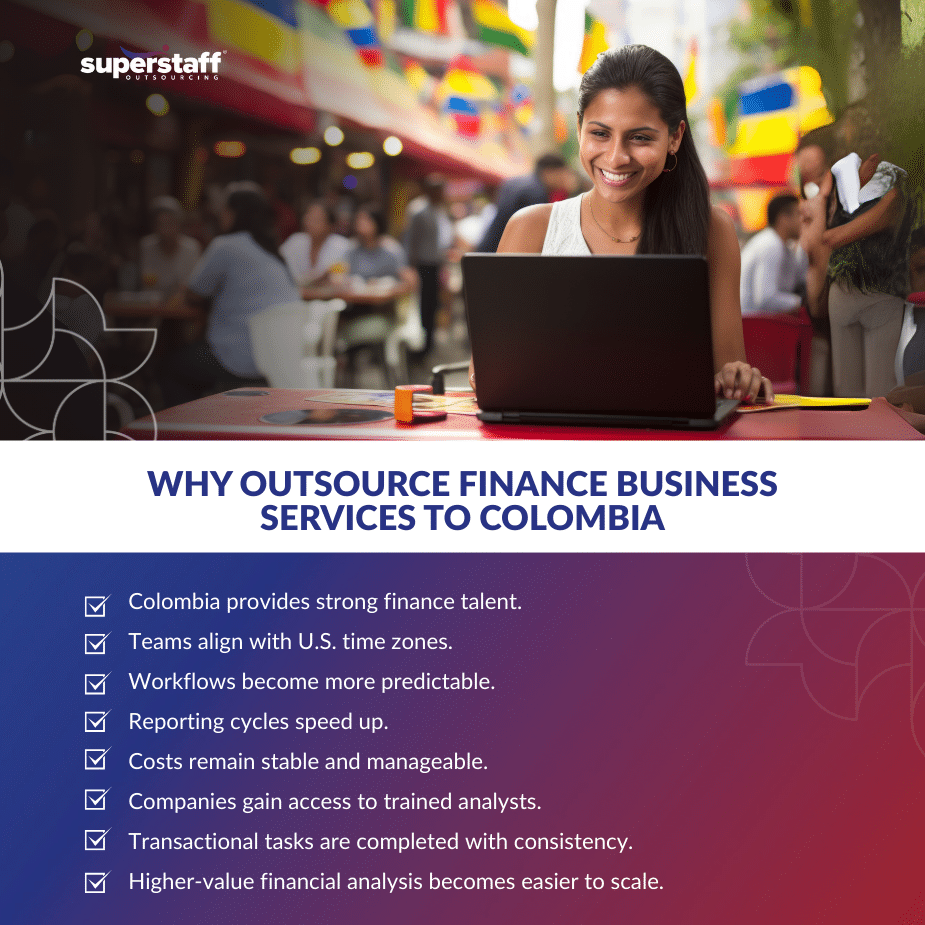

Chief financial officers are navigating a period marked by rising operating costs, rapid technology shifts, and increasing pressure to deliver accurate insights faster. Many leaders are responding by expanding their operating models across borders. As a result, nearshoring to Colombia has moved from optional to strategic, especially for organizations aiming to modernize finance business services while preserving quality and control.

Colombia offers a strong mix of talent, time zone alignment, and operational agility. These strengths allow CFOs to build resilient structures that support growth, transformation, and risk reduction. The right nearshore model does more than extend capacity. It creates predictable, well-governed workflows that strengthen decision-making across the entire finance organization.

Why CFOs Are Turning to Nearshore Teams in Colombia

Colombian finance teams bring practical strengths that help streamline core processes. Leaders relying on tight reporting cycles, compliance-heavy workflows, and integrated planning functions see clear advantages when they add nearshore support.

Here are the most common priorities among CFOs building global finance business services:

- Greater cost stability

- Access to trained analysts and specialists

- Faster turnaround for recurring tasks

- Improved support during peak reporting periods

These elements allow companies to maintain performance even as business demands shift. The nearshore model also supports faster operational scaling without the burden of hiring delays or rising labor costs.

How Colombian Teams Strengthen Day-to-Day Finance Operations

A nearshore team is most effective when aligned with existing systems and internal teams. This creates a unified structure that supports all functions inside finance business services. CFOs often begin by assigning recurring, rules-based work to their Colombian teams. Over time, the scope expands to include higher-value analysis and workflow ownership.

Key areas where Colombian teams add immediate impact include:

- Accounts payable processing

- Accounts receivable follow-up

- Reconciliations and variance checks

- Procurement support

- Expense management control

These functions benefit from disciplined workflow execution. With clear handoffs and predictable turnaround times, organizations avoid backlogs that often slow financial reporting. This steady rhythm also helps leadership anticipate issues earlier and redirect resources before small delays grow into costly setbacks.

Creating a Governance Structure That Protects Quality

CFOs who succeed with nearshore models invest in governance early. Strong oversight enables nearshore teams to support finance business services without gaps or disruptions. A well-designed structure clarifies ownership, accountability measures, and escalation paths.

Effective governance also includes a defined communication rhythm. Daily check-ins, weekly workflow reviews, and monthly performance assessments allow both onshore and nearshore teams to adjust quickly. These practices create a stable environment built on transparency and trust.

Colombian teams adapt well to structured environments. Their strength in documentation, compliance, and process discipline supports organizations that require consistent adherence to internal controls and audit standards.

Leveraging Nearshore Teams for Higher-Value Finance Work

Finance leaders are shifting nearshore operations beyond transactional work. As Colombian teams gain familiarity with systems, they can transition into more analytical roles within finance business services.

Examples include:

- Budget preparation support

- Forecasting and scenario tracking

- Spend analysis

- Vendor performance review

- Cash flow pattern analysis

These responsibilities require a mix of technical skills and business awareness. Colombian analysts often bring strong English proficiency and experience with financial tools, which allows them to support cross-functional teams.

This progression helps CFOs redeploy onshore analysts to strategic projects. As the organization grows more comfortable with the nearshore structure, it becomes easier to balance cost efficiency with higher-value problem solving.

Managing Risk Across a Distributed Finance Function

Expanding finance business services across geographies does introduce risk, but CFOs can mitigate it with strong design. The goal is to create replicable processes that operate consistently regardless of location.

Common risk controls include:

- Segregation of duties

- Access management based on role

- Documentation aligned with audit standards

- Redundant coverage during peak periods

Colombian teams work well within these frameworks because they are trained in global compliance standards. This reduces the burden on onshore teams and ensures all financial activities remain aligned with regulatory expectations.

Nearshore models also diversify operational risk. If an onshore team experiences turnover or local disruptions, nearshore teams maintain continuity. This structure provides CFOs with additional protection during times of organizational change.

Integrating Technology With Nearshore Operations

Technology accelerates the performance of any distributed model. Colombian teams use automation tools, workflow systems, and collaboration platforms to improve accuracy and speed. This strengthens the operational foundation of finance business services.

CFOs who integrate nearshore teams into their digital roadmap see improved efficiency across the board. Automation handles volume-heavy tasks. Analysts provide human oversight and quality validation. Leadership gains clearer visibility into performance metrics and bottlenecks.

The combination of people and technology gives organizations the flexibility they need to support expansion, acquisitions, or restructuring efforts with fewer disruptions.

How Nearshore Teams Improve Forecasting and Strategic Planning

Forecasting accuracy is now a leadership priority. Organizations cannot afford delayed insights or inconsistent reporting. Nearshore teams play an important role by preparing data, validating assumptions, and maintaining model discipline.

Colombian analysts support onshore planning teams by:

- Updating key drivers and assumptions

- Validating monthly actuals

- Monitoring spending trends

- Preparing initial forecast drafts

This expanded capacity allows leaders to run more scenarios in less time. CFOs gain a stronger view of business risks and performance shifts. With more reliable planning cycles, companies can move faster and make decisions with greater confidence.

Driving Scalability as the Organization Grows

One of the strongest advantages of Colombian nearshore teams is scalability. Companies can expand or contract their support structure without heavy infrastructure investment. This flexibility is essential for organizations that depend on responsive finance business services.

CFOs also appreciate the ability to recruit specialized talent quickly. Colombia’s workforce includes professionals with backgrounds in accounting, financial planning, data analysis, and shared services. This helps organizations fill skill gaps that are more difficult or expensive to address onshore.

A scalable nearshore model reduces hiring pressure and smooths the transition during growth phases. Organizations can maintain service levels without sacrificing quality.

Building a Finance Model That Supports Long-Term Strategy

The integration of Colombian teams into finance business services has become a strategic move. It helps organizations maintain stable service delivery, expand analytical capabilities, and build long-term resilience.

Leaders using this model gain a more flexible cost structure, improved operational depth, and stronger planning functions. As nearshore teams take on more responsibilities, finance organizations become better equipped to support expansion, transformation, and performance improvement.

Outsourcing Finance Business Services: Strengthening Finance for the Future

The right nearshore model allows CFOs to modernize finance business services and support future growth with confidence. With SuperStaff as your partner, you gain access to trained Colombian teams who bring structure, speed, and reliability to your finance operations.

Explore how SuperStaff can help you build a scalable global model that supports your strategic goals.