In today’s volatile business environment, financial precision is more than a back-office necessity; it’s a survival strategy. As companies face tighter margins, complex compliance rules, and global expansion pressures, many are turning to outsourced bookkeeping to maintain both accuracy and agility. What was once seen as a simple cost-saving move has evolved into a strategic partnership that drives business stability.

Nowhere is this transformation more evident than in the Philippines, where world-class bookkeeping professionals deliver far more than just number crunching. They bring consistency that ensures every figure aligns, compliance that shields businesses from costly errors, and confidence that empowers leaders to make smarter, faster decisions.

By outsourcing bookkeeping functions to the Philippines, businesses not only strengthen their financial backbone but also gain the flexibility and foresight needed for long-term growth, scalability, and risk management.

Bookkeeping is no longer a back-office task—it’s a pillar of business resilience.

Bookkeeping has evolved far beyond maintaining ledgers and balancing accounts. Today, it sits at the core of business strategy. Organizations now depend on outsourced bookkeeping not only for data accuracy but also for actionable insights that drive long-term stability.

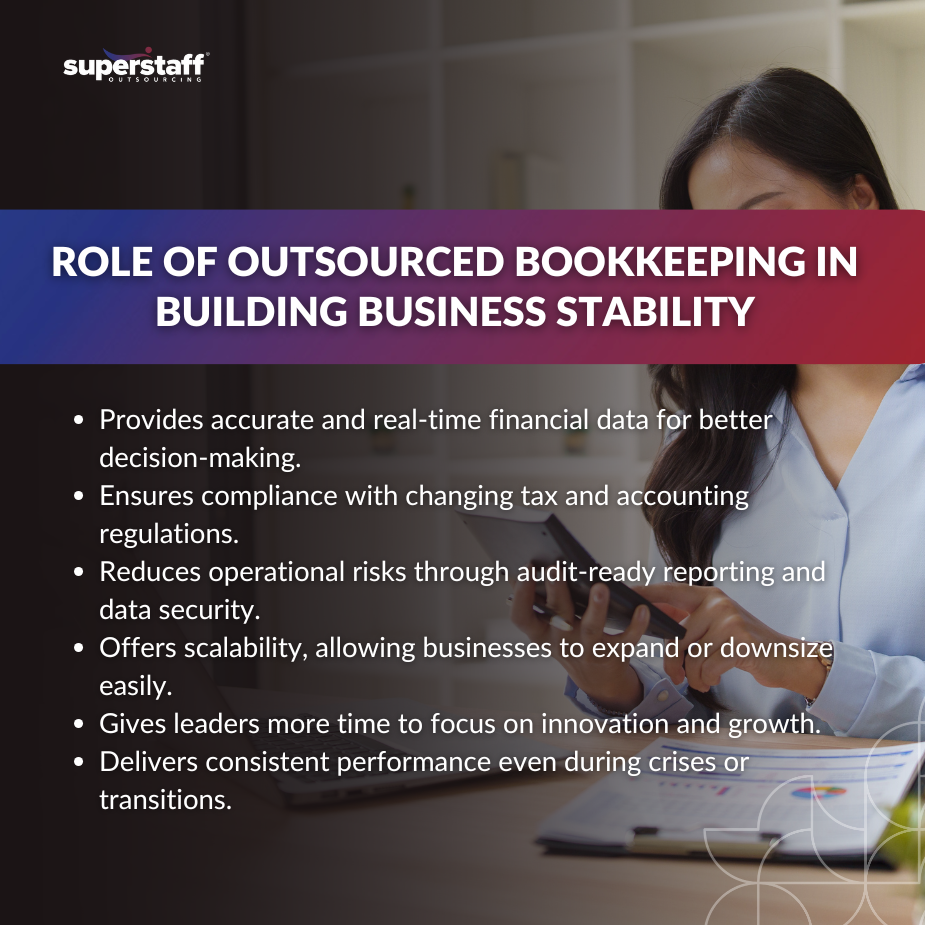

Modern bookkeeping plays a strategic role in shaping financial foresight. Real-time access to clean, organized financial data enables leaders to make proactive decisions—like identifying cash flow risks before they escalate or spotting growth opportunities early. These insights ensure not only compliance but also continuity. When markets shift, businesses with reliable bookkeeping support can adapt quickly, guided by solid numbers rather than guesswork.

Accurate financial records also enhance forecasting. By understanding spending patterns and profitability drivers, companies can predict outcomes with confidence. This data-driven approach transforms bookkeeping into an essential pillar of operational resilience.

With rising expectations, businesses are turning to specialized teams that deliver both precision and scalability. Through bookkeeping support services, companies gain more than just organized data—they gain financial clarity, risk control, and a foundation for sustainable growth.

The Philippines has emerged as a global hub for reliable, high-quality bookkeeping talent.

When businesses seek to outsource, the Philippines consistently tops the list—and for good reason. Its deep pool of financial professionals, fluent in English and trained under global accounting standards, has made the country a powerhouse in offshore bookkeeping services.

Filipino bookkeepers are educated in rigorous programs that align with GAAP and IFRS frameworks, ensuring they meet the same quality benchmarks as their Western counterparts. Many hold CPA credentials or international certifications like ACCA, allowing them to handle complex, multi-market bookkeeping with ease.

Beyond qualifications, outsourcing to the Philippines offers significant cost advantages. Companies can reduce overhead costs without compromising quality, gaining access to dedicated financial experts at a fraction of onshore rates. This cost efficiency is particularly valuable for SMEs and midmarket companies that need top-tier support but must remain budget-conscious.

Cultural compatibility also plays a crucial role. Filipino professionals are known for their attentiveness, respect, and proactive communication—traits that align seamlessly with Western business practices. These soft skills transform transactions into true partnerships.

Beyond credentials, Filipino bookkeepers bring a deep sense of ownership and service excellence that turns financial management into a source of competitive advantage.

Outsourced bookkeeping ensures compliance and reduces operational risk.

The global business environment is increasingly complex, and compliance has never been more demanding. Keeping up with changing tax laws, evolving accounting standards, and data protection regulations can overwhelm in-house teams. That’s why many organizations now rely on outsourced bookkeeping to ensure compliance and reduce exposure to risk.

Reputable outsourcing partners use automated reporting systems that make documentation audit-ready. Financial reports are produced with transparency and consistency, minimizing errors and ensuring accountability. With built-in checks and balances, outsourced teams identify discrepancies before they impact the bottom line.

Data security is another critical factor. Leading outsourcing providers in the Philippines implement strict protocols—encryption, access control, and regular audits—to protect sensitive financial information. These practices not only comply with international data protection laws but also safeguard business continuity.

By outsourcing, companies also gain agility. During peak seasons or financial reporting deadlines, external teams ensure accuracy under pressure—without the burnout or bottlenecks that often hit internal staff.

Risk management becomes even stronger when combined with scalability, allowing businesses to weather volatility without compromising compliance.

Scalability is the hidden advantage of outsourced bookkeeping.

Financial management needs are rarely static. Growth spurts, seasonal demands, or new market entries all require scalable systems. This is where offshore bookkeeping services stand out. They offer flexible support that expands—or contracts—based on business needs.

Through outsourcing, companies can scale operations effortlessly without hiring or retraining internal teams. During high-volume months, additional bookkeepers can be onboarded quickly. When activity slows down, businesses can scale back to core personnel without the burden of layoffs or underutilized staff.

Cloud-based tools make this flexibility seamless. Real-time collaboration platforms allow offshore teams to integrate into existing systems, ensuring consistent access to financial records across time zones. For SMEs, this flexibility is transformative; it allows them to scale like larger enterprises without incurring fixed overhead.

Scalability supports stability—but the true value lies in the partnership model that underpins these collaborations.

A people-first outsourcing culture turns financial processes into lasting partnerships.

One of the most overlooked strengths of outsourced bookkeeping in the Philippines is its human element. Filipino professionals don’t just manage numbers—they nurture relationships built on trust and collaboration.

The famous “Yes, po” culture captures the Filipino spirit of respect and service. It reflects a deep-seated willingness to listen, adapt, and deliver—qualities that foster long-term engagement and client satisfaction. Transparent communication and empathy turn transactional outsourcing arrangements into genuine partnerships.

In a field that demands precision, the Filipino approach adds warmth and accountability. Cultural empathy ensures smoother interactions, fewer misunderstandings, and a more cooperative working environment. These interpersonal skills translate into consistent, dependable service—a hallmark of Philippine-based outsourcing.

These human qualities make the Philippines more than just an outsourcing destination—it’s a stability partner that strengthens the global business ecosystem.

Business stability thrives on consistent financial visibility and control.

Outsourcing isn’t about relinquishing control—it’s about gaining better visibility. Through bookkeeping support services, businesses enjoy real-time access to dashboards, KPIs, and automated reports that improve oversight and decision-making.

These tools empower leaders to spot irregularities early, adjust budgets dynamically, and assess performance across departments. With every financial move tracked and analyzed, leaders can act with confidence instead of guesswork.

Proactive financial planning becomes second nature. Accurate data enables precise forecasting, better cash flow management, and faster recovery during downturns. In fact, many companies that once struggled with delayed reporting have regained stability and profitability after adopting outsourced bookkeeping models.

Case examples show how outsourcing to Philippine teams helps companies rebuild after financial disruptions, thanks to meticulous record-keeping, error-free reconciliations, and fast turnaround times.

With the right outsourcing partner, financial stability evolves into sustained growth momentum.

Outsourced bookkeeping frees leaders to focus on innovation, not reconciliation.

For CEOs, CFOs, and business owners, time is the most valuable currency. Delegating repetitive financial tasks through offshore bookkeeping services frees leaders to focus on strategy, product innovation, and customer engagement.

When professionals no longer have to spend hours reconciling statements or verifying entries, they can devote energy to driving new initiatives. Reduced managerial workload means less burnout and better strategic execution.

Bookkeeping outsourcing transforms finance from a reactive process into a proactive one. Instead of waiting for monthly reports, leaders gain continuous insights that inform real-time decisions. The result is a more agile organization—one that can pivot, plan, and innovate confidently.

Time saved on reconciliation is time gained for reinvention. This shift turns bookkeeping from a routine obligation into a catalyst for business transformation.

As the financial backbone strengthens, opportunities for innovation naturally expand.

Partnering with a trusted BPO in the Philippines transforms bookkeeping into a business continuity asset.

A strong financial system is essential to business continuity, and outsourcing amplifies that strength. When companies partner with experienced providers in the Philippines, outsourced bookkeeping becomes a resilience strategy.

These partnerships combine technical expertise with reliability and adaptability. Whether during global crises, system upgrades, or organizational restructuring, Philippine-based teams deliver consistent performance. Their ability to integrate with client workflows and technology ecosystems ensures minimal disruption even in unpredictable conditions.

Integrated offshore teams act as an extension of internal departments, aligned with client goals and compliance standards. The outcome? Predictable and sustainable financial performance that anchors the business during uncertainty.

In an era where resilience defines success, outsourcing financial functions isn’t a shortcut; it’s a strategic safeguard.

Stability becomes measurable when companies see it reflected in improved forecasting, stronger liquidity, and higher investor confidence.

Turn to SuperStaff for Outsourced Bookkeeping Solutions

Outsourced bookkeeping in the Philippines isn’t just about balancing the books—it’s about building enduring stability. By combining technical excellence, cultural alignment, and scalability, Filipino bookkeeping professionals redefine what it means to be a financial partner.

Through a blend of precision, compliance, and human connection, Philippine outsourcing firms help businesses withstand volatility and grow sustainably. Leaders gain control, confidence, and clarity—all at a fraction of the cost of traditional models.

Partner with SuperStaff and discover how our dedicated Filipino bookkeeping professionals transform financial accuracy into operational strength. Together, we’ll move beyond the numbers—and build a foundation for long-term business success.