As a business leader, you must constantly seek innovative ways to grow your workforce and scale your operations. Here’s the good news: outsourcing can help you meet your company goals by allowing you to tap into a wider talent pool and expand your operational capabilities.

For many businesses, hiring an offshore BPO in the Philippines can be a tremendous help in achieving their scalability goals. However, utilizing this strategy requires meticulous planning and compliance with local regulations.

The technicalities of hiring offshore employees involve navigating labor laws, preparing contracts, and understanding the necessary documentation. In this article, we’ll help you understand this process step-by-step, with a particular focus on the legal and technical requirements.

Your Comprehensive Guide to Hiring an Offshore BPO in the Philippines

The Philippines is known as one of the top global BPO hubs for a reason. Many Western companies choose it as their go-to outsourcing destination because of its vast talent pool of English-speaking, highly educated professionals.

However, working with an offshore team may feel intimidating when you don’t know where to start. We’ve prepared this comprehensive guide to walk you through the legal and procedural details of hiring outsourced employees in the Philippines, ensuring compliance and a smooth onboarding process. Here’s what you need to know:

Understanding the Legal Framework

First, let’s answer this crucial question: “What is offshore outsourcing in BPO companies?” Imagine running a business in the U.S. In this case, you would be offloading tasks to reliable providers far from your headquarters, such as in countries like the Philippines. However, since you’ll be hiring employees outside your nation, you must familiarize yourself with the local labor laws.

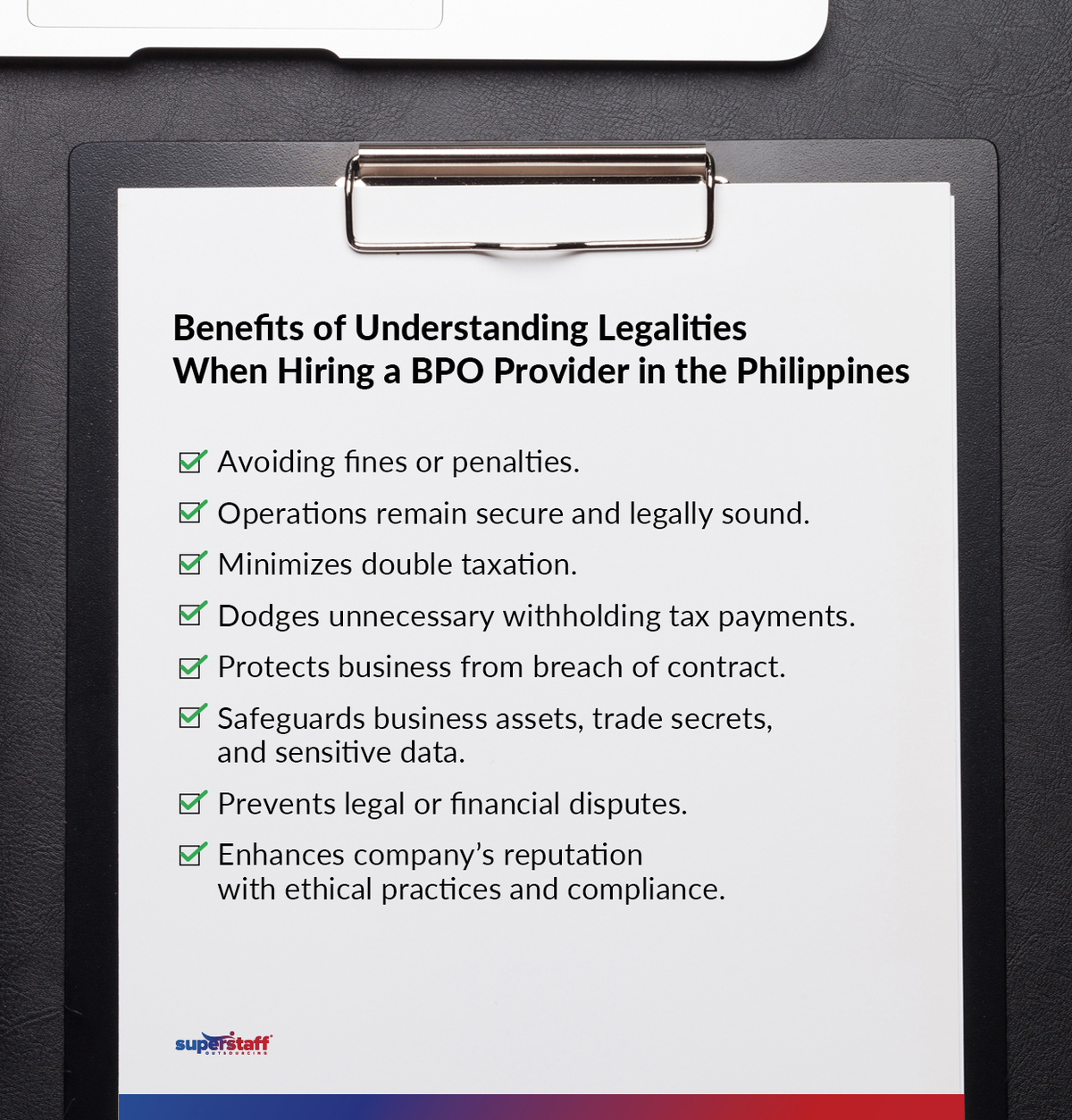

Understanding the legal framework and requirements of the country your chosen BPO provider is operating in will allow for a more seamless and hassle-free partnership. Make sure to select an outsourcing company that abides by the Labor Code of the Philippines, providing fair and equitable compensation and working conditions for your offshore team.

Overview of the Philippines’ Key Labor Laws and Employment Regulations

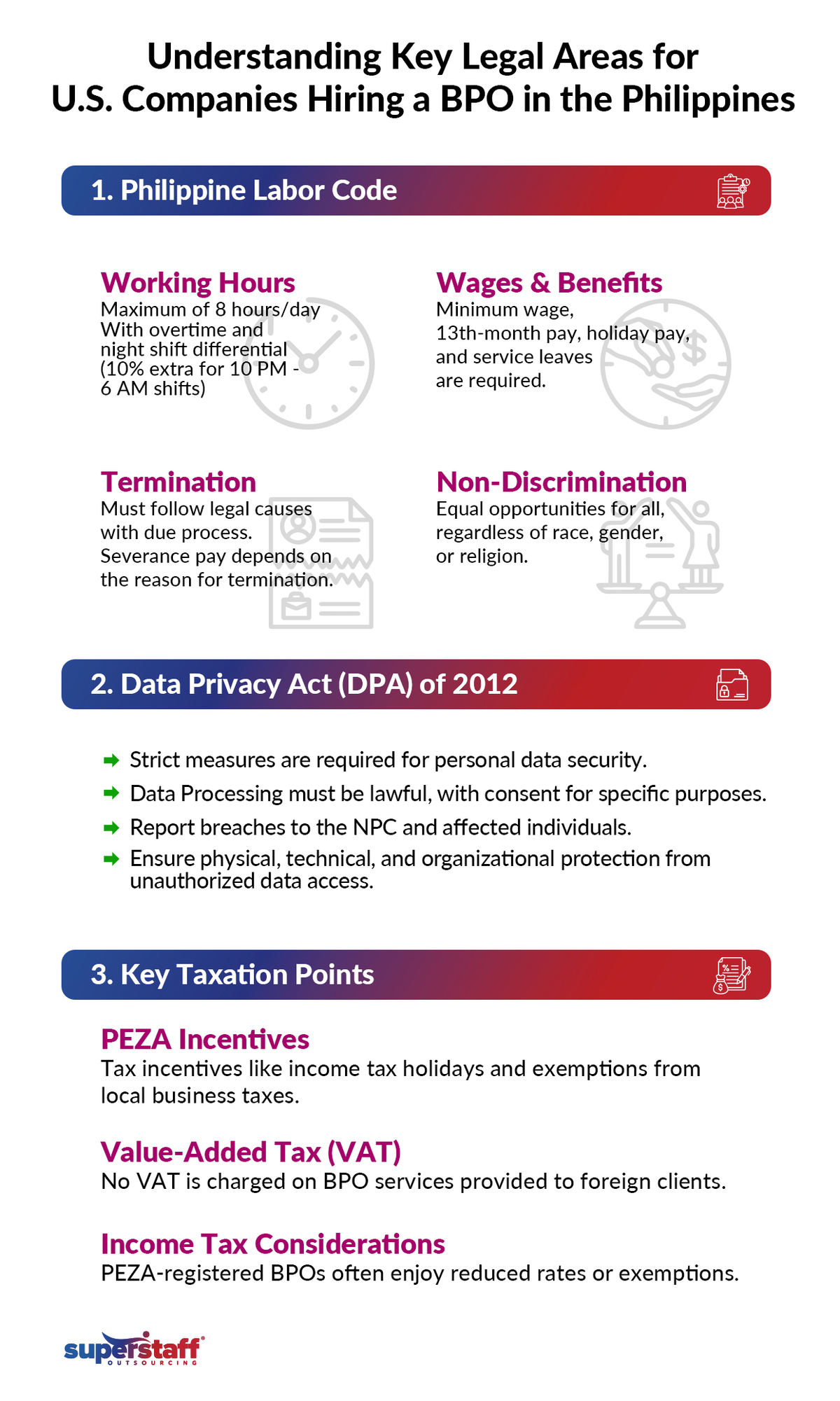

The Labor Code, developed and enforced by the Department of Labor and Employment (DOLE), governs employment relationships in the Philippines and focuses on employee rights and benefits.

Adhering to the labor code is necessary for all companies operating in the country, and non-compliance can result in hefty penalties, sanctions, and even costly litigation. Here are the fundamental DOLE laws, guidelines, employee rights, and standard employment contracts you must be familiar with:

Employment Classifications

The Philippines has four primary employment classifications: regular, probationary, project-based, or casual. Here is a breakdown:

- Regular employees have a continuous relationship with their employer and reap benefits such as health insurance, paid time off, and retirement plans. This is the traditional employment classification, and most BPO workers fall under it.

- Probationary employees undergo a trial period, with their employment being contingent on good performance. If they pass their performance evaluations, they may become regular fixed-term employees.

- Project-based workers are employed only for a specific project with a fixed duration or purpose. Their employment ends upon the project’s completion. Gig workers, freelancers, and self-employed individuals can also fall under this category.

- Casual or seasonal employees fulfill temporary demands, such as during holiday periods or peak seasons. They are only hired temporarily and work to address urgent staffing needs.

Minimum Wage

Minimum wage rates vary per region in the Philippines. In Metro Manila, where many BPO offshore outsourcing companies establish their headquarters, the minimum wage rate (as of 2024) is P608 to P645 per day (about $10.90 to $11.57). Meanwhile, provinces like Pampanga range between P493 to P500 (about $8.84 to $8.97).

Standard Work Hours and Overtime

In the Philippines, regular working hours should not exceed eight hours daily. The country’s standard workweek is 40 hours, divided over five days. However, the maximum is up to 48 hours or six days. Employees who work beyond their required shift are entitled to overtime pay. Overtime rates also vary depending on whether the individual worked during a rest day or regular holiday.

Preparing Essential Documents for Hiring

Once familiar with the legal landscape, the next step is preparing the necessary documents for a compliant hiring process. Having detailed legal documents and employment contracts will not only ensure that your offshore employees understand their responsibilities, benefits, and rights. It will also help your business comply with Filipino labor laws, avoid legal complications, and establish trust with your outsourced team.

Required Documents for Onboarding Offshore Employees

Before you can onboard your BPO offshore outsourcing team in the Philippines, make sure to prepare these essential documents:

Employment Contracts

Detailed employment contracts help you manage your employees effectively, set expectations before the start of your relationship, and provide safeguards in case of conflicts. To align with the Labor Code of the Philippines, your employment contract should include the following details:

- Job Information and Responsibilities: When drafting your employment contract, you must include critical information about the employee’s role, including job titles, job descriptions, team and department assignments, and primary responsibilities. To set expectations as early as the hiring stage, defining who the new hire will report to and how their performance will be evaluated can also be beneficial.

- Salary and Benefits: This is arguably the most vital information to include in your employment contract. Make sure to mention the employee’s hourly or monthly rate, raises and incentives, health benefits, signing bonuses, and other compensation.

- Time Off, Sick Days, and Leaves: Although leaves are included in employee benefits, they are worth highlighting in a separate section since they are among many job seekers’ most sought-after benefits. Be specific about how many sick days, vacation leaves, and paid time off your employees can take.

- Termination Terms: As part of your employment contract, it’s critical to state what is required for you or your employee to terminate the relationship. For instance, what are the terms where firing an employee is acceptable? Before resigning, do you require employees to give at least two-weeks notice? Does your agreement include severance packages?

- Government-Mandated Benefits: Besides the benefits packages stated above, your employment contract must mention government-mandated benefits, such as 13th-month pay, rest days, and holiday pay.

Tax Identification Numbers (TIN)

All Filipino employees must have a Tax Identification Number (TIN), which they can obtain from the Bureau of Internal Revenue (BIR). The TIN is a system-generated number assigned to each individual in the BIR database, which is necessary for processing and filing tax returns.

In the Philippines, employers are responsible for filing annual tax returns for their full-time workers. As such, you’ll need access to your offshore employees’ TIN for more straightforward documentation and seamless tax compliance.

Social Security System (SSS), Pag-IBIG, and PhilHealth Registration

BPO companies and all businesses operating in the Philippines must be intimately familiar with the government-mandated benefits from the Social Security System (SSS), Pag-IBIG, and PhilHealth. All full-time employees must register for these benefits, and employers pay contributions on their behalf.

To make the mandatory contribution process smoother, you’ll need to request the following documents for proof of registration and membership:

- SSS E1 Form or ID: The E1 form is the personal record form for SSS members, containing information such as their name, address, social security number, and beneficiaries. Employees can request a copy through the SSS online portal. If they do not have a copy of their E1 form, giving you a photocopy of their SSS ID is also an acceptable alternative.

- Pag-IBIG MDF: The Members Data Form (MDF) includes an employee’s Membership ID (MID) number and other personal information and serves as proof of registration. Individuals can access the Pag-IBIG online portal if they need to request a copy of this form.

- PMRF or PhilHealth ID: The PhilHealth Member Registration Form (PMRF) contains an employee’s PhilHealth Identification Number (PIN) and personal information and serves as proof of membership. If employees do not have a copy of their PMRF, they can instead submit a photocopy of their PhilHealth ID.

Confidentiality, Privacy, Non-Disclosure Agreements (NDAs), and Non-Compete Clauses

All businesses have trade secrets or sensitive client information that must be protected. So, make sure to outline your company’s confidentiality and privacy rules and regulations during the hiring process. This helps you protect your intellectual property and other business information and interests.

Some companies also have non-compete agreements to ensure employees don’t share company information with direct competitors after leaving their workplace. However, please note that you must consult a qualified legal professional before adding any non-compete clauses or other employee restrictions.

Navigating Compensation and Taxation

With documents in order, the next step is navigating the tax and compensation landscape in the Philippines. To ensure compliance, you must thoroughly understand payroll, tax obligations, and benefits before hiring your offshore employees.

Essential Tax and Contribution Requirements for Employers and Employees

If you’re serious about hiring an offshore BPO, you’ll need to understand employers’ compensation structure and tax responsibilities in the Philippines. Here’s what you need to know:

Payroll Requirements

When setting up shop in the Philippines, you must comply with local laws and regulations concerning proper payroll management. This means that you must pay employees every two weeks or twice a month, and the intervals between paydays must not exceed 16 days. By law, all companies operating in the country cannot pay workers only once monthly. Here are other requirements to take note of:

- Overtime Pay: Employees are entitled to overtime pay if they work more than the standard 8-hour day. The overtime rate for regular work days is the individual’s hourly wage plus at least 25%, equaling 125% overall. During holidays, overtime rates increase to 130% of an employee’s hourly salary.

- Holiday Pay: The Philippines has about 18 national holidays, and all full-time employees are entitled to receive a paid day off during these days. However, employees must be paid 200% of their salary if they report to work during a holiday.

- Night Shift Differential: Employees who work during the night shift (between 10 PM to 6 AM of the next working day) are entitled to additional compensation of at least 10% of their wage rate. BPO employees catering to U.S. clients will often fall under this category.

- 13th Month Pay: Another mandatory payroll benefit in the Philippines is the 13th-month pay, paid to all probationary and full-time employees on or before December 24. The 13th-month pay is usually equivalent to one month of a worker’s basic salary.

Withholding Taxes, Government Forms, and Reporting

Employers in the Philippines are responsible for calculating and processing withholding income taxes. The amount will be directly deducted from employee salaries, and companies must submit the necessary forms to the Bureau of Internal Revenue (BIR).

Employers should be concerned with BIR Form 2316, which consolidates individual employees’ annual gross income, taxes, and government contributions. The deadline for filing this form is on or before January 31 of the following calendar year.

Tax rates will depend on each employee’s salary bracket, and failure to comply with withholding tax requirements will result in penalties and fines for the company.

Mandatory Contributions

As mentioned in previous sections, employers in the Philippines must contribute to each full-time employee’s SSS, Pag-IBIG, and PhilHealth. Here’s a quick overview of what each benefit entails:

-

- Social Security System: SSS contributions amount to 14% of an employee’s salary credit, with employers contributing 9.5% and workers shouldering the remaining 4.5%. The Philippines’ social security package covers death benefits, sickness and disability welfare, retirement pension, and maternity benefits.

- Pag-IBIG: With this mandatory savings fund, employees in need can apply for short-term loans, particularly for their housing needs. Contributions rates are 4% of a full-time worker’s monthly wages, with the employer and employee contributing 50/50.

- PhilHealth: The Philippines Health Insurance Commission, or PhilHealth, is the local government-backed health insurance program. Contribution rates amount to 5%, with employers shouldering 50% and the other 50% deducted from employees’ salaries. This insurance program covers part or all of an individual’s hospitalization and medical expenses.

Onboarding and Training the Offshore Team

Now that payroll and tax processes are clear, it’s time to consider the onboarding and training of your offshore team. Remember: The success of your outsourcing partnership will depend on how well you and your BPO provider can work together. Efficient onboarding and training can help ensure that your offshore team is integrated seamlessly into your operations.

Since offshore BPO services are, by definition, far from your geographic location, proper onboarding is the best way to ensure that your outsourced employees align with your internal culture and processes. During this stage, discussing your expectations, goals, communication protocols, and other relevant policies is advisable to ensure a harmonious working relationship.

Steps to Onboard New Hires Effectively

The onboarding process is critical for helping your outsourcing team acclimate to your company culture and understand what is expected of them. Here are the steps you should take to onboard your offshore employees effectively:

Orientation Programs

The first part of your onboarding process should be the employee orientation. This is your time to introduce your company’s vision, policies, and expectations to your new offshore team. Some of the core elements of an orientation program include:

- Introduction to Company Mission and Vision

- Overview of Company Policies and Procedures

- Office Tour and Work Station Assignments

- Introduction to Department Leaders and Team Members

We also recommend having an interactive Q&A session during the orientation so everyone can ask questions, share concerns, and get a better feel for what it will be like to work with you.

Technical and Soft Skills Training

After finishing the orientation, your offshore BPO team must also undergo technical and soft skills training. During this stage, a trainer will teach your outsourced employees everything they need to know to perform their duties properly, including learning the specific tools and platforms you use in your company.

We also advise using this time to explain your communication and reporting protocols with your offshore team. For example, what platforms can employees use to share feedback and concerns? Who will be monitoring their performance and progress? What key performance indicators (KPIs) will be used to measure their productivity and effectiveness?

Employee Handbook

Give your offshore team access to a detailed employee handbook to ensure they have a record of all company policies. This document will cover employment basics, codes of conduct, and workplace policies on attendance, discipline, leaves, and benefits. Giving them an online or printed version of this handbook will ensure workers understand their rights and responsibilities, leaving little room for misunderstandings and conflicts.

Continuous Learning and Development

Remember: Processes must be continually reviewed, updated, and innovated to keep operations efficient and businesses competitive. As such, it’s essential to provide your offshore employees with continuous learning and development opportunities and keep them up-to-date on your industry’s latest developments, processes, and technologies.

Compliance and Performance Management

The hiring process doesn’t end at onboarding — continuous compliance and performance management are critical for long-term success. Maintaining compliance with labor laws and regulatory guidelines is crucial for promoting a culture of accountability, which protects your employees’ rights, guarantees quality products and services for your customers, and helps you protect your brand reputation and avoid legal problems.

Meanwhile, conducting regular employee assessments helps ensure your BPO offshore outsourcing team performs according to your needs and expectations. Here are the steps you need to take to fulfill compliance and performance management:

Compliance Audits

Compliance audits formally review a company’s policies and procedures, ensuring these adhere to relevant regulatory guidelines and industry standards. Review Filipino laws when designing your internal rules, and monitor every development to maintain compliance even before the audit. This is especially critical for payroll, tax contributions, benefit remittances, and other financial regulations. Also, stay informed about changes in labor laws and update employee contracts as needed.

Performance Appraisals

Conducting regular performance appraisals is essential for ensuring operational efficiency and productivity. They also help improve employee engagement by providing workers with honest feedback and guidance and creating opportunities for mentorship, growth, and career development. We recommend implementing structured performance management systems to make the process easier and more streamlined.

Handling Disputes

One of the biggest challenges in managing an offshore team is handling disputes. Resolving in-house workplace conflicts is already tough, but the added complexity of understanding foreign labor laws can make handling offshore team disputes even more difficult. As such, you must familiarize yourself with the various legal procedures and guidelines for handling employee payroll disputes, performance issues, terminations, and other grievances.

Turn to SuperStaff for Comprehensive Offshore BPO Services

Hiring offshore employees in the Philippines requires a deep understanding of labor laws, documentation, compensation structures, and continuous compliance. Following every step we shared in this comprehensive guide can help ensure your outsourcing team operates smoothly and within the legal framework.

At SuperStaff, we are committed to helping our clients establish a compliant, efficient outsourcing team that contributes to their long-term growth and operational success. When you hire our offshore BPO in the Philippines, we will take care of all necessary documentation, ensure compliance with payroll and tax laws, and handle onboarding and performance management.

For more helpful content on outsourcing and business strategies, follow us on LinkedIn and browse our website. If you’re ready to take your BPO journey to the next level, contact us for a quick consultation!