Healthcare providers operate in an environment where margins are tight, administrative complexity is rising, and patient expectations continue to evolve. While clinical excellence remains the priority, operational accuracy increasingly determines financial stability. Few processes illustrate this reality more clearly than eligibility verification.

Medical insurance eligibility verification sits at the front of the revenue cycle, yet its impact extends far beyond billing. When performed correctly, it protects cash flow, reduces friction for patients, and strengthens operational confidence across the organization. When handled inconsistently, it creates downstream issues that are expensive and difficult to resolve.

As a result, many U.S. healthcare providers are choosing to outsource this function to specialized offshore teams. The decision is less about cost reduction and more about operational discipline, scalability, and risk management. Below are seven reasons why this shift continues to gain momentum.

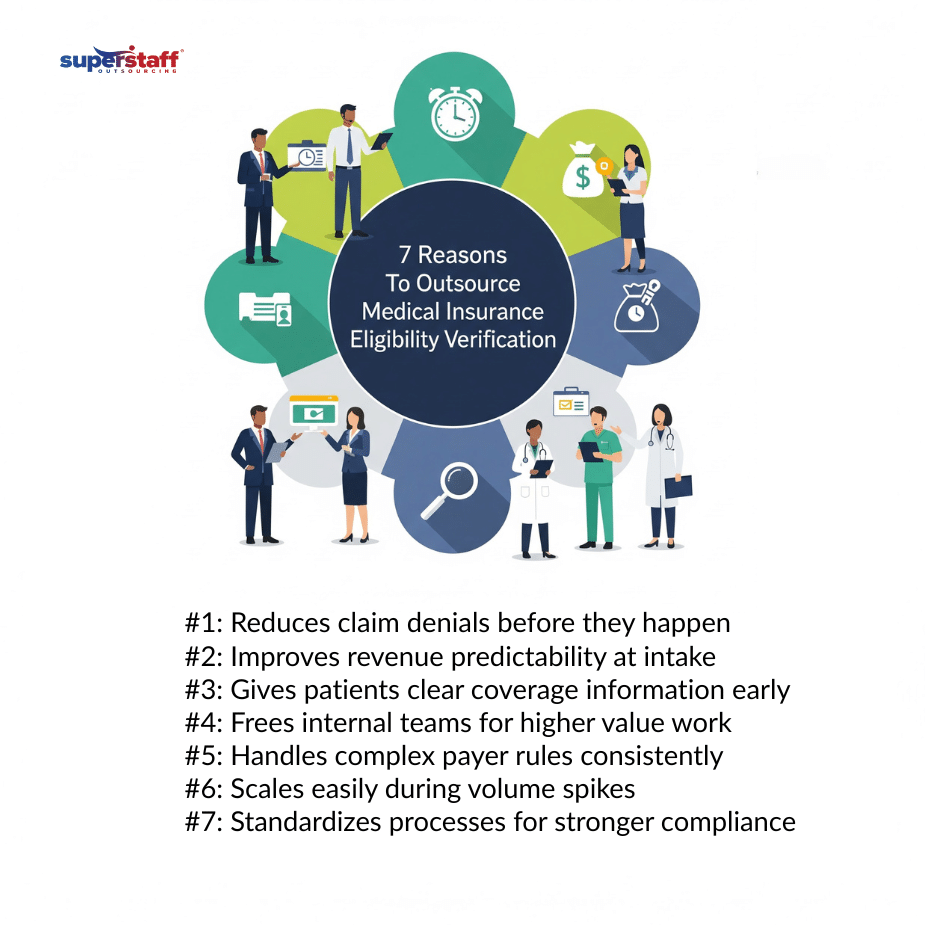

Reason 1: Eligibility Accuracy Protects Revenue Before Care Begins

Revenue leakage often starts long before claims reach the payer. Inaccurate coverage checks lead to denials, delayed reimbursements, and additional follow-up work that strains billing teams. These issues rarely stem from clinical errors. Instead, they originate at intake.

Outsourced teams see medical insurance eligibility verification services as a dedicated responsibility. This specialization ensures coverage is confirmed before services are rendered. When eligibility is validated early, providers enter the billing process with greater certainty and fewer avoidable obstacles.

Over time, this proactive approach stabilizes revenue cycles and reduces the administrative burden associated with claim rework.

Reason 2: Patient Experience Improves Through Financial Clarity

Patients want transparency. They expect to understand coverage details, copay responsibilities, and authorization requirements before their visit. When answers are unclear, trust erodes quickly.

Outsourcing medical insurance eligibility verification allows providers to deliver consistent, accurate information at the first point of contact. Dedicated teams follow structured workflows that ensure key coverage details are communicated clearly and documented properly.

As a result, patients arrive better prepared. Conversations shift from confusion to confidence, improving satisfaction without adding pressure to front desk staff.

Reason 3: Internal Teams Stay Focused on Higher Value Tasks

Front office and billing teams already manage scheduling, documentation, patient communication, and collections. Adding eligibility checks into this mix increases cognitive load and raises the likelihood of errors, especially during peak periods.

By outsourcing medical insurance eligibility verification, providers free internal teams to focus on tasks that require institutional knowledge and patient interaction. Productivity improves because responsibilities are clearly separated rather than layered onto overstretched staff.

This clarity also supports retention by reducing burnout among administrative employees.

Reason 4: Payer Complexity Is Managed More Consistently

Payer requirements vary widely. Coverage rules differ by plan type, employer group, and state. Changes occur frequently, often without clear notice. Keeping internal teams fully updated across multiple payers is a persistent challenge.

Specialized offshore teams manage medical insurance eligibility verification as a core function. Their workflows are designed to track payer-specific requirements and apply them consistently across patient accounts.

This consistency reduces variance in eligibility outcomes and strengthens provider confidence in front-end data accuracy.

Reason 5: Operational Flexibility Increases Without Staffing Risk

Healthcare demand is not static. Seasonal patterns, enrollment cycles, and staffing gaps all affect patient volume. Internal teams struggle to absorb these fluctuations without overtime or temporary hires.

Outsourcing medical insurance eligibility verification provides built-in scalability. Offshore teams can adjust capacity based on demand while maintaining service levels. Providers gain flexibility without compromising accuracy or overextending internal staff.

This adaptability is especially valuable for growing practices and multi-location organizations.

Reason 6: Standardization Strengthens Compliance and Oversight

Eligibility workflows often evolve informally over time. Different staff members follow different processes, resulting in inconsistent documentation and limited audit visibility. This fragmentation increases compliance risk.

Outsourced insurance verification healthcare teams operate under standardized protocols. When performing medical insurance eligibility verification, every check follows defined steps, and outcomes are documented consistently.

This structure improves reporting, supports internal audits, and provides leadership with clearer insight into operational performance.

Reason 7: Cost Predictability Supports Strategic Planning

Eligibility verification is essential but operational. It does not differentiate care delivery, yet mistakes carry financial consequences. Providers must balance cost control with accuracy.

Outsourcing medical insurance eligibility verification allows organizations to manage this balance more effectively. Costs become predictable, staffing models stabilize, and leadership gains greater control over administrative spend.

The result is an operating model aligned with long-term planning rather than short-term fixes.

Why Offshore Teams Perform Well in Eligibility Work

Eligibility verification rewards focus and repetition. The work requires attention to detail, familiarity with payer systems, and consistent execution. Offshore teams are structured to deliver exactly that.

By concentrating solely on medical insurance eligibility verification, offshore staff develop deeper process expertise over time. Performance improves as workflows mature and feedback loops tighten.

This specialization is difficult to achieve internally without dedicating significant resources.

Why the Philippines Is a Strategic Location

The Philippines has become a trusted hub for healthcare support services. Strong English proficiency enables clear communication with U.S. payers and patients. Cultural alignment supports professionalism and service consistency.

Teams in the Philippines handling medical insurance eligibility verification operate during U.S. business hours. This alignment enables real-time verification, faster escalations, and smoother coordination with onshore teams.

For providers seeking reliability without geographic distance, this model offers a practical advantage.

What Healthcare Leaders Should Consider Before Outsourcing

Successful outsourcing depends on governance. To reap the benefits of outsourcing medical insurance eligibility verification, providers must first evaluate partners based on operational maturity rather than pricing alone. Key considerations include process discipline, data security practices, and escalation management.

Additionally, clear service definitions ensure medical insurance eligibility verification remains accurate and accountable. Strong partnerships feel like extensions of internal operations rather than external vendors.

This alignment is essential for long-term success.

Realistic Operational Scenarios

A specialty practice experiences rising denial rates tied to incomplete eligibility checks. Internal staff are overwhelmed during high-volume scheduling periods. Outsourcing restores accuracy without expanding payroll.

A multi-site provider struggles with inconsistent eligibility documentation across locations. Standardized offshore workflows improve visibility and reduce audit exposure.

These scenarios reflect everyday challenges healthcare leaders face as administrative complexity grows.

Eligibility Verification as an Operating Discipline

Eligibility verification is not a transactional task. It is an operational discipline that affects revenue, compliance, and patient confidence. When managed deliberately, it strengthens the entire revenue cycle.

Medical insurance eligibility verification deserves the same strategic attention as billing and collections. Outsourcing enables that focus without diverting internal resources from patient care.

Turn to SuperStaff for Reliable Medical Insurance Eligibility Verification

Healthcare providers can no longer afford uncertainty at the front of the revenue cycle. Medical insurance eligibility verification must be accurate, timely, and consistently executed to protect both revenue and patient trust.

SuperStaff supports U.S. healthcare organizations with dedicated offshore teams in the Philippines that specialize in eligibility verification workflows. Our approach emphasizes process discipline, accountability, and seamless integration with provider operations.

Explore how SuperStaff can help you build a more resilient eligibility verification model and allow your teams to focus on delivering better care outcomes.