In the insurance industry, one of the greatest challenges is balancing efficiency and empathy. Behind every claim lies a story—someone seeking help during an unexpected, often stressful life event. Whether it’s a damaged home, a car accident, or a medical emergency, policyholders expect not only resolution but also reassurance.

This is where insurance call center outsourcing plays a transformative role. When done right, outsourcing allows insurers to handle growing workloads while maintaining the human connection customers deserve. Among the most effective approaches today is nearshore insurance BPO solutions for claims support, where regional proximity and cultural alignment ensure responsiveness and genuine care.

This blog explores how nearshore insurance call centers deliver compassionate, human-centered service while maintaining operational accuracy and speed.

The Emotional Core of Every Claim

The insurance claims process isn’t just about numbers or forms; it’s about people. Policyholders often reach out to insurers in moments of distress or uncertainty, expecting empathy as much as efficiency.

That’s why the best insurance call center outsourcing solutions focus on more than technical accuracy. They emphasize active listening, reassurance, and transparent communication.

When an agent listens attentively and validates a customer’s concern, it eases tension and builds trust. Conversely, a lack of empathy, such as rigidly scripted responses or long response delays, can lead to dissatisfaction and lost loyalty.

- Empathy drives retention. Customers who feel understood are more likely to renew their policies and recommend the insurer to others.

- Tone matters. Even in regulated, process-driven industries like insurance, the way a message is delivered shapes perception.

To meet this dual need for empathy and precision, insurers are increasingly partnering with a nearshore call center for insurance that can handle both the procedural and emotional sides of claims management.

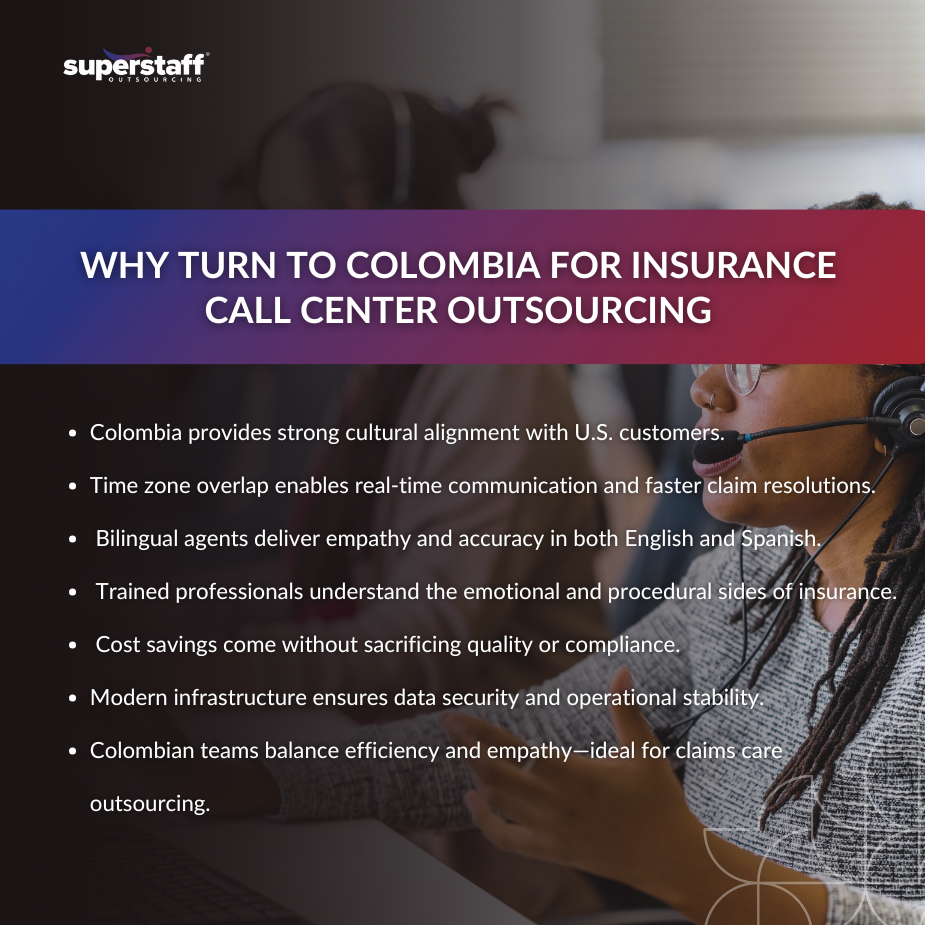

Cultural Alignment Strengthens Customer Empathy

Empathy thrives when cultural and linguistic nuances are understood. One of the biggest advantages of insurance call center outsourcing to nearshore regions, especially in Latin America, is the ability to connect naturally with U.S. policyholders.

Nearshore teams share overlapping time zones, cultural references, and communication styles. This proximity allows for real-time collaboration between client headquarters and outsourced teams, ensuring consistency in tone and service delivery.

For instance, Colombian agents can relate closely to North American customer expectations. They use familiar conversational cues, adapt their tone based on emotional context, and provide comfort while maintaining professionalism.

- Shared values: Family, integrity, and courtesy resonate deeply in both regions.

- Communication ease: Accent neutrality and bilingual fluency eliminate language barriers.

- Cultural empathy: Agents understand when to offer reassurance versus when to provide concise, factual updates.

Beyond empathy, this alignment also strengthens efficiency. Working in similar time zones means claims can be handled in real time, ensuring policyholders receive timely updates and resolutions.

Responsiveness and Efficiency at the Core of Nearshore Operations

Responsiveness defines modern insurance service excellence. In a field where timing impacts both customer satisfaction and regulatory compliance, insurance call center outsourcing to nearshore partners offers a strategic edge.

Because nearshore teams operate in overlapping hours with U.S. companies, response times are significantly improved. Customers receive immediate follow-ups, and internal teams can collaborate on active claims without lag.

Infrastructure also plays a vital role. Nearshore insurance BPO solutions for claims support leverage secure, cloud-based systems to streamline information flow while maintaining compliance with U.S. data protection standards.

Key operational advantages include:

- Reduced claim resolution times through live coordination and quick data access.

- Seamless collaboration with in-house insurance teams using shared platforms.

- Bilingual professionals who manage both English and Spanish-speaking customers confidently.

This synergy between empathy and speed is what differentiates nearshore models from distant offshore solutions. However, while efficiency is vital, effective claims management must always preserve the human element.

Training for Both Technical and Emotional Intelligence

Behind every successful insurance claims call is a well-trained agent. Nearshore teams stand out because of their comprehensive training programs that blend technical precision with emotional intelligence.

Leading insurance BPO services invest in role-playing exercises that simulate high-stress customer interactions. Agents learn how to de-escalate frustration, express empathy, and maintain professionalism—all while ensuring claims are processed accurately.

Additionally, agents receive ongoing coaching in:

- Regulatory compliance and policy interpretation under U.S. standards.

- Insurance software systems such as Guidewire or Duck Creek.

- Empathy-driven communication that strengthens trust during claim resolutions.

This approach builds not just skilled employees but emotionally aware professionals who understand the weight of each conversation.

Continuous learning programs ensure agents stay updated on policy changes, compliance guidelines, and evolving customer expectations. As a result, nearshore teams deliver measurable quality improvements—shorter resolution times, higher satisfaction scores, and stronger retention rates.

This commitment to empathy-driven excellence is what sets nearshore teams apart from traditional offshore options.

The Measurable Impact of Nearshore Insurance Outsourcing

The benefits of insurance call center outsourcing go beyond operational convenience—they translate into tangible, measurable outcomes.

Insurers that partner with the best insurance call center outsourcing companies consistently report improvements in customer metrics such as:

- Higher First Contact Resolution (FCR): Fewer follow-ups mean faster peace of mind for policyholders.

- Stronger Customer Satisfaction (CSAT): Agents trained in empathy deliver experiences that exceed expectations.

- Increased retention rates: Satisfied policyholders renew more often, reducing churn and acquisition costs.

Moreover, nearshore insurance partners help lower costs without compromising quality. Because labor and infrastructure expenses are more competitive in regions like Colombia, insurers gain significant savings while still benefiting from highly educated, bilingual professionals.

Consider the case of a midmarket U.S. insurer that shifted its claims support to a nearshore call center for insurance providers. Within six months, the company reduced claim backlogs and improved CSAT scores. The reason wasn’t just faster turnaround—it was the empathetic tone that agents brought to every call.

These outcomes prove a powerful truth: technology and training can support efficiency, but human care defines loyalty.

SuperStaff’s Human Approach to Claims Support

At SuperStaff, we believe every claim is more than a transaction—it’s a chance to rebuild trust. Our insurance call center outsourcing model integrates compassion, compliance, and communication excellence to deliver true care in every interaction.

Our nearshore teams in Colombia undergo extensive insurance-specific training that includes:

- Tailored modules on claims lifecycle management, underwriting, and policy servicing.

- Scenario-based role-plays that teach empathy under stress.

- System integration training to align seamlessly with clients’ existing tools.

SuperStaff’s bilingual teams provide a natural extension of your brand. Through consistent quality monitoring, customer sentiment tracking, and cultural calibration, we ensure that every policyholder feels valued.

Our nearshore insurance BPO solutions for claims support go beyond basic call handling. We integrate omnichannel platforms—voice, chat, and email—to provide customers with convenience and consistency. Whether it’s guiding a customer through a claim form or updating them on progress, our agents handle every step with professionalism and heart.

With a track record of supporting major insurers, SuperStaff has become a trusted partner in delivering care-driven outcomes that improve claim satisfaction, retention, and brand reputation.

Connect With SuperStaff Colombia for Reliable Insurance Call Center Outsourcing

Insurance call center outsourcing is no longer just about cutting costs; it’s about delivering human-centered care at scale. Nearshore models prove that when cultural alignment, empathy, and efficiency come together, insurers can meet rising customer expectations without sacrificing operational precision.

By blending technical expertise with compassion, a nearshore call center for insurance providers redefines what customer experience in claims management should be: swift, compliant, and genuinely caring.

SuperStaff embodies this balance. Our teams treat every interaction as an opportunity to make policyholders feel heard, supported, and respected.

Partner with SuperStaff to deliver claims with care, combining human understanding and operational excellence that strengthens trust, loyalty, and long-term success in every claim you manage.