As a business leader, it’s crucial to ask yourself: How can I close this year on a high note?

One key to answering that question is a thorough financial performance analysis. A comprehensive financial review highlights areas for improvement and provides an opportunity to realign business goals and optimize financial allocations for the year ahead.

Outsourcing your bookkeeping and accounting needs can be a strategic move in this process. These intricate and often time-consuming tasks can overwhelm your in-house team, leading to errors and inconsistencies. By leveraging the expertise of professional accountants and bookkeepers, you can ensure accuracy, compliance, and valuable insights that drive informed decision-making.

This article delves into the benefits of outsourced bookkeeping and accounting services. It demonstrates how they can contribute to a successful year-end financial review and position your business for continued success.

The Complexity of Year-End Financial Reviews

Year-end financial reviews are more than a routine check of your financial records; they demand a rigorous and comprehensive approach. This process involves auditing financial statements, reconciling accounts, and adhering strictly to tax laws and regulations.

Understanding Your Financial Statements

A crucial aspect of year-end financial reviews is thoroughly examining your financial statements. These statements offer a comprehensive overview of your company’s financial activities and overall health throughout the year.

Critical financial statements include the balance sheet, income, and cash flow statement. Each of these documents provides unique insights into various facets of your company’s financial performance over the fiscal year.

The balance sheet outlines your company’s assets and is instrumental in assessing your business’s financial standing. It also reflects how much shareholders and investors have financially committed to the company and details ownership and liabilities.

Conversely, the income statement presents a detailed view of your company’s revenues and expenses. In contrast, the cash flow statement highlights where your company’s funds are being allocated and how they are generated.

Proper Preparation of Compliance Documents

Equally important is the preparation of compliance documents, which is essential for adhering to tax regulations during year-end financial reviews. While the specific tax documents required can vary based on the type of business, generally, you should maintain records such as expense receipts, previous year’s tax returns, 1099-NEC forms, 1096 forms, and W-2 and W-3 wage and tax statements. These documents contain critical information about employee earnings and tax deductions and are issued by the Internal Revenue Service (IRS), which oversees compliance with tax laws.

Keeping Track of Your Revenue and Expenses

Another fundamental task during year-end financial reviews is analyzing revenue and expenses. This analysis ensures that your company’s funds are carefully monitored, contributing to economic stability and preventing unnecessary expenditures. Revenue represents the income generated from your core business activities, while expenses cover the costs of producing and delivering those services. By closely examining these figures, you can maintain a healthy financial position.

Analyzing Your Profitability Ratios

Profitability analysis, on the other hand, focuses on evaluating profitability ratios, which measure your company’s ability to generate earnings. This analysis is crucial for internal assessments and attracting investors and shareholders, as it demonstrates the effectiveness of your financial management and operations. A strong profitability ratio can enhance your company’s appeal to potential investors and strengthen its market position.

Conducting a Comprehensive Risk Assessment

Finally, a comprehensive risk assessment is vital in identifying potential financial risks that may impact your business. By proactively analyzing these risks, your company can better prepare for challenges in the coming year and address any current issues. Effective risk management helps safeguard your company’s financial health and ensures long-term success.

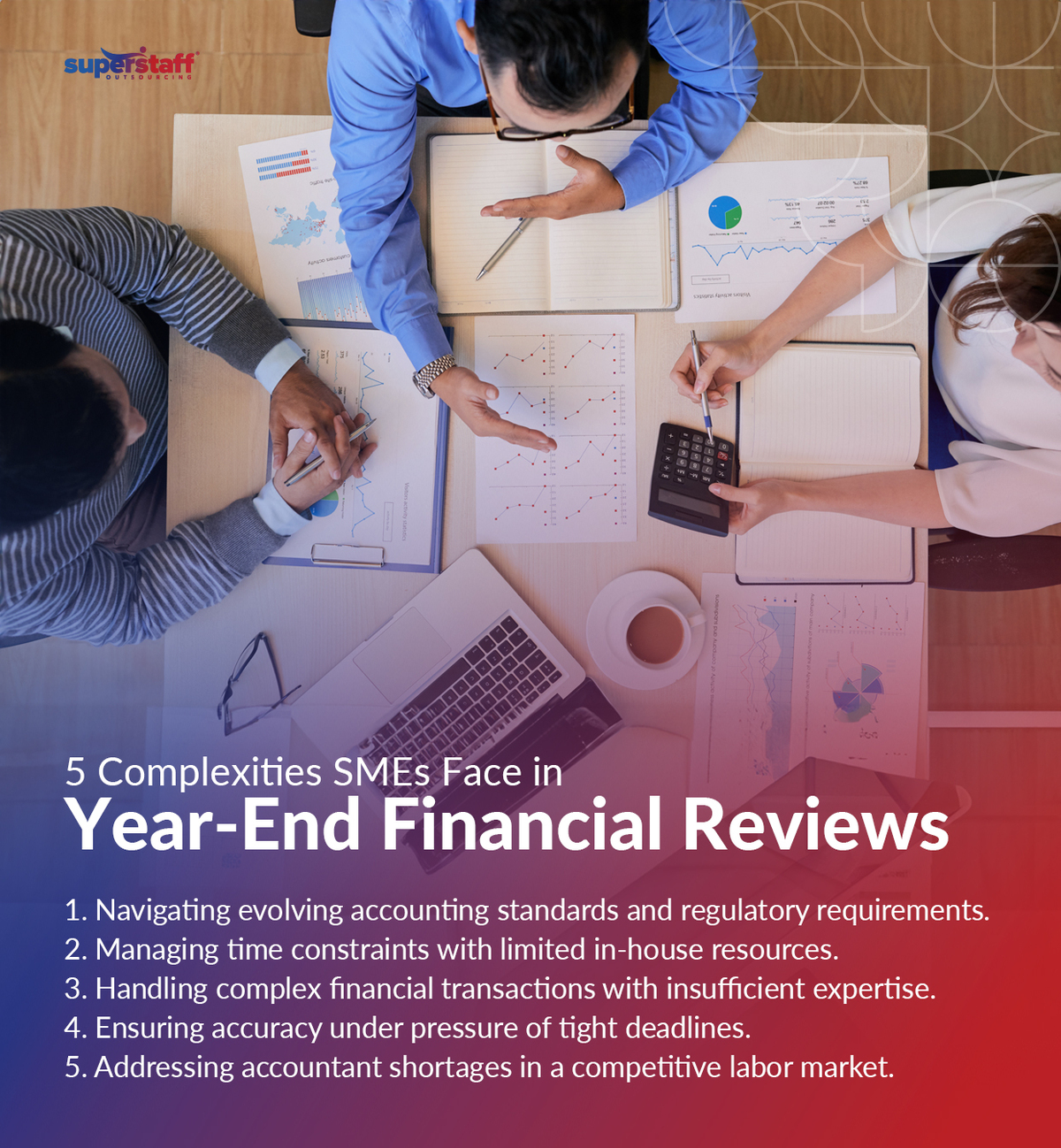

Common Challenges Faced By Businesses During Year-End Financial Reviews

Complying with Accounting Standards

Businesses often face significant challenges when adhering to accounting standards like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). These standards ensure that financial records are accurate, transparent, and consistent. However, staying up-to-date with these evolving regulations can be a significant hurdle for companies. As these standards change, businesses must adapt their processes, which can be time-consuming and disruptive. Compliance with GAAP and IFRS is non-negotiable, and failure to adhere to these guidelines can lead to financial misstatements and regulatory issues.

Time Constraints and Tight Deadlines

Time constraints and tight deadlines present another challenge during year-end financial reviews. Preparing financial statements requires meticulous attention to detail, thorough auditing, and absolute accuracy. However, the pressure of meeting deadlines can compromise the quality of financial reporting. Accelerating the preparation of financial statements to meet these obligations often leads to errors and inaccuracies, negatively impacting your company’s financial representation and overall credibility.

Complexity of Transactions

Complex transactions, such as mergers and acquisitions, shareholder agreements, joint ventures, and leasing agreements, add another difficulty to year-end financial reviews. These transactions require specialized expertise that may be beyond the scope of your in-house team. Without the right expertise, managing these transactions can become overwhelming, detracting from your primary business operations and complicating your year-end financial statements.

Addressing Accountant Talent Shortages

In today’s labor market, many businesses face the challenge of accountant talent shortages. The demand for skilled accountants often exceeds supply, making it difficult for companies to find and retain the necessary talent for accurate financial management.

That shortage can further complicate year-end financial reviews, as the expertise to navigate complex regulations and transactions becomes more challenging to secure. Outsourcing provides a viable solution to this issue, giving businesses access to a pool of experienced professionals without the strain of recruiting and retaining in-house talent.

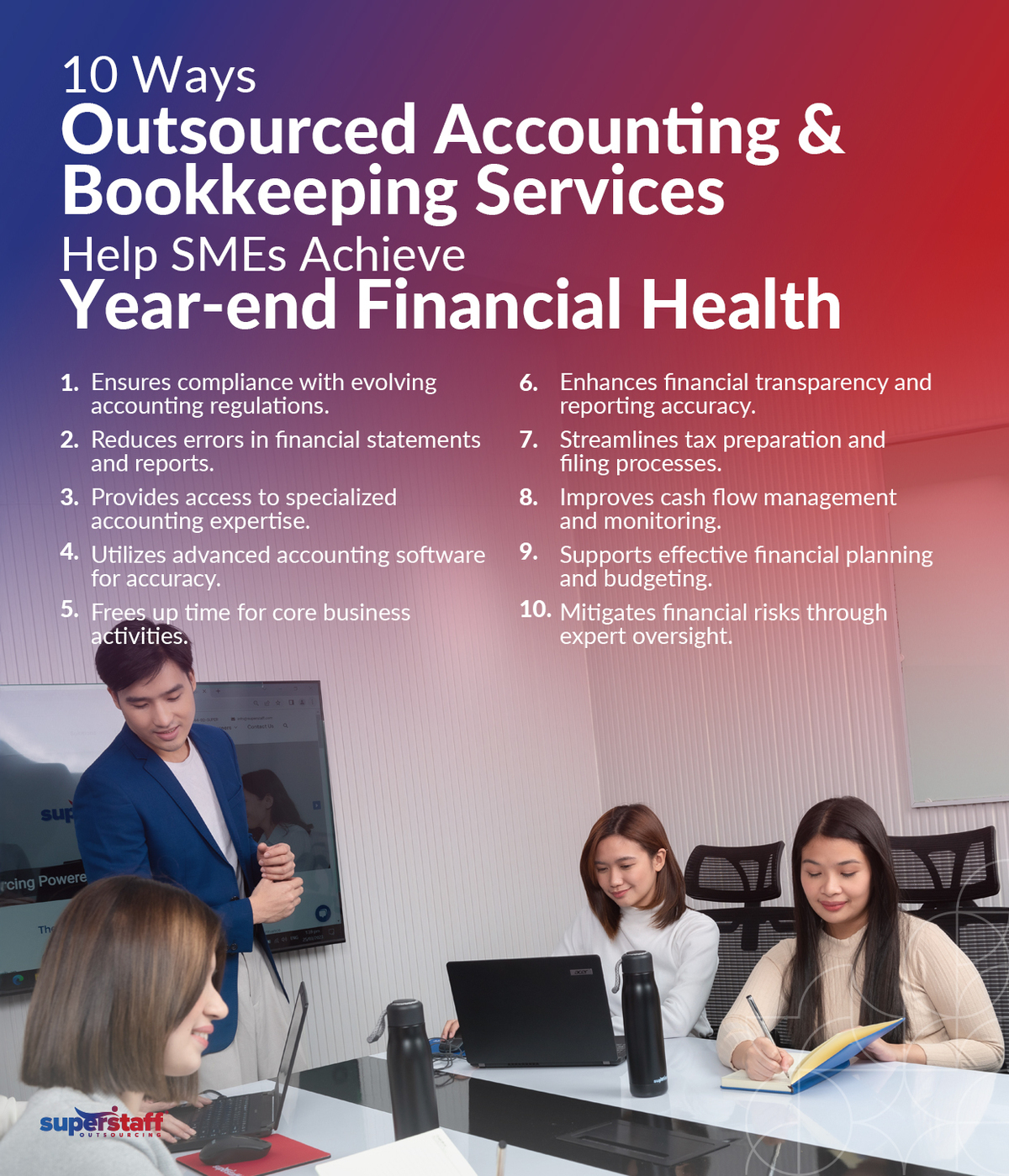

The Benefits of Outsourced Bookkeeping and Accounting

Outsourcing bookkeeping and accounting services offers substantial advantages that can significantly streamline your year-end financial review process. By outsourcing, you gain access to specialized expertise from accounting professionals such as CPAs, utilize advanced accounting software, reduce the risk of errors, and ensure greater accuracy in your financial reporting.

Access to Experienced Professionals

The ongoing shortage of accounting professionals poses a significant challenge for businesses, often straining in-house staff who are already burdened with increased bookkeeping and accounting responsibilities. Recent data shows that 83% of senior leaders report a shortage of accounting talent, a rise from 70% in 2022.

This shortage not only increases the workload on existing staff but also heightens the risk of inaccuracies in financial reviews. According to Gartner, 80% of accountants report making daily financial errors, and 59% admit to monthly mistakes, mainly due to the pressures of talent shortages.

Outsourcing can alleviate these challenges by connecting your business with experienced professionals. This allows your in-house team to focus on primary tasks while experts handle the complexities of financial reviews.

Utilization of Advanced Accounting Software

In today’s rapidly evolving technological landscape, staying competitive requires adopting advanced tools and technologies. Accountants increasingly rely on AI and automation to improve efficiency and accuracy.

A recent Intuit QuickBooks survey found that 98% of accountants and bookkeepers have used AI in the past year. Firms have invested an average of $25,000 in accounting technologies and plan to invest an additional $24,000 in the coming year.

Outsourcing ensures your business benefits from these cutting-edge tools, as experienced professionals utilize advanced software to enhance decision-making and streamline financial processes.

Reduced Risk of Errors and Fraud

The shortage of accounting talent strains your in-house team and increases the likelihood of errors and fraud due to overwork and burnout. Gartner reports that 73% of accountants experience increased workloads due to new regulations, which can compromise the quality of financial reporting.

Outsourcing helps mitigate these risks by distributing the workload more effectively and involving additional experts who can ensure accuracy and compliance in your financial reports. This support enables your in-house staff to maintain high standards without being overwhelmed.

Time Saved on Training and Managing In-House Staff

Outsourcing brings expertise and advanced tools to your business, offering significant cost-efficiency and time savings. By outsourcing, you can reduce overhead costs and allow your in-house team to focus on core business functions. For instance, training and managing in-house staff is both time-consuming and expensive.

According to Forbes, the average cost of training an employee in 2023 is about $1,220, with employees receiving an average of 57 hours of training annually. Outsourcing eliminates these costs and time commitments by providing access to professionals already well-versed in accounting and bookkeeping functions, allowing your business to allocate resources more effectively.

Ensuring Compliance and Mitigating Risks

Ensuring compliance with regulations and managing financial risks are critical components of a successful year-end financial review. Outsourced accountants and bookkeepers keep your business up-to-date with the latest regulations, ensuring full compliance while providing valuable insights into risk management.

Compliance is essential for avoiding penalties and building trust with clients, investors, and stakeholders. Your business can maintain a strong reputation and foster long-term relationships by ensuring transparency and addressing potential risks.

Outsourcing helps you achieve this by providing expert guidance on regulatory compliance and financial risk mitigation, safeguarding your business’s future.

Outsource With a BPO Partner for a Seamless Financial Year-End Review

Navigating the complexities of financial year-end reviews — amid evolving regulations, tight deadlines, and intricate accounting tasks — can be overwhelming. This is where outsourcing becomes not just an option but a strategic advantage.

Outsourcing your accounting and bookkeeping gives you access to expertise, ensuring your financial review is accurate, compliant, and transparent.

SuperStaff, with its headquarters in the Philippines, has access to thousands of Certified Public Accountants and bookkeepers with mastery of the latest accounting standards and regulations. When you partner with us, you’re setting the stage for a prosperous year-end.

Let’s close this year strong together.