As economic storm clouds gather, businesses face a pressing question: How can we effectively navigate a potential downturn?

Recent indicators—rising interest rates, persistent inflation, global trade tensions, and financial market volatility—are all warning signs of a possible U.S. recession. While no one can predict the exact timing or severity, the risk is real, and businesses must act now to strengthen their resilience.

This blog explores the growing concern over a potential recession and presents a proactive solution: strategic outsourcing. Far from being just a cost-saving measure, outsourcing has evolved into a powerful strategy for future-proofing business operations. From enhancing operational agility to protecting core functions amid economic uncertainty, outsourcing offers companies a buffer against disruption.

In the following sections, we’ll unpack the current economic climate, analyze key recession signals, and reveal how outsourcing can help your business stay lean, responsive, and competitive—no matter what the economy throws your way.

Understanding the Current Economic Climate: Is the US Economy Going Into a Recession in 2025?

Economic indicators across multiple sectors signal potential challenges ahead, prompting businesses and analysts alike to brace for a possible downturn. According to reputable industry experts, the United States has a 40% chance of falling into a recession in 2025, jumping 20 percentage points in less than a month. While the U.S. economy has demonstrated remarkable resilience in recent years, several red flags are beginning to emerge—each pointing to the risk of a recession on the horizon.

Inflationary Pressures

One of the primary concerns is persistent inflation. Despite the Federal Reserve’s efforts to cool price increases through interest rate hikes, inflation remains elevated in key sectors such as housing, energy, and food. These pressures erode purchasing power and strain household budgets, affecting consumer behavior.

Volatile International Trade Market

At the same time, trade policies and geopolitical tensions—from ongoing tariff disputes to supply chain disruptions—have introduced additional layers of uncertainty for businesses operating across borders. The result is a more cautious global trade environment, where risk mitigation and agility have become priorities.

Lower Consumer Confidence

Another critical warning sign is the decline in consumer confidence and spending. In March 2025, the University of Michigan’s Consumer Sentiment Index fell to 57.9, down from 64.7 in February, marking its lowest point since November 2022. This decline reflects growing consumer concerns over economic uncertainties, particularly related to President Donald Trump’s trade policies and the imposition of tariffs.

As individuals grow increasingly wary about their financial futures, discretionary spending is shrinking. Retail sales have slowed, and major consumer-driven sectors like travel and entertainment are starting to feel the pinch.

Unpredictable Financial Markets

Meanwhile, financial markets have grown increasingly volatile, with wild swings in equity prices, currency values, and bond yields. These fluctuations reflect investor anxiety and influence borrowing costs and investment decisions for companies of all sizes.

Taken together, these factors create a landscape filled with economic headwinds. For business leaders, now is the time to assess vulnerabilities, streamline operations, and consider long-term strategies—such as outsourcing—that can offer flexibility, cost efficiency, and adaptability in an unpredictable economic climate.

Future-Proofing Business Operations: The Strategic Advantage of Outsourcing During Recessions

Given these challenges, businesses must explore strategies to safeguard their operations. When economic uncertainty looms, companies must make deliberate choices to stay agile and resilient. Outsourcing emerges as a powerful strategic lever for survival, long-term stability, and growth during recessions. By leveraging external expertise and resources, companies can streamline operations, manage costs, and remain competitive in a volatile market.

What Does Outsource Mean in Business?: How BPO Solutions Can Help You Navigate a Potential Recession

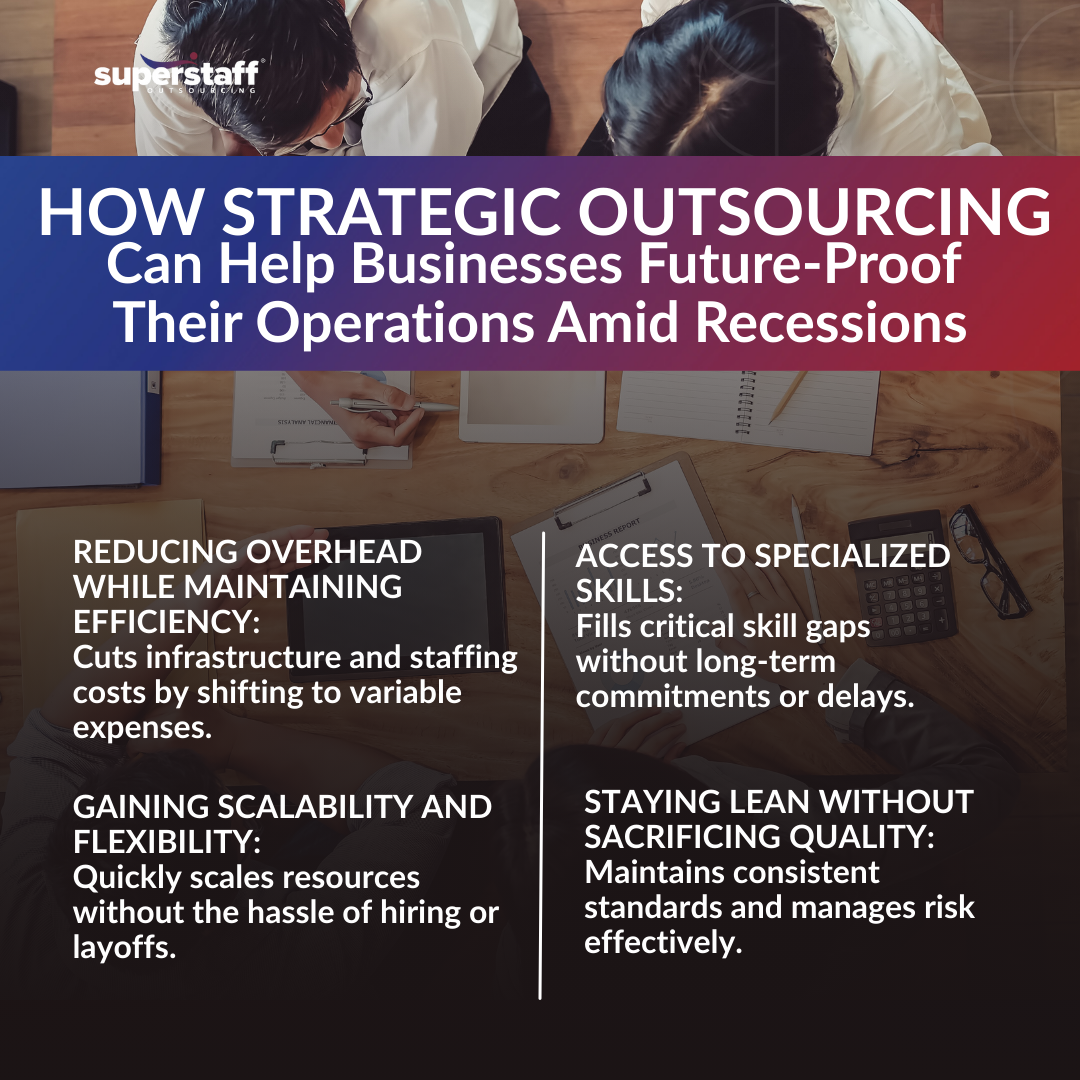

Outsourcing in business means delegating specific tasks or functions to third-party providers to reduce costs and improve efficiency. During recessions, it helps companies stay agile by lowering overhead and allowing them to focus on core operations. Here’s how:

Reducing Overhead While Maintaining Efficiency

One of outsourcing’s most immediate benefits is its ability to reduce operational expenses without compromising performance. In times of economic uncertainty, cost reduction through outsourcing becomes a practical strategy, helping businesses eliminate expenses tied to in-house infrastructure, full-time salaries, and employee benefits. By shifting to a variable cost model—paying only for services as needed—companies can maintain continuity while reallocating resources to more strategic business areas.

Gaining Scalability and Flexibility

Market conditions during a recession can change rapidly. Demand may drop suddenly or shift unpredictably. Outsourcing provides built-in scalability, allowing companies to adjust the size and scope of their workforce as needed without the financial and logistical burden of hiring and layoffs. Whether scaling up to meet a seasonal spike or scaling down to weather a slowdown, outsourcing partners offer the agility to respond in real-time.

Access to Specialized Skills Without Long-Term Commitment

Recessions often expose organizational skill gaps, especially as internal teams are downsized or refocused. Outsourcing provides on-demand access to specialized expertise in customer service, IT support, accounting, data analytics, and more. This allows companies to maintain quality and innovation without the overhead of long-term employment contracts or delays in recruitment and training.

Staying Lean Without Sacrificing Quality

Finally, outsourcing supports a lean operating model while upholding service standards. Experienced outsourcing providers bring optimized workflows, dedicated teams, and proven processes that ensure consistent results—even under pressure. This operational resilience allows companies to continue delivering value to customers and stakeholders while more effectively managing risk.

By integrating strategic outsourcing decisions into their recession plan, forward-thinking companies gain a flexible, cost-efficient foundation for future-proofing business operations—not just surviving the downturn but emerging from it stronger and more competitive.

Best Practices for Implementing Outsourcing Strategies Amid a Potential Recession

Outsourcing can be a powerful tool during economic downturns and disruptions, but only when executed carefully. To fully realize the benefits of cost efficiency, agility, and resilience, businesses must take a strategic approach to implementation. The following best practices can help ensure outsourcing becomes a long-term advantage, not just a short-term fix.

1. Identify Non-Core Functions Suitable for Outsourcing

The first step is to assess which business areas can be delegated without disrupting your core value proposition. Non-core functions such as customer support, IT services, finance and accounting, HR administration, and data entry are often ideal candidates. Outsourcing these tasks allows your internal teams to focus on strategic initiatives while maintaining operational continuity.

2. Select Reputable Outsourcing Partners

The success of your outsourcing strategy depends heavily on the provider you choose. Look for outsourcing partners with a proven track record in your industry, strong client testimonials, and a demonstrated ability to scale and adapt. Due diligence should include reviewing their security protocols, compliance standards, and service delivery models to ensure alignment with your business goals.

3. Establish Clear Communication Channels and Performance Metrics

Once a partner is selected, clarity and consistency are essential. Establish well-defined communication channels to ensure transparency and alignment between your team and the outsourcing provider. In addition, develop performance metrics and KPIs that reflect your priorities—such as response times, error rates, or customer satisfaction—so you can regularly measure outcomes and make data-informed adjustments.

When applied with foresight, these best practices turn outsourcing into more than just a cost-saving tactic. They help businesses create a flexible, future-ready structure that can withstand economic pressure and continue delivering value—even in a recession.

Stay Resilient With SuperStaff: Future-Proofing Business Operations Made Simple

In times of economic uncertainty, agility and efficiency are non-negotiable. At SuperStaff, we help businesses stay ahead of the curve by delivering customized outsourcing solutions that drive performance, reduce costs, and build operational resilience.

Whether you need support for customer service, back office, IT, or specialized functions, our proven track record and scalable teams make us the ideal partner for future-proofing your business operations.

Don’t wait for a downturn to take action—partner with SuperStaff today and build a stronger, more adaptable organization for tomorrow.