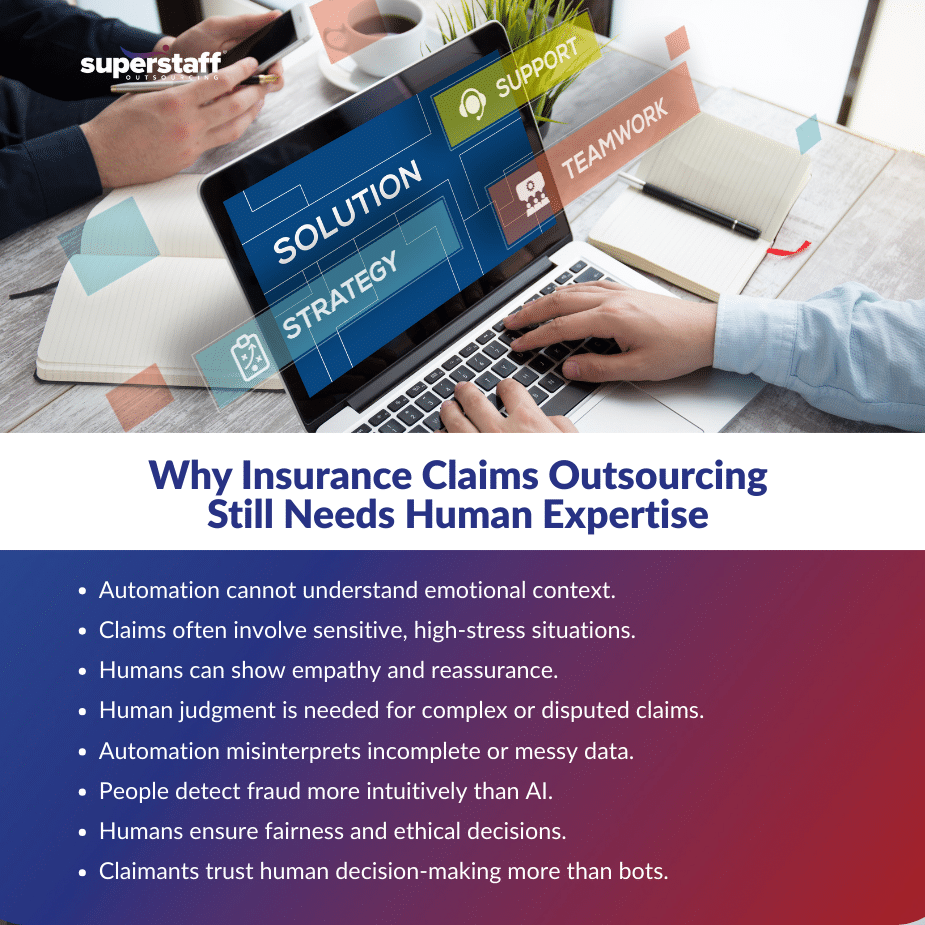

Automation has reshaped the insurance sector—from AI-powered fraud detection to workflow automation that accelerates documentation review. But even as technology advances, one truth remains: insurance claims outsourcing still depends heavily on human judgment. When people experience loss, injury, property damage, or financial uncertainty, they want speed. But they also want empathy, accuracy, transparency, and fairness. Technology alone cannot deliver this.

That is why modern insurers are leaning into a hybrid model. Automation handles the predictable tasks. Skilled claims professionals handle the exceptions, the judgment calls, and the emotional moments that define the customer experience. This blend is the future of insurance claims outsourcing, and it is how insurers stay competitive in a world where policyholders demand both convenience and connection.

Below is a deeper look at why automation isn’t enough—and why human experts remain indispensable in outsourced claims teams.

Automation Helps—but It Cannot Replace Human Context

There is no question that automation enhances the workflow within claims processing outsourcing arrangements. OCR tools extract information from documents. AI can classify claims based on severity. Chatbots can answer basic inquiries instantly.

But claims aren’t just data. They are stories.

A customer might file a claim after a medical emergency or a life-saving surgery. Automated systems can recognize keywords, but they cannot interpret nuance. They cannot detect when a claimant is distressed. They cannot adapt when a case falls into a gray area. They cannot navigate conflicting information with compassion.

This is where human expertise in insurance claims processing becomes the differentiator. Claims specialists know how to read between the lines. They ask clarifying questions. They investigate inconsistencies with sensitivity. They pick up on emotional cues that indicate whether a client needs reassurance, escalation, or additional support.

Automation provides efficiency. Humans provide understanding. Insurers need both.

Why Policyholders Still Trust Human Decision-Makers

Insurance is built on trust. When someone files a claim, they are experiencing a disruption—sometimes a painful or life-changing one. How they are treated during the claims process determines whether they stay with the insurer or move on.

Studies consistently show that policyholders prefer human interaction for high-stakes or emotionally sensitive tasks. With insurance claims outsourcing, insurers can access trained claims specialists who excel in communication, empathy, and accurate decision-making.

Humans can:

- Explain coverage in simple, conversational language.

- Calm angry or anxious callers.

- Detect fraud more intuitively than rule-based systems.

- Negotiate resolutions that make sense for both the insurer and the policyholder.

- Build relationships over time.

Automation accelerates the process, but people build trust. And trust is the foundation of retention in insurance.

Complex Claims Require Human Judgment

AI is excellent at handling structured data. But insurance is full of exceptions.

No algorithm can perfectly evaluate:

- Disputes over liability

- Situations with incomplete or conflicting documentation

- Medical claims requiring interpretation

- High-risk cases that require manual investigation

- Claims involving emotional or psychological trauma

These situations demand a nuanced approach that automation cannot replicate.

Insurance claims outsourcing gives carriers access to specialists trained in:

- Critical thinking

- Interpreting policy language

- Contextual decision-making

- Coordinating with adjusters, medical experts, and legal teams

- Identifying red flags while still treating clients with empathy

Technology supports the process, but human expertise drives accuracy and fairness.

Automation Can Introduce Risk Without Human Oversight

Many insurers learned this the hard way: fully automated claims workflows can lead to errors that damage both customer trust and regulatory compliance.

Automation may:

- Misclassify claims

- Misinterpret handwritten documents

- Deny claims prematurely

- Flag legitimate claims as fraud

- Miss key contextual details that change the outcome of a case

This is why even the most advanced insurance outsourcing solutions still rely on trained professionals to validate data, audit results, and apply real-world reasoning to the decision-making process.

Human oversight safeguards:

- Compliance

- Fairness

- Quality

- Customer satisfaction

- Brand reputation

Automation is powerful, but unsupervised automation is dangerous.

The Emotional Intelligence That Automation Can’t Deliver

Insurance is more than paperwork. It is emotional.

A claimant who just experienced an accident or loss does not want to “speak” to a chatbot. They want to feel heard. They want reassurance. They want to know that the person on the other end cares about resolving the issue.

Human claims specialists offer:

- Empathy

- Patience

- Active listening

- Personalized guidance

- Conflict management

These soft skills are part of the benefits of outsourcing insurance claims to humans. They shape the customer experience and influence how claimants talk about the brand—online and offline.

Automation cannot comfort a policyholder who is shaken by a traumatic event. But a trained claims professional can.

Why Outsourced Teams Are Best Positioned for a Hybrid Model

Modern insurers are turning to insurance claims outsourcing providers not just to reduce costs, but to build scalable, flexible teams that combine automation with human intelligence.

Outsourced specialists can manage:

- First Notice of Loss (FNOL)

- Policy coverage verification

- Investigation and documentation

- Communication with claimants

- Fraud checks

- Escalations and resolutions

- Data entry and workflow updates

- Coordination with adjusters

Meanwhile, automation handles repetitive tasks such as:

- Document extraction

- Data classification

- Template messaging

- Status updates

- Initial triage

This hybrid model improves both speed and quality. It keeps operational costs predictable. It supports 24/7 coverage. Most importantly, it aligns with what policyholders actually want.

How Humans Strengthen Automated Claims Processing

Automation can identify patterns. Humans understand intentions. Together, they form a claims ecosystem that is accurate, fast, and emotionally aware. Humans in outsourced claims teams offer:

1. Empathy-Driven Customer Experiences

They can navigate stressful conversations and provide the reassurance that customers need.

2. Contextual Accuracy

They can interpret information that AI cannot—especially when data is messy or incomplete.

3. Ethical Decision-Making

Humans ensure fairness and reduce the likelihood of wrongful denials or misclassifications.

4. Real-Time Problem Solving

When something unexpected happens, humans can adapt, investigate, and resolve.

5. Quality Control and Compliance

They audit automated outputs and ensure regulatory accuracy.

Outsourcing allows insurers to scale these advantages without inflating internal workforce costs.

Automation Is a Tool. Humans Are the Strategy.

Automation accelerates claims handling. It reduces clerical workload. It improves efficiency. But humans remain the core of the process.

Insurance claims outsourcing provides insurers with a workforce trained in empathy, communication, investigation, fraud detection, and conflict resolution. These are skills that automation cannot replicate—not now and not in the foreseeable future.

When insurers combine automation with human intelligence, they get:

- Faster claims turnaround

- Higher accuracy

- More satisfied policyholders

- Reduced operational risk

- Stronger trust and loyalty

- Seamless scaling for peak seasons

This is why the most successful insurance carriers are not replacing humans—they are empowering them with better tools.

Insurance Claims Outsourcing: The Future Is Hybrid and Human-Centric

Automation has changed the insurance landscape, but it has not eliminated the need for skilled claims professionals. If anything, it has made them more important. As insurers adopt more technology, the value of human judgment, empathy, and communication becomes even more critical.

Insurance claims outsourcing provides the perfect balance: automation for speed and consistency, and human expertise for accuracy, fairness, and emotional intelligence.

In a world where customers expect both efficiency and compassion, the insurers that combine both will lead the industry. Automation gives you speed. Humans give you trust. And outsourcing gives you both—at scale.

If you’re looking for comprehensive insurance claims outsourcing solutions, turn to the BPO professionals at SuperStaff. Let us be your reliable partner as you navigate your most pressing industry challenges.

Contact us today!