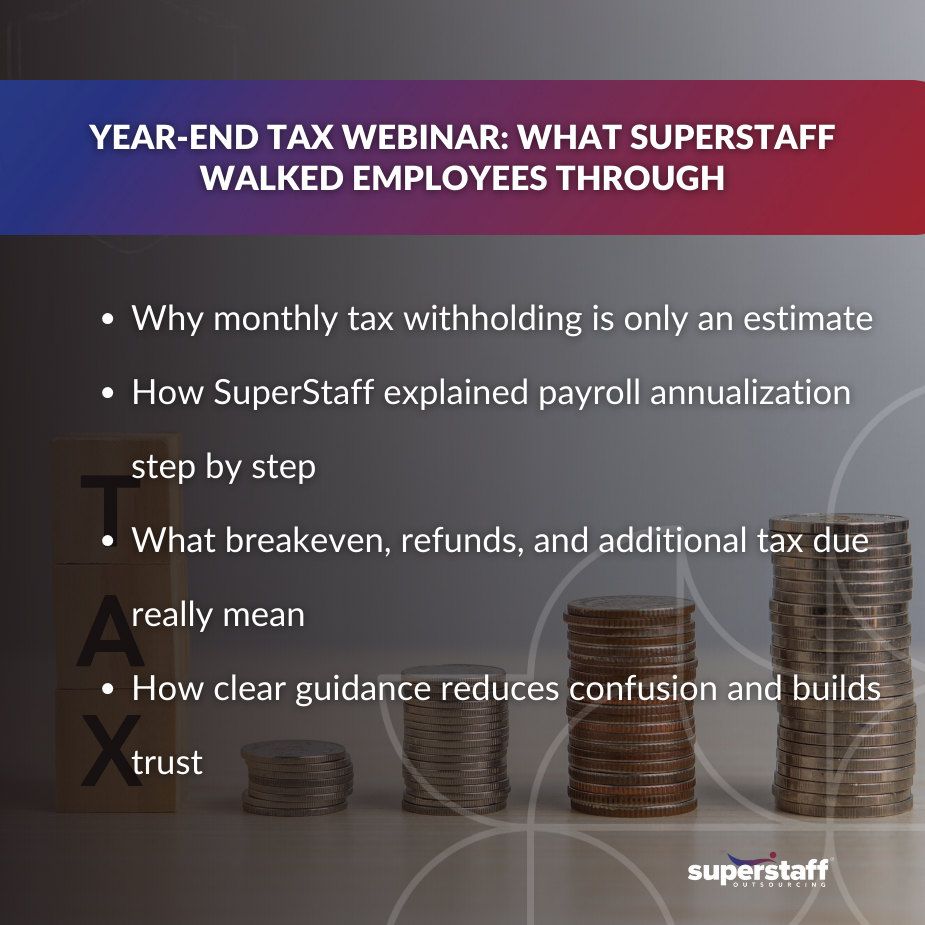

Year-end payroll often triggers questions, confusion, and concern across global teams. SuperStaff recently hosted a year-end tax webinar to explain why December deductions look different and how payroll annualization works in practice.

For Filipino employees, the session focused on clarity and predictability. For U.S. business leaders, it reinforced why structured payroll processes matter for compliance and trust.

This article breaks down the key takeaways from the year-end tax webinar, translating technical rules into practical insight for decision-makers managing Philippine-based teams.

Why Year-End Payroll Feels Different

The year-end tax webinar opened by addressing a common concern. December payroll rarely matches January through November.

Payroll systems calculate withholding tax using estimates. These estimates assume consistent income across the year. Real income patterns rarely behave that way.

Key reasons December changes occur include:

- Promotions, bonuses, or commissions during the year

- Employees starting or leaving midyear

- Periods without pay such as maternity leave

The year-end tax webinar emphasized that this difference is not an error. It is a correction process built into Philippine payroll rules.

What Payroll Annualization Actually Does

Payroll annualization is the foundation of the year-end tax webinar discussion. It recalculates tax based on actual annual earnings rather than assumptions.

At year-end, payroll teams:

- Add all taxable income from January to December

- Deduct non-taxable income and mandatory government contributions

- Apply the annual tax table to compute the exact tax due

This process ensures alignment with Philippines payroll and tax requirements. It also protects employees from underpayment penalties later.

Semi-Monthly Estimates Versus Annual Reality

Throughout the year, withholding tax is deducted using semi-monthly tables. The year-end tax webinar showed how this creates a gap.

Monthly deductions rely on:

- Compensation range per pay period

- Prescribed withholding percentages

- An assumption of full-year employment

Annual reality reflects:

- Actual months worked

- Actual bonuses or income changes

- Final taxable income for the year

Annualization closes that gap. The year-end tax webinar made it clear that this reconciliation is required, not optional.

The Three Possible Year-End Outcomes

One of the most practical sections of the year-end tax webinar focused on outcomes. Every employee ends the year in one of three positions.

Possible results include:

- Breakeven where tax withheld equals tax due

- Withholding tax refund

- Additional withholding tax due

Each outcome is driven by income timing rather than payroll mistakes. The year-end tax webinar used real payroll logic to explain why.

When Employees Reach Breakeven

Breakeven occurs when income remains consistent throughout the year. The year-end tax webinar showed this scenario using stable monthly earnings.

Common traits include:

- No promotions or salary adjustments

- No one-time taxable bonuses

- Full-year employment

In this case, monthly estimates closely match annual reality. No refund applies. No additional deduction is required.

Why Withholding Tax Refunds Happen

Refunds often surprise employees. The year-end tax webinar explained why they occur.

Refunds usually result from:

- One-time taxable bonuses that triggered higher withholding

- Promotions that increased tax rates midyear

- Shorter work years due to leave or resignation

In these cases, monthly deductions exceed the final annual tax. Payroll returns the excess during annualization. This aligns with year-end tax filing best practices and employee protection rules.

When Additional Withholding Tax Is Due

Additional tax due is less popular but equally important. The year-end tax webinar addressed this carefully.

This outcome often happens when:

- An employee changes employers within the year

- Income from multiple sources pushes the employee into a higher bracket

- Prior income was not fully captured earlier

Annualization consolidates all taxable income. If total tax due exceeds what was withheld, the difference appears in December payroll. The year-end tax webinar stressed that this prevents penalties later.

Scenario-Based Examples From the Webinar

The year-end tax webinar used real scenarios to make the rules easier to follow. These examples reflected actual payroll behavior without hypothetical numbers.

Scenarios discussed included:

- Employees receiving a one-time taxable bonus

- Promotions with midyear salary increases

- Maternity leave resulting in partial-year income

- Resignations with final pay computation

- New hires joining midyear with prior employment

Each scenario followed the same annualization formula. Outcomes differed based on income timing, not system inconsistency. This approach supports explaining year-end tax requirements for Filipino employees in a practical way.

Why This Matters to U.S. Business Leaders

For U.S. companies with Philippine teams, payroll clarity goes beyond accuracy. The year-end tax webinar highlighted a broader business impact.

Clear payroll processes help:

- Reduce employee confusion and disputes

- Build trust in offshore operations

- Protect employer reputation and compliance standing

When employees understand why deductions change, confidence improves. That stability matters for retention and performance.

The Strategic Value of Payroll Expertise

The year-end tax webinar also reinforced why payroll should not be treated as a simple back-office task.

Experienced payroll teams:

- Apply tax tables consistently

- Handle complex scenarios correctly

- Ensure proper issuance of tax forms

- Support smooth transitions between employers

For growing SMEs and midmarket firms, outsourcing payroll and employee support functions creates operational discipline. This is especially important when navigating Philippines payroll and tax requirements at scale.

Making Sense of Year-End Tax Adjustments

The year-end tax webinar made one point clear. December payroll adjustments are not surprises. They are the result of structured annualization designed to ensure accuracy, compliance, and fairness.

By understanding how estimates differ from annual reality, businesses gain control over payroll outcomes. Filipino employees gain clarity. U.S. leaders gain confidence in their offshore operations.

SuperStaff supports organizations by combining payroll expertise with transparent employee education. If your company is scaling teams in the Philippines and wants predictable, compliant payroll outcomes, explore how SuperStaff can support your operations with clarity and trust.