Finance teams are being pushed to do more with less.

In 2025, the finance function is under enormous pressure. Digital disruption and ongoing economic volatility are redefining expectations. CFOs and their teams must now operate with agility, deliver real-time insights, and navigate tightening compliance standards. The answer for many businesses? Turning to outsourced finance and accounting to maintain resilience, efficiency, and forward momentum.

This blog explores how outsourcing empowers finance teams in 2025 by enabling lean operations, building digital fluency, and expanding capacity without increasing headcount.

The Finance Function Is Under Pressure in 2025

Finance departments are expected to do more than close books. They are now central to strategy and growth. But with this expanded role comes greater demand for data accuracy, faster turnaround, and tech proficiency. All of this while budgets remain tight and skilled talent is harder to secure.

The complexity of today’s finance environment—spanning automation, analytics, and regulatory compliance—is outpacing many companies’ internal capabilities. In particular, there is a widening skills gap in digital finance tools. Platforms like NetSuite, SAP, and Power BI offer significant value—but only when used effectively.

Financial stress is also bleeding into workplace performance. According to Forbes, 37% of professionals report financial pressure as their biggest stressor outside of work—highlighting how stretched internal finance teams truly are, both operationally and emotionally.

To stay ahead, finance leaders are embracing outsourced finance and accounting as a strategic solution. This approach offers not only immediate relief from operational strain but also long-term adaptability.

Outsourcing Enables Lean, Scalable Financial Operations

Agility is now a defining trait of competitive businesses. That agility is increasingly powered by outsourcing. By shifting routine yet essential finance tasks to outsourced accounting teams, businesses achieve leaner, more responsive models.

Functions like accounts payable, receivable, payroll, and tax compliance are ideal for outsourcing. These areas demand precision and timeliness, both of which are strengthened by having around-the-clock offshore support. Bookkeeping and reconciliations, while foundational, are time-consuming. When handled by dedicated teams trained in global accounting standards, the burden on internal staff is significantly reduced.

And that burden is heavier than many realize. According to Forbes, 24% of knowledge workers are experiencing high or very high levels of financial stress—a growing concern that directly impacts focus and productivity within finance departments.

Outsourced finance and accounting enables companies to scale quickly, manage seasonality, and stay compliant without overextending internal resources. Rather than hiring additional full-time employees, businesses gain access to skilled professionals on-demand—supporting growth without unnecessary overhead.

Driving Digital Fluency With Specialized Outsourcing Partners

In today’s finance world, fluency with digital tools isn’t a bonus—it’s a requirement. But not every business has the resources to train and maintain in-house experts across multiple systems. That’s where outsourcing proves invaluable.

Leading BPO firms bring specialized knowledge of tools like QuickBooks, SAP, Oracle, and more. They don’t just provide back-office support; they offer strategic enablement. These teams are equipped to manage integrations, streamline reporting, and automate manual processes—bringing organizations closer to real-time financial visibility.

Outsourced accounting teams can help implement digital transformation projects, supporting cloud migrations and building workflows that cut cycle times and improve data accuracy. This positions the finance function as a proactive engine of growth, not just a reporting function.

As technology evolves, staying current is key. With outsourced finance and accounting, businesses gain a partner that evolves with them—bringing continuous improvements without constant internal retraining.

Outsourcing Supports CFOs in Leading Through Uncertainty

CFOs face a new set of expectations. In addition to maintaining compliance and accurate reporting, they must now drive innovation, manage risk, and advise the C-suite. In 2025, that’s a full-time job—and then some.

Outsourced finance and accounting frees up internal bandwidth so finance leaders can focus on what matters most. With a reliable outsourcing partner, businesses reduce the risk of delays, errors, and audit issues. More importantly, they gain the stability needed to make data-driven decisions under pressure.

For CFOs leading through uncertainty, outsourcing offers control—not chaos. The ability to scale support based on demand, adapt to new regulations, and maintain continuity across time zones ensures that the finance function can keep pace with business complexity.

This flexibility is especially critical for midmarket companies looking to grow without losing control. Outsourced finance and accounting provides the infrastructure to support expansion, without adding internal friction.

Lean Finance Models Are the Future

Traditional finance teams are resource-intensive and slow to adapt. In contrast, lean finance models prioritize speed, insight, and cost efficiency. By adopting lean models supported by outsourced accounting teams, businesses eliminate inefficiencies while staying focused on core strategy.

Lean doesn’t mean under-resourced—it means intentionally optimized. Outsourcing makes this possible by reducing internal workload and delivering immediate access to specialized talent. Instead of building in-house capabilities from scratch, companies can plug into high-performing teams with experience across industries and platforms.

With outsourced finance and accounting, lean models become sustainable. Companies scale operations up or down, onboard new tools faster, and adjust workflows without the lag of traditional hiring cycles. The result? A finance function that’s as dynamic as the market it serves.

A Digitally Fluent Finance Department Is a Competitive Advantage

Digital fluency separates reactive companies from forward-thinking ones. Finance teams that can interpret data, automate processes, and connect tools are better equipped to guide business strategy. But fluency doesn’t happen overnight—and it doesn’t always need to come from inside the organization.

Outsourced accounting teams now serve as accelerators of digital transformation. Whether it’s integrating ERP systems, automating vendor payments, or building analytics dashboards, they help businesses harness the full potential of their tools.

These teams bring tested processes and cross-industry insight. They’ve seen what works—and what doesn’t. That’s how outsourcing empowers finance teams in 2025, digital tools driving outsourced finance operations and enabling real-time decisions with confidence.

In an environment where every second counts, the ability to analyze financial data quickly and accurately is a powerful advantage. Outsourcing provides the infrastructure and expertise to make that happen.

The Power of Partnership: What to Look For in a BPO Provider

Choosing the right outsourcing partner is key. It’s not just about finding someone who can handle data—it’s about finding a team that understands your business, tools, and goals.

The best partners offer deep experience in your sector, are trained on the digital systems your team uses, and operate with transparency and data security top of mind. They align with your pace, not the other way around.

SuperStaff, headquartered in the Philippines, brings all of these qualities to the table. Our outsourced finance and accounting teams are designed to scale with your growth, support your digital initiatives, and ensure your financial operations are always two steps ahead.

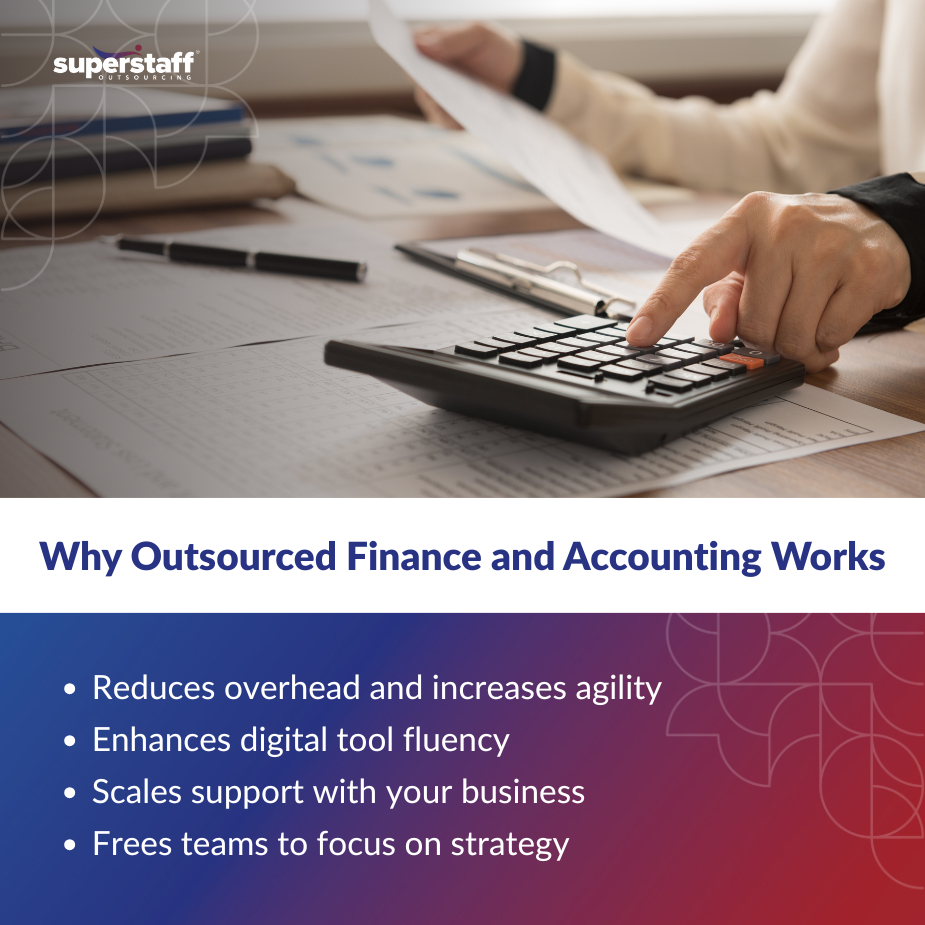

Why Outsourced Finance and Accounting Is a Must in 2025

Outsourced finance and accounting is the foundation of a lean, digitally fluent finance operation.

As CFOs juggle more responsibilities with fewer resources, outsourcing offers clarity, flexibility, and control. It reduces operational costs, strengthens compliance, and increases speed—all while enabling in-house teams to focus on what truly moves the business forward.

In 2025, finance is no longer just about the numbers—it’s about driving strategy, building resilience, and acting fast. SuperStaff helps you get there.

With deep finance expertise, industry-standard digital tools, and a commitment to client success, SuperStaff is ready to support your transformation. Ready to build a future-ready finance team? Let’s talk!