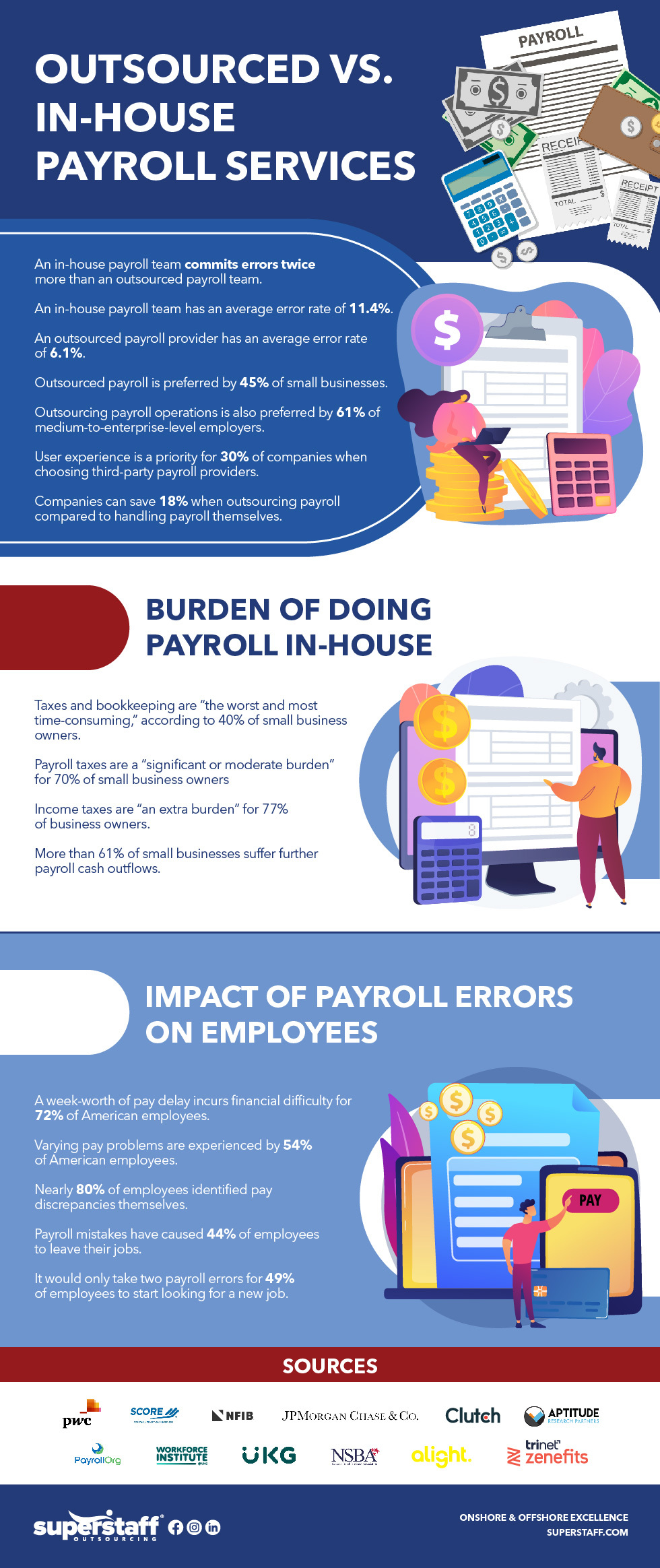

At that point, outsourcing payroll services can be a viable solution. Let’s look at some powerful statistics representing the significance of efficient payroll management.

5 Questions (and Answers) About Payroll Services Outsourcing

If this is the first time you’ve become aware of payroll services outsourcing and aren’t sure how it works, read these frequently asked questions. These payroll outsourcing FAQs will help you better understand this outsourcing solution.

#1: What is outsourcing payroll services?

Payroll has a double meaning. It refers to the list of employees yet to be paid and the total salary owed by an employer. But for our discussion, payroll is compensating employees or the designated agents and entities for work rendered.

Outsourcing payroll services is when businesses hire a BPO that offers outsourced financial services to manage payroll processes. This outsourcing solution falls under the accounting and bookkeeping umbrella and is often performed by highly qualified finance professionals.

Depending on your business needs, the specialists can take over your payroll process or do part of the job.

#2: What tasks are involved in payroll services outsourcing?

Employee Compensation and Benefits

When you outsource payroll services, your BPO provider can tally an employee’s completed work hours, calculate total net wages, record tax withholdings, and provide a breakdown of compensation bonuses and other benefits with zero to minimal errors. The outsourced team can also oversee annual salary increases for employees who excel in yearly performance evaluations.

Administering employee benefits requires the prowess of an outsourced payroll services team. They’d organize a swamp of employee information with robust tech systems. You’ll have the option to have them automate routine tasks and integrate programmed scheduling for monthly or annual payroll calculations.

Even seemingly mundane but bulk payroll tasks will all be simple for payroll management experts. For example, when employees subscribe to your employee perks, the team can track the number of employees enrolling in those benefits and their signing-up progress.

An outsourced payroll team can also process health insurance, retirement plans, off days, and additional compensation.

Most importantly, the payroll team ensures employees receive payments on the dot. This way, you would keep the employee morale on an upward trajectory.

Tax Compliance

Companies don’t want to get in trouble with the Internal Revenue Service (IRS). At all times, you want to make sure that you comply with the tax laws and legislation.

That’s why businesses should set up a payroll system to stay in the clear.

An outsourced payroll services team files your employees’ tax returns for you. At the same time, payroll specialists can also supervise all forms of taxable income — such as Fringe Benefits.

Your adherence to local legislation directly correlates to your company’s reputation. Making accurate and timely payments shows that your business is stable and well-informed. It tells employees and potential customers that you know what you are doing and that they are safe doing business with you.

#3: What are the benefits of outsourcing payroll services?

Ensure on-time payment to avoid employee disengagement and distrust.

The last thing you want is for your workers to disengage from work due to late payments.

Recently, employee engagement has declined from 36% in 2020 to 32% in 2022, whereas active disengagement is at 18%, a 4% increase from 2020. When employees are actively disengaged, they will resent their work more because many of their needs are left unfulfilled.

Applying Maslow’s hierarchy of needs, employees should be paid on time to satisfy their safety and security needs. Otherwise, it will have a ripple effect on their work morale, productivity, and motivation. Bear in mind that delayed payment is no trivial matter. Even if your working environment is healthy, they could still be fazed by their incoming expenses and impending debts.

In 2022, a PwC surveyed employees who can’t be productive at work due to financial constraints. Here’s what the survey found:

- 67% struggle to pay their household bills in full.

- 71% are burdened with personal debts.

- 64% use credit cards to buy things they can’t afford.

- 57% of companies say outsourcing payroll enables them to focus on the core business.

Consequently, your employees will lose trust in your company — making them look elsewhere for better job opportunities. Worse, they may even write bad reviews about your company, which could erode your reputation and turn away competent recruits.

As an employer, you need to consistently show your appreciation, care, and respect for them in one way or another. Paying your employees on payday strengthens their desire to work and stimulates their sense of fulfillment at work. And a great way to motivate them and ensure excellent performance is by keeping your promise and paying them on time.

That’s why companies must outsource experts in payroll systems for timely appreciation of employees’ productivity, engagement, and trust.

With that, employees no longer need to track and reconcile hours manually. Instead, the software would automatically record employee attendance and navigate them through their shifts. Also, an effective payroll helps streamline leave management. Workers would receive immediate updates on their leave status requests, enabling them to achieve the desired work-life balance.

Save time and money.

Payroll processing is more challenging than it seems. Companies need to spend so much money and time to complete payroll.

A survey in Small Business Trends: 2020 indicated that 11% of small business owners find payroll and other administrative work a significant hurdle. There is more to payroll than meets the eye:

- Fixing inaccuracies in paychecks

- Getting on top of amended tax or other laws

- Processing regulation changes

Managers or HR professionals also spend at least 20% of their time handling payroll for up to 40 employees on average. Bump up to 200 personnel, and it now becomes a full-time job for one or even many professionals.

The bigger problem is that many business owners aren’t payroll experts and could commit payroll errors. Businesses may spend extra to rectify payroll errors.

The solution is simple: working with a third-party payroll provider.

Payroll outsourcing service is an ideal way to minimize expenditures on easily-avoidable mistakes.

Improve flexibility and scalability.

An ADP 2021 report shows that 70% of companies need more time to prepare for any upcoming interference or massive regulatory changes. To ensure business continuity, employers must be quick and proactive in responding to changes. Otherwise, companies will suffer and experience stunted growth.

An outsourcing payroll company refines a business’s ability to scale according to the company’s precise needs and budget. Gladly, most companies (75%) are considering this solution.

Work with qualified finance professionals.

Organized, efficient, and accountable — these qualities contribute to a high-integrity payroll. But these can’t be attained when businesses treat payroll functions as nothing more than a chore. This is where a payroll service provider steps in.

An outsourced payroll team is a team of financial professionals solely trained to manage payroll and run accurate financial reports. Integrating cutting-edge tech and hands-on experience, you’d get a perfect formula for ideal payroll management.

Avoid hefty tax fines.

Employers may underestimate the risk of audits. However, there were businesses levied with tax penalties in 2022 alone. The penalties, including those related to employment taxes, were estimated at around $3.4 billion.

Recently, Congress has approved the appropriation of $80 billion in funding for the IRS to ramp up audits in the coming years.

Take a look at some of the actions that could result in getting audited:

- Late filing of tax returns

- Delayed payment of taxes, such as business income tax or the Federal Insurance Contributions Act (FICA)

- Failure to submit or file accurate information returns

Here’s the danger: the penalties may compound over time if you fail to pay your taxes. This can deplete your company’s cash flow, inhibiting other business activities and strategies.

Hiring payroll services can help you comply with these tax laws and obligations to escape from possible legal ramifications. They will also ensure that your payroll taxes will be paid at the correct rate and on time to save you from penalties, fines, and fees.

#4: What are the best practices for outsourcing payroll services?

Pick the right outsourcing partner.

Companies shouldn’t take this option for granted. As mentioned earlier, payroll management is a crucial part of any business. When selecting your payroll outsourcing provider, take the time to delve into their work and determine whether they can meet your entrepreneurial needs.

Here’s what you should look for in a potential payroll outsourcing partner:

- Do they often update their tax tables whenever new tax laws are introduced?

- Are they experienced in handling businesses that belong to similar industries as you?

- Can they blend your employee benefits offerings into the payroll software?

- Will they be able to manage your future growth?

- Do they have a set in place top-tier security for your payroll data?

If you answer “yes” to these questions, you’re on the right track to partnering with a reliable outsourcing partner.

Keep yourself updated on the latest payroll and tax regulations.

Every country has its laws governing employment and tax regulations. When opting for an offshore payroll service, choose one well-informed on U.S. tax provisions and limitations to avoid the risk of non-compliance.

Moreover, a trustworthy provider would never assume that their payroll process will be successfully remitted. Instead, they’d thoroughly check whether the digits are correct. After all, no BPO company wants their clients to suffer the consequences of careless inputs or omissions.

#5: Is payroll services outsourcing better than in-house payroll?

The best option for your organization depends on your company’s specific needs. However, outsourced payroll management offers a wealth of benefits for your business. For starters, it significantly reduces costs, saves time recruiting qualified finance professionals, and allows better flexibility and scalability for future growth.

There are layers to handling an in-house payroll team; every layer has its cost. First, employers need to consider the salary of their in-house payroll employees. Next, companies must set up software to make the job easier. If the employees aren’t adept at payroll systems, business owners must pay for their training.

As those costs accrue, they could ultimately go beyond your company’s annual budget.

Payroll outsourcing services can help companies strike down certain expenditures, which can reduce company spending by a substantial amount. Some providers charge their clients monthly — including all services like payroll processing, tax filing, benefits administration, and time tracking.

Outsourcing Payroll Services in the Philippines

Financial service outsourcing is when a business hires a third-party expert to handle its financial operations. And one of the services that the solution offers is managing payroll.

Equipped with the latest tech and a deep pool of experienced financial specialists, reliable payroll outsourcing services in the Philippines can implement strategic processes to your payroll to empower your business in the long run. Allow SuperStaff to educate you on how this solution may benefit your business. Give us a call today.