With the United States transitioning to a new administration, proposed tariffs and stricter immigration policies have the potential to reshape the pharmaceutical industry’s supply chain landscape. These policies threaten to drive costs, create labor shortages, and disrupt production cycles.

Thankfully, businesses still have a way to maintain efficiency and product availability amid these regulatory changes: outsourcing. With the right BPO partner, pharmaceutical companies gain a strategic, cost-effective solution to emerging supply chain challenges. In this blog, we’ll explore exactly how outsourcing can help firms navigate changing regulations and future-proof their operations for 2025 and beyond.

Overview of Proposed Tariffs and Immigration Policies Under Trump

In November, U.S. President-elect Donald Trump announced his plans for massive tariff hikes and stricter immigration policies, particularly for goods and workers from Mexico, China, and Canada. The regulatory changes will take effect on January 20th, the first day of his administration, and may have a widespread impact on multiple industries, including the pharmaceutical sector.

Business analysts expect these proposed measures to add approximately $272 billion in annual tax burdens to U.S. industrial sectors, raising the prices of goods across the board and potentially stunting overall economic growth. The tariff hikes on raw materials and finished goods, combined with immigration restrictions on skilled workers, may disrupt pharmaceutical supply chains and force firms to reinvent their strategies to remain competitive and compliant.

With these challenges in mind, pharmaceutical companies must explore ways to safeguard their operations. Let’s break down the proposed regulatory changes and how they may impact the pharma landscape:

Key Tariffs Affecting Pharmaceutical Imports and Exports

One of President-elect Trump’s first Executive Orders includes a blanket tariff of 20% on all imports, a 25% tariff on goods from Mexico and Canada, and a 60% tariff for products from China. With these tariff hikes, the new administration aims to create more production and manufacturing jobs in the U.S. and incentivize businesses to reshore operations. However, the proposed policies create problems for existing pharmaceutical supply chains.

According to industry experts, over 80% of all active pharmaceutical ingredients (APIs) are produced overseas, particularly in China and India. Due to rising costs and labor shortages in the U.S., most generic drug manufacturing activities are also conducted abroad.

As such, pharmaceutical companies foresee future manufacturing and production challenges because of the proposed tariffs, limiting access to raw ingredients and finished goods. The added expenses could be passed down to consumers, leading to higher generic drug prices and lower product availability. Additionally, the higher production costs could create a nightmare scenario for smaller drug manufacturers, affecting their operational efficiency and profitability.

Impact of Immigration Policies on the Availability of Skilled Labor

In addition to the proposed tariff hikes, President-elect Donald Trump made immigration one of the key elements of his 2024 campaign. Trump’s hardline policies include adding more immigration restrictions, updating ICE enforcement priorities, and revoking humanitarian parole programs for immigrants, all of which make it more difficult for aspiring migrants to work, live, and stay in the U.S.

Here’s the problem: Immigrant workers have been instrumental in addressing skilled labor shortages for many businesses, including those in the pharmaceutical industry. As such, the new administration’s stricter stance on immigration may exacerbate the existing labor crisis in the U.S., leading to more unfilled job openings, higher risks of business disruptions, and lower operational productivity.

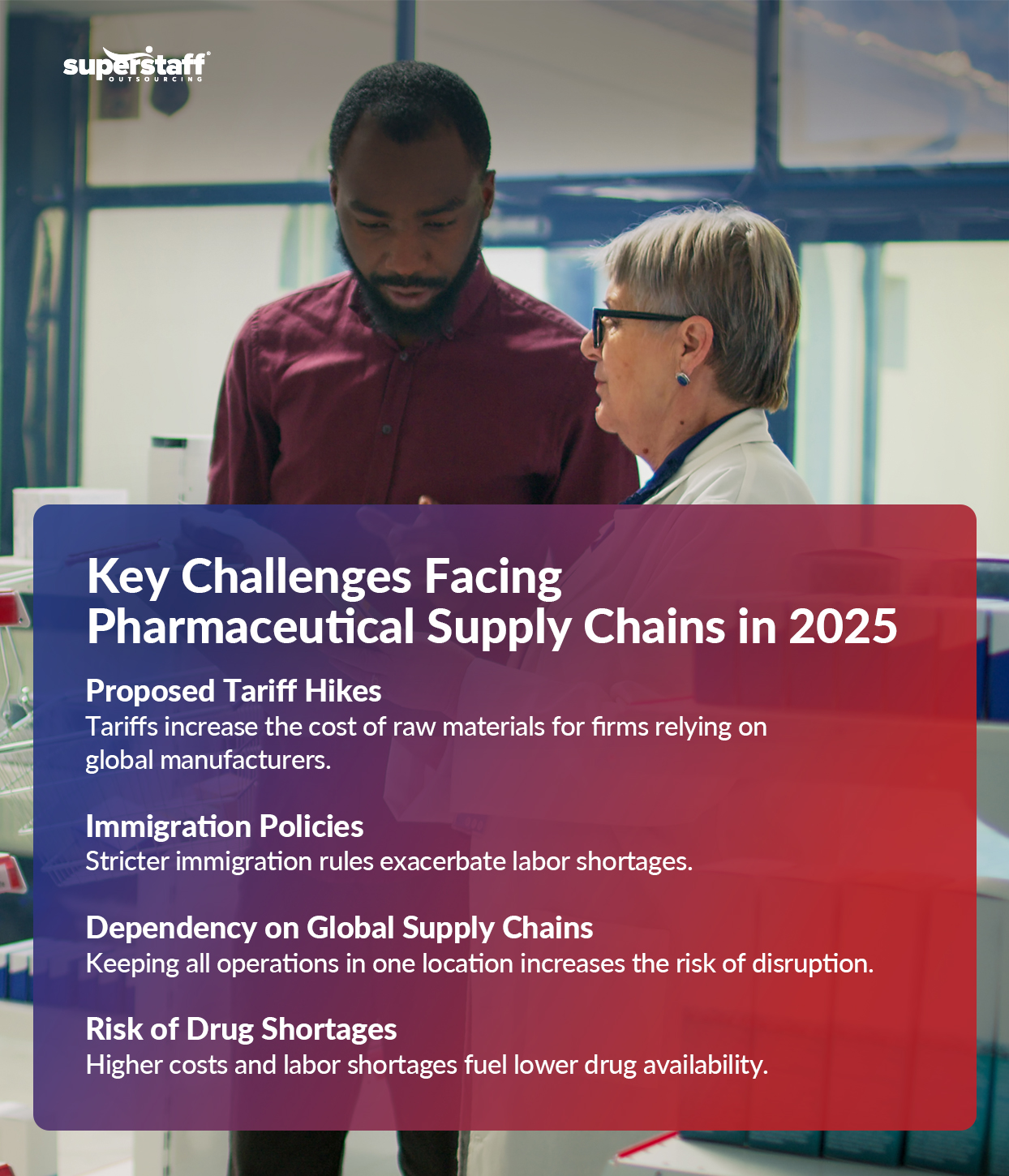

Challenges Facing Pharmaceutical Supply Chains

After briefly discussing the new administration’s proposed tariffs and immigration policies, let’s move on to the specific challenges pharmaceutical supply chains face due to these regulatory changes. The evolving policies may introduce significant hurdles to the pharmaceutical sector, increasing costs, amplifying vulnerabilities, and boosting the risk of drug shortages.

Industry analysts foresee that the proposed tariff hikes will increase the cost of raw materials, particularly for pharmaceutical companies that rely on international suppliers. Meanwhile, stricter immigration rules will exacerbate labor shortages in the U.S. and create operational problems for businesses. Combined, these two issues will contribute to longer production times, significant supply chain disruptions, and higher overall expenses.

Increased Costs and Reduced Margins

The newly proposed tariff hikes under the Trump administration are foreseen to be the most significant tax increases in over a decade, imposing nearly $80 billion in taxes on U.S. citizens. With the higher costs of imports, pharmaceutical companies relying on global manufacturers will pay more to produce and transport medications and other products, impacting their profitability and bottom line.

Many pharmaceutical firms will struggle to control costs while maintaining product safety and quality. At the same time, companies may need to raise prices to address skyrocketing expenses, but this strategy will reduce patient accessibility and lower buyer satisfaction.

Dependency on Global Supply Chains Amplifies Vulnerabilities

As mentioned in previous sections, many pharmaceutical companies depend on global supply chains to produce, manufacture, and distribute products. This increased dependence on overseas manufacturers can amplify vulnerabilities and increase the risk of supply chain disruptions, especially amid fluctuating geopolitical environments and rising inflationary pressures.

Risk of Drug Shortages Affecting Public Health

According to the American Society of Health-System Pharmacists (ASHP), the United States experienced widespread drug shortages in 2024, with a record-high dearth of 323 active cases. Because of this alarming trend, many healthcare facilities and providers were forced to ration medications for patients, leading to less effective treatment plans, delayed patient care, and increased costs.

With the newly proposed tariffs and immigration policies, industry experts believe that drug shortages may worsen in 2025 and beyond. Since pharmaceutical firms will have to pay more to manufacture and distribute medications, many will be forced to slow down production cycles or raise prices significantly. Both of these strategies will reduce drug availability and accessibility, which could harm public health and create increased barriers for patients seeking needed medications.

Industry Trends and Adaptation Strategies

As pharmaceutical companies face these obstacles, industry trends reveal a pivot toward innovative adaptation strategies. To withstand the pressure of changing immigration policies and tariff hikes, firms must reinvent their operational models by prioritizing regional supply chains, diversifying sourcing activities, increasing reliance on digital tools, and working with outsourcing providers. Let’s break down these strategies one by one:

Regional Supply Chains

One strategy top pharmaceutical companies in the U.S. employ to address changing regulations is investing in regional supply chains. Firms are exploring more localized operational models to reduce dependence on international trade, remain compliant with shifting policies, and take advantage of domestic tax incentives.

According to a 2023 report, over 1,800 U.S. companies opted to reshore their supply chains, bringing their workforces back home and creating 350,000 additional jobs on American soil. This strategic move was sparked by the pandemic-induced supply chain disruptions and increasing geopolitical tensions of the time.

Under the Trump administration, more firms may reshore their manufacturing and distribution functions to mitigate risks and avoid financial penalties. Instead of establishing factories overseas, pharmaceutical companies may focus on establishing regional manufacturing hubs in areas with comparatively lower living and labor costs.

Diversified Sourcing

Beyond establishing regional supply chains, many U.S. pharmaceutical firms may also consider diversifying their sourcing activities. Expanding their supplier base can enable businesses to minimize risks tied to specific locations and regions while optimizing incentives and policies related to diverse markets.

For example, many pharmaceutical companies relied on Chinese partners for drug manufacturing and distribution in the past. Today, firms can establish operations in different countries instead of putting all their eggs in one basket, such as leveraging nearshoring to Colombia for supply chain management or offshoring non-core operations to the Philippines.

This hybrid outsourcing strategy allows businesses to spread operations across multiple locations, minimizing the risk of keeping all activities concentrated in one area. So, suppose geopolitical tensions, weather disturbances, or other disruptions threaten manufacturing in one country. In that case, several other headquarters are available to pick up where they left off, maintaining productivity, efficiency, and quality.

Increasing Reliance on Digital Supply Chain Management Tools

In addition to establishing regional manufacturing hubs and diversifying sourcing, another strategy top pharmaceutical companies can embrace is investing in digital supply chain management tools. These technologies can help firms keep track of inventory levels, coordinate with suppliers, oversee product transportation and distribution, and create a more seamless supply chain process.

According to a Statista report, the global supply chain management software market is projected to reach $20.07 billion in 2024 and will likely grow to $24.58 billion in the next five years. This eye-opening statistic shows the growing importance of technology in optimizing supply chain functions. For many pharmaceutical companies, investing in this technology can help minimize production and distribution delays while lowering costs associated with supply chain bottlenecks.

Outsourcing as a Solution for Navigating Pharmaceutical Supply Chain Challenges

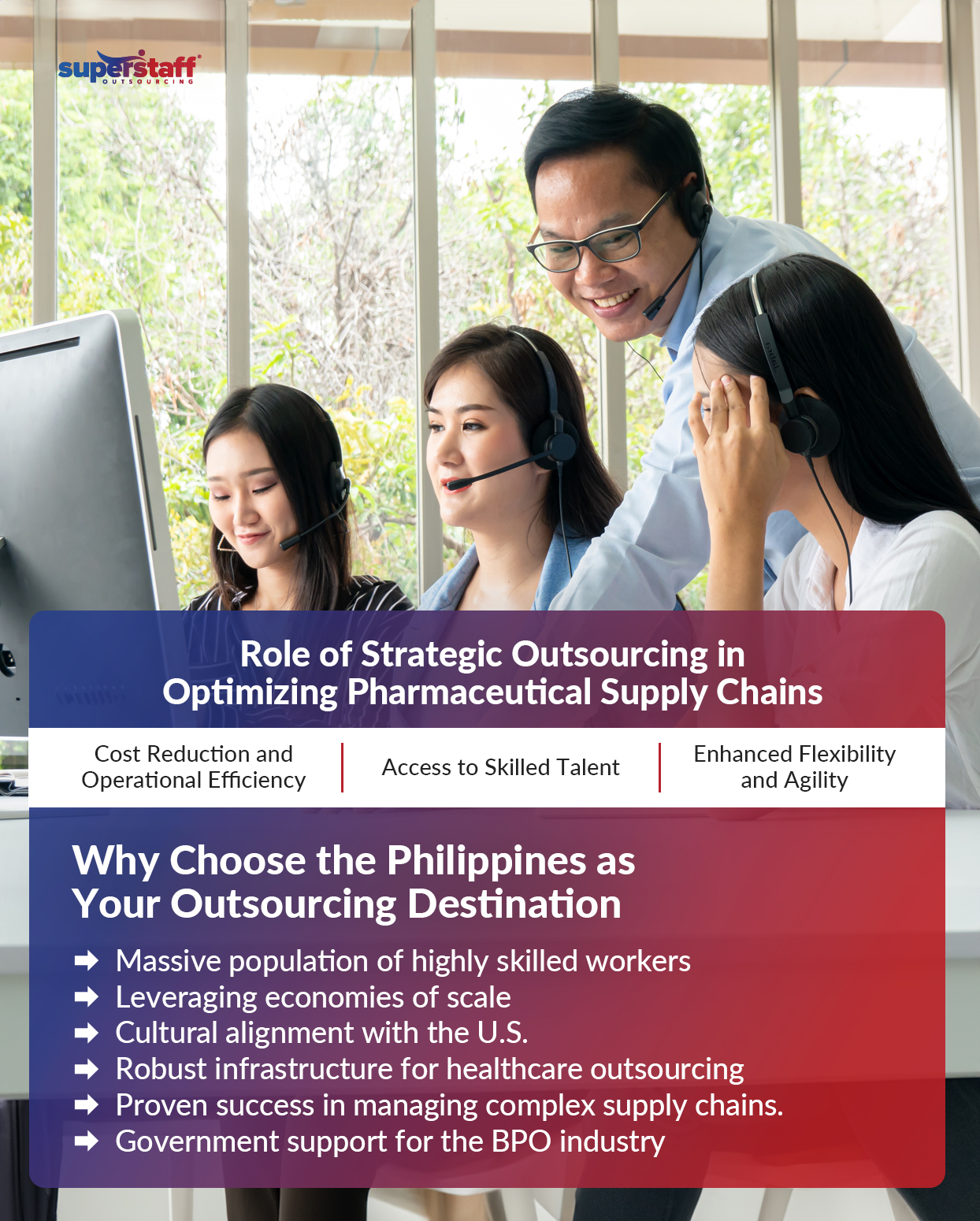

Among the strategies shared above, outsourcing stands out as a powerful solution to mitigate these challenges’ financial and operational impacts. Pharmaceutical firms can opt for strategic outsourcing to lower overhead expenses while expanding their workforce and capabilities.

By connecting with a BPO partner, pharmaceutical companies can reduce costs, access skilled talent, and maintain flexibility in operations, giving them a strategic edge in navigating supply chain challenges. Here are the reasons why firms should consider outsourcing as a way to address the regulatory changes under the new administration:

Cost Reduction and Operational Efficiency

In previous sections, we mentioned how the proposed tariff hikes will drive up manufacturing and supply chain costs for the pharmaceutical industry. Because of these additional expenses, pharma companies must reinvent their operational strategies to maintain their production cycles, keeping product quality and safety in mind while safeguarding profitability and their bottom line.

Thankfully, working with an outsourcing provider can help pharmaceutical firms reduce overhead costs and improve operational efficiency. By leveraging external expertise from professionals in countries with lower living and labor costs, companies can tap into economies of scale and keep expenses under control. At the same time, they can maintain productivity and efficiency, knowing offshore experts are handling their crucial non-core tasks.

Access to Skilled Talent

With the new administration’s stricter immigration policies, many pharmaceutical companies may struggle to find qualified workers to fill necessary job openings. This is especially critical for specialized roles like data analysts, AI development support, software engineers, and research and development teams.

To address the narrowing local talent pool, pharmaceutical firms can expand their horizons through strategic outsourcing. With a BPO provider, companies can gain access to a global pool of skilled professionals unaffected by immigration restrictions. This solution allows them to fill the gaps in their operations, expanding their workforce and capabilities beyond the confines of their home country.

Enhanced Flexibility

Another advantage of strategic outsourcing for pharmaceutical companies is increased flexibility. The newly proposed tariffs and immigration policies are only two of the regulatory changes projected to reshape the pharmaceutical landscape in 2025. More legislation could be updated and revised in the coming years, both locally and internationally.

To remain competitive in the global business environment, pharmaceutical firms must improve their flexibility and agility, facilitating speedy responses to shifting requirements and standards. Through outsourcing, companies can scale their operations up or down depending on changing demands. This enables them to quickly adapt to regulatory changes, shifting supply chain demands, and unforeseen disruptions.

Why the Philippines is a Prime Outsourcing Destination

Now that we’ve outlined the indispensable advantages of outsourcing for helping pharma companies overcome supply chain challenges, let’s talk about finding the ideal BPO vendor. Partnering with a reliable outsourcing provider is not only beneficial for navigating the new regulatory changes; It is also essential to ensuring long-term success in the ever-shifting pharmaceutical landscape.

Choosing the right BPO destination is vital when selecting an outsourcing provider, helping companies tap into a cost-effective talent pool, take advantage of favorable government policies, and ensure the stability of their supply chains. The Philippines can be the ideal outsourcing destination for pharmaceutical companies seeking these advantages. Here’s why:

Massive Population of Highly Skilled Workers

The Philippines is known as the “BPO Capital of the World” for a reason, one of which is its wealth of highly skilled workers. In 2024, the country had an exceptionally high average labor participation rate of 64.3%, meaning an estimated 50.12 million Filipinos were employed.

Of these millions of workers, a large portion are highly trained professionals in fields like supply chain management and back-office support. Many top pharmaceutical companies outsource to the Philippines to tap into this sizable talent pool and connect with world-class specialists who meet their business needs.

Cost Efficiency and Economies of Scale

In addition to expanding their talent pool, outsourcing to the Philippines empowers pharmaceutical firms to reduce operational costs without compromising quality. Compared to Western economies, the Southeast Asian nation has lower labor, commercial rent, utility, and equipment costs. This allows companies to expand their workforce and operations without overextending their tight budget.

Cultural Alignment With the United States

Another advantage of working with an offshore BPO in the Philippines is its familiarity and alignment with U.S. cultural norms and preferences. As a former American colony, Filipinos are well-versed in Western culture and business practices, including having one of Southeast Asia’s highest English proficiency levels. Because of the deep history between the two countries, Filipino workers can easily adapt their service quality to U.S. standards.

Robust Infrastructure for Outsourcing in Healthcare and Pharmaceuticals

Many pharmaceutical companies worldwide choose the Philippines as their ideal outsourcing destination. This is because the Southeast Asian nation has invested heavily in technological infrastructure and internet connectivity, enabling workers to perform tasks for clients remotely. The country also has a wealth of specialty healthcare outsourcing professionals familiar with global industry legislation, allowing them to adapt swiftly to changing regulatory requirements.

Proven Success in Managing Complex Global Supply Chains

Beyond managing complex healthcare functions, BPO companies can also connect businesses with specialists who understand the importance of supply chain management in pharmaceutical companies. These outsourced professionals can assist pharmaceutical firms in tracking inventory levels, coordinating with suppliers, planning product transportation and logistics, and providing emergency dispatching services.

Government Support for the Outsourcing Industry Ensures Stability and Growth

Finally, another valuable advantage of offshore outsourcing to the Philippines is the favorable business environment. The local government provides financial incentives and tax breaks for foreign investors to encourage companies to establish headquarters in the country.

As such, pharmaceutical firms that outsource to the Philippines may reap financial benefits in addition to cost-effective labor and operational expenses. By choosing an offshore BPO provider, companies can ensure seamless operations even in the face of global challenges.

Navigating Pharmaceutical Supply Chain Challenges? Connect With the BPO Professionals at SuperStaff!

Amid an uncertain regulatory environment, pharmaceutical companies can navigate challenges with help from a dedicated BPO provider. Strategic outsourcing empowers firms to overcome tariffs, labor shortages, and supply chain disruptions.

With the right outsourcing partner, the pharmaceutical industry can reap significant cost savings, access skilled talent, and gain the adaptability needed in a volatile global trade environment.

As the BPO arm of a healthcare biopharma parent company, SuperStaff can be the ideal partner for pharmaceutical firms. Our team’s expertise in back-office support, procurement coordination, and supply chain management can empower your firm and allow it to thrive despite policy challenges.

Are you ready to future-proof your pharmaceutical operations? Reach out today for a quick consultation!