The COVID-19 crisis significantly affected all aspects of business, including companies’ revenues and margins. As businesses recover from the pandemic’s effects, they face many cash flow concerns. One common problem they struggle with is collecting their outstanding accounts receivable in the “new normal.”

At the height of the pandemic, many companies delayed collections as a courtesy to customers facing financial difficulties. However, now that the world economy is starting to bloom again, it’s time for these businesses to improve their cash flow and collect the payments due to them–and outsourcing accounts receivable can be an effective strategy to accomplish these goals.

This article will discuss the ins and outs of accounts receivable, including its process, its classifications, how it differs from accounts payable, and the dangers of mismanagement. Then, we’ll tackle how accounts receivable outsourcing can benefit businesses in this post-pandemic era.

What Are Accounts Receivable?

In simple terms, accounts receivable outsourcing services refer to the system put in place for customers to make delayed payments on their purchased goods or services.

Typically, a company will allow clients to pay their dues in installments or full after a short period. The goal of accounts receivable is to incentivize customers to buy expensive products or large quantities of goods without paying for everything upfront.

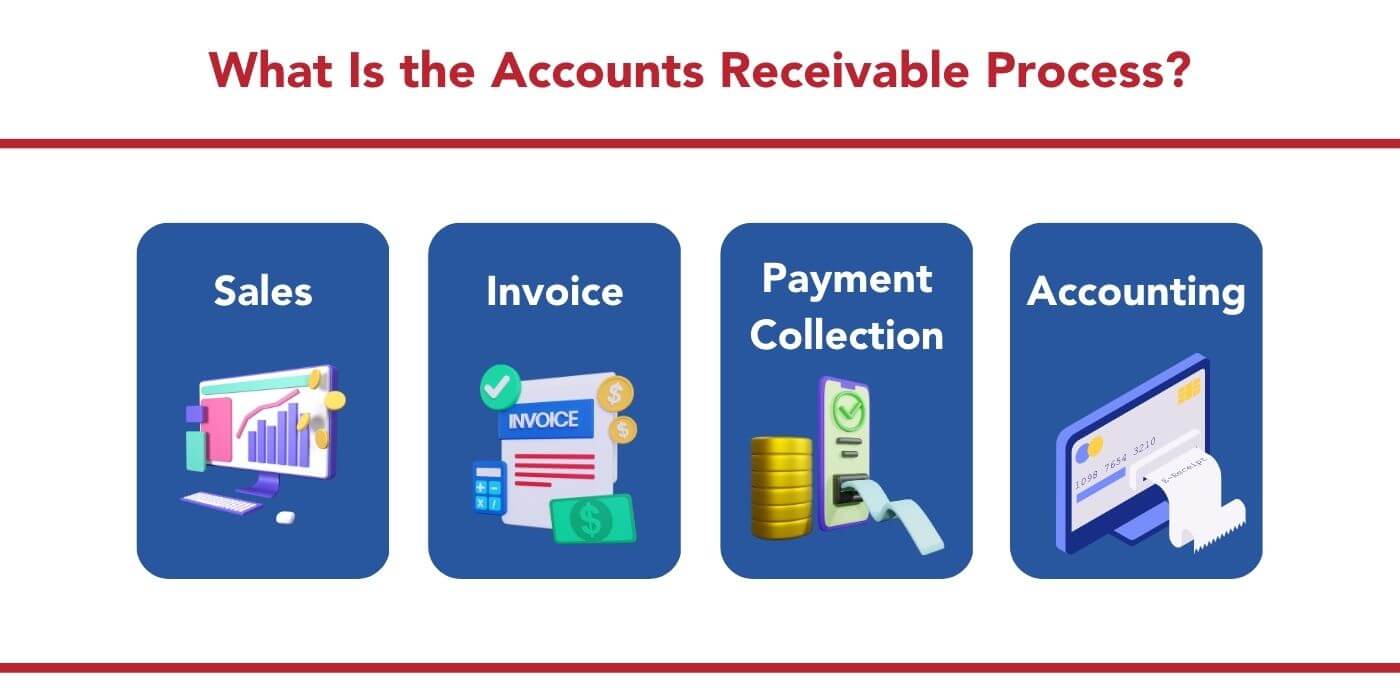

What Is the Accounts Receivable Process?

In a traditional accounts receivable (AR) process, there are four main steps: sales, invoice, payment collection, and accounting.

Step 1: Sales

The first step involves communicating with customers about the goods or services they want to purchase. During this time, businesses must establish the payment period, the amount of credit they wish to extend to customers, late payment penalties, and any other stipulations specific to the company or industry.

Step 2: Invoice

Sometime after the customer has purchased and received the goods or services, the next step is for the business to send an invoice. This reminds customers about their outstanding balances and encourages them to send payments before specific deadlines.

In the past, paper invoices were sent through the mail, but nowadays, electronic invoices are seen as a more convenient, efficient, and consistent alternative.

Step 3: Payment Collection

Most companies collect outstanding payments within 30 or 90 days after purchase. Many businesses rely on automated cloud-based software to track balances and monitor their company’s cash flow, making the collection process easier and more efficient to reduce manual effort and avoid human error.

Step 4: Accounting

The final step of the accounts receivable process is to document every transaction in an accounting ledger, using invoices to record the details accurately. Proper accounting is essential because keeping track of all accounts receivable and payable enables businesses to maximize revenue and minimize losses, liabilities, and expenses.

The 3 Types of Accounts Receivable

Trade Receivables

Trade receivables are the most common accounts receivable, wherein customers buy goods or services on credit. Payment periods for this type usually range between one to two months.

Notes Receivables

In this type of accounts receivable, businesses keep records of formal letters or promissory notes stating that customers agree to pay their dues at a predetermined date in the future. Payment periods for notes receivables often range from between two to three months.

Other Receivables

Other receivables can include:

- Employee Advances

- Tax Refunds

- Interest Receivables

- Salary Receivables

- Loans Made to Employees or Other Companies

Accounts Receivable vs. Accounts Payable: What’s the Difference?

As previously mentioned, accounts receivable refer to the funds that customers owe your business. On the other hand, accounts payable refer to the amount your business owes to suppliers and other creditors.

Accounts receivable and accounts payable are terms that seem opposites but are two sides of the same equation. To achieve financial health and maximize revenue, a company must find a healthy balance, ensuring that the funds the business owes suppliers are not more than customer payments.

The Dangers of Mismanaging Accounts Receivables

In previous sections, we’ve tackled how accounts receivable can incentivize customers to make large purchases. However, if businesses don’t have a good collection process, many clients may forget to make payments, leaving companies vulnerable to lost revenue and wasted resources.

In addition, companies that need to manage their accounts receivable adequately might also find difficulty getting business loans. Banks and lending institutions consider multiple factors before agreeing to extend credit to a business. A high amount of unpaid invoices can make your loan applications look riskier and less credible.

Why You Should Consider Outsourcing Accounts Receivable Services in the Philippines

In our post-pandemic world, it has become even more crucial for businesses to straighten out their accounts receivable. After over two years of staying home and making online purchases, customers prioritize convenient and hassle-free transactions.

To win their business, brands must have a solid collection process that makes it easy for customers to pay their dues.

If your business has trouble managing collections, there can be one effective solution: accounts receivable outsourcing services. Instead of building your accounts receivable process from the ground up, allow experienced outsourcing professionals to handle everything, from closing a sale to collecting payments to ensuring that all accounting records are logged and accurate.

The Philippines is home to many accounting professionals and Certified Public Accountants (CPAs). Most are familiar with international accounting standards and practices due to the country’s close ties and history with the U.S.

By tapping into this vast pool of skilled workers. Businesses can easily streamline their accounts receivable process and improve cash flow and revenue.

Does Your Business Need Accounts Receivable Outsourcing Services?

Have you always been putting up with late payments? Do you need help balancing your accounts? If the answer to those questions is “yes,” it’s time to outsource accounts receivable experts for your company.

Here are the signs that your business needs AR outsourcing:

Limited Budget

Your company would need help rebounding when it accumulates too much debt. And sadly, that is true. According to a study, businesses wipe out 1.5% of their receivables as irrecoverable debt. Because of that, 93% of companies stop operations because of late customer payments. Late credit sales also occur at 47%, leading to higher penalty rates.

You could fall into one of these statistics without immediate action. So, the best solution is to hire an outsourced service for accounts receivable. By outsourcing AR services, they can streamline communication processes with your consumers and resolve their overdue payment status. In return, you’ll save money and time from demanding them their dues.

Gain Business Exposure

In a crowded market, your goal is to make your business stand out and receive good publicity. One way to be on your customer’s good side is to maintain customer satisfaction. Because when your clients are irritated, they will hop to another firm. That means you’d lose your prospective customers and the company’s reputation.

Without realizing it, we tend to provoke our clients when they incur payment delays. A gentle nudge of reminder calls could be perceived as an annoying jab to them.

Outsourcing AR functions can kill two birds with one stone: easing the payment process and protecting your relationship with clients. They help you ensure faster payments by providing automated reminders for clients. At the same time, your provider will match ideal communication styles that resonate with your consumers, guaranteeing a great customer experience.

Redistribute Your Priorities

Do you find yourself too focused on administrative and repetitive work that you need more time for other priorities? Keep in mind that no matter what, your company needs to grow. By neglecting the tasks requiring more emphasis, your business could easily overshadow your competitors.

That’s when hiring AR specialists becomes beneficial. When you allow your accounting providers to take over your financially-related tasks, you can focus on what matters most for your business—ensuring longevity and long-term success.

Top 5 Master Plans for Effective Accounts Receivable Management

The road to effective management of financial reports sometimes requires guidance from a trusted AR provider. With proper and efficient accounts, you’d secure punctual payments, improve customer relationships, and have better cash flow.

Planning to have effective AR management? Here are five strategies for this:

- Leveraging electronic or online platforms: Times are changing. Now, it’s time to replace paper, snail-mail billing, and paper checks with an electronic invoicing system. This allows customers to make convenient transactions with you online. The system could also record all necessary information, helping you keep abreast of cash collections and settle outstanding invoices.

- Update your accounts statement: As a business owner, you might be too busy streamlining your business systems. As a result, you won’t have to arrange and balance your account statements. With AR services, your financial information, invoices, accounts receivable, and customer data will always be up to date on your systems.

- Utilizing the correct KPIs: Your accounts receivable processes need to function correctly. It would be best if you stayed on top of various AR performance metrics. One example of this is the Day Sales Outstanding (DSO). DSO measures the average number of days it requires to collect payment. A lower DSO signifies that your company is receiving its payments quickly.

- Drafting transparent billing systems: Clarity and consistency are key factors when approaching your billing procedure. Please take note of the processes so your employees can refer to and emulate them in future business dealings.

- Include all teams: Effective payment collections calls for the intervention of various departments. When all members are included, it makes sure to keep everyone on the same wavelength. In turn, it optimizes business processes, reduces repetitions, and eliminates errors that could negatively affect profitability.

Thinking About Outsourcing Accounts Receivable?

Now that you understand the advantages of accounts receivable outsourcing, your next step is to connect with a reliable outsourcing partner. With the right provider, you’d receive automated and meticulous accounting services while adopting best practices for your finances.

Remember to choose a provider that offers a wide range of financial service outsourcing solutions, including accounts receivable and accounts payable management. It is also possible to source for a BPO company with a 99% success rate in filling accounting positions and a minimum attrition rate for financial service roles.

As such, you can expect a team of trained and experienced financial professionals to meet your clients’ needs and goals.