In a world where disruptions can halt operations overnight, financial resilience has become a top priority. Companies are reimagining their back-office strategies to weather economic shifts, regulatory changes, and talent shortages. One proven approach? Choosing to outsource AP services.

By outsourcing Accounts Payable (AP) functions, businesses strengthen continuity, reduce costs, and maintain data integrity. Among the many destinations available, Colombia has emerged as a standout hub for reliable, high-quality financial process outsourcing that combines skill, efficiency, and proximity to U.S. markets.

Resilience in Finance Begins With a Strong Back Office

A company’s financial strength is only as solid as its back office. The back office ensures liquidity, compliance, and control—the three pillars that sustain business growth even amid uncertainty.

The Accounts Payable (AP) department, in particular, plays a central role in maintaining these pillars. From managing vendor payments to enforcing compliance and maintaining accurate ledgers, nearshore accounts payable teams keep the financial engine running smoothly. But when inefficiencies, errors, or backlogs occur, they ripple across the organization.

- Organizational stability starts in AP. A single missed invoice or delayed payment can lead to strained vendor relationships and potential disruptions in supply chains.

- Workflow inefficiencies weaken financial control. Manual data entry, paper invoices, and limited visibility create bottlenecks that slow down payment cycles and expose companies to fraud risks.

- Market volatility magnifies existing weaknesses. During economic downturns or sudden growth spurts, companies without agile back-office support face liquidity risks and missed opportunities.

With financial teams under constant pressure to “do more with less,” many forward-thinking organizations are choosing to outsource AP services. This strategy not only eases operational burdens but also builds long-term resilience by ensuring that AP functions remain efficient, compliant, and scalable—no matter the circumstances.

Outsourced AP Services Provide Flexibility, Accuracy, and Cost Efficiency

Traditional AP processes are often slow, expensive, and vulnerable to human error. Outsourcing transforms these workflows into streamlined, intelligent systems managed by skilled professionals equipped with the latest technology.

When you outsource AP services, you gain access to specialized teams that can handle end-to-end invoice processing, reconciliation, and vendor management with unmatched precision.

Here’s how outsourcing reshapes AP performance:

- Real-time automation and reconciliation: Outsourcing partners employ digital tools that capture and process invoices automatically, minimizing human errors and ensuring consistent accuracy.

- Reduced costs and faster payment cycles: By eliminating overhead and automating repetitive tasks, companies save significantly while improving vendor satisfaction through timely payments.

- Specialized expertise without increasing headcount: You can scale AP operations instantly—adding resources during peak periods and streamlining during slower months—without the cost of hiring or training new staff.

Beyond efficiency and savings, outsourcing offers adaptability. Whether a company is expanding into new markets or bracing for economic headwinds, an outsourced AP team provides the agility needed to pivot without losing control.

While outsourcing is beneficial globally, the real strategic advantage lies in where you outsource, and that’s where AP services outsourcing to Colombia enters the picture.

Colombia’s Finance Professionals Are Redefining Nearshore Excellence

Colombia has quickly evolved into Latin America’s financial outsourcing powerhouse. Over the past decade, it has built a strong ecosystem of finance and accounting professionals trained to global standards.

The country’s talent pool offers a blend of technical expertise and cultural compatibility that makes it a top choice for U.S. companies looking to outsource AP services.

Key strengths of Colombia’s financial workforce include:

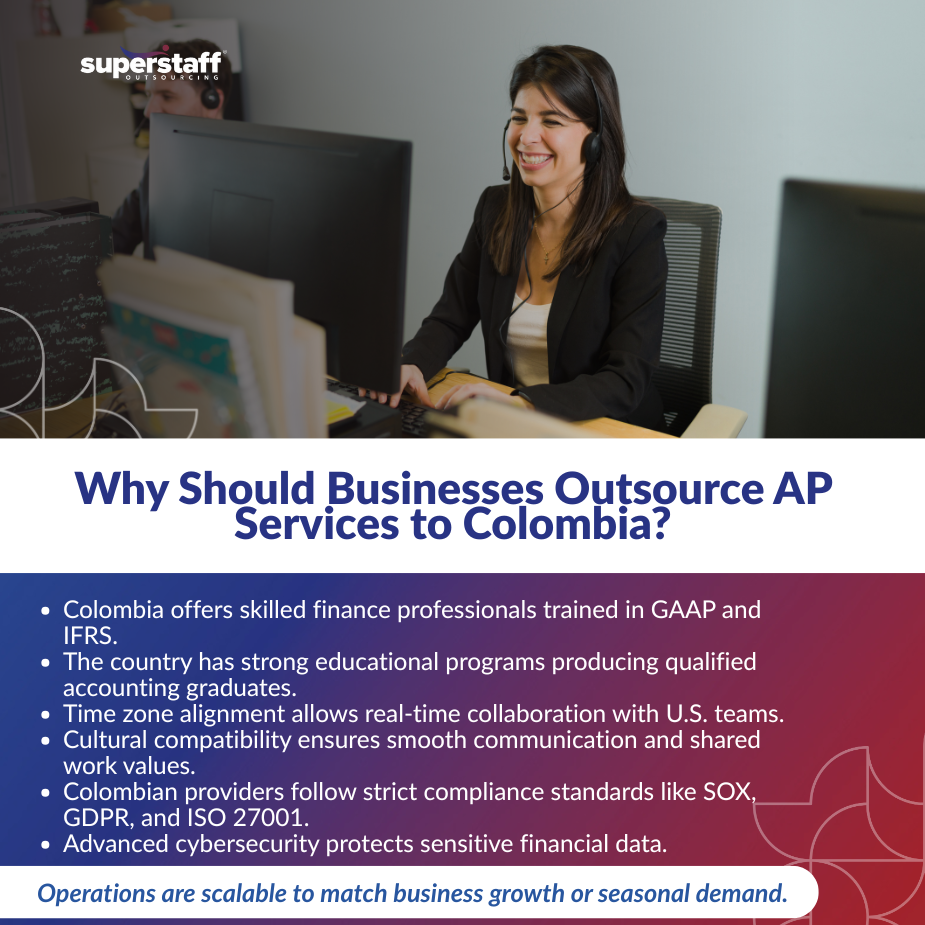

- Proficiency in global accounting standards: Colombian professionals are well-versed in GAAP and IFRS, ensuring seamless compliance with international financial reporting requirements.

- World-class education and training: Top universities such as Universidad de los Andes, EAFIT, and Universidad Nacional produce finance graduates skilled in modern accounting software and analytics.

- Established presence of multinational service centers: Bogotá, Medellín, and Barranquilla have become financial service hubs, housing shared service centers for Fortune 500 companies and global BPO firms.

The combination of advanced education, bilingual proficiency, and experience with international clients positions Colombian AP teams as dependable partners capable of managing high-volume, high-stakes financial operations.

This strong talent base gives companies the confidence that their outsourced AP functions are handled with precision, reliability, and transparency.

Cultural and Time Zone Alignment Make Colombian Teams Ideal Partners for U.S. Finance Departments

When you outsource AP services to Colombia, the collaboration feels less like outsourcing and more like extending your in-house team. The nearshore advantage ensures real-time communication, shared work culture, and aligned business values.

Here’s why alignment matters:

- Overlapping work hours: Colombian professionals operate in time zones that overlap with U.S. business hours, allowing instant communication, faster problem-solving, and real-time reporting.

- Cultural compatibility: Colombia’s business culture emphasizes accountability, collaboration, and professionalism—traits that U.S. finance departments value highly.

- System integration made easy: Colombian teams are experienced with ERP and accounting systems like QuickBooks, NetSuite, and SAP, enabling seamless integration with your internal workflows.

This proximity, both geographic and cultural, means fewer delays, smoother collaboration, and greater transparency. Instead of managing offshore teams across continents and time zones, businesses gain a responsive, connected finance partner that feels just next door.

Beyond convenience, this model also enhances compliance and control. Nearshore teams provide direct oversight, ensuring that critical financial activities remain visible and auditable at all times.

Compliance, Security, and Scalability—The Cornerstones of Colombian AP Outsourcing

Financial operations rely on trust. When outsourcing such sensitive processes, businesses must be confident that their data and compliance standards are never compromised. Colombia’s BPO industry understands this deeply.

When you outsource AP services to Colombia, you work with providers that uphold the highest levels of financial governance and data protection.

- Compliance with international standards: Colombian firms adhere to SOX, GDPR, and ISO 27001 frameworks to ensure secure and compliant operations.

- Robust cybersecurity protocols: Providers invest heavily in advanced encryption, access controls, and real-time monitoring systems to safeguard financial data.

- Scalability for business continuity: Whether a company experiences rapid growth or seasonal fluctuations, Colombian providers can scale operations quickly without compromising accuracy or service levels.

This combination of compliance, security, and scalability transforms AP outsourcing into a strategic risk management tool. Businesses can maintain transparency, prevent fraud, and adapt rapidly to new financial regulations—all while keeping operational costs low.

For companies seeking sustainable growth, outsourcing AP services to Colombia is not merely a cost-cutting move—it’s a way to future-proof financial operations.

Measuring Resilience—Tangible Results From Outsourcing AP Functions

The true impact of outsourcing isn’t measured in promises—it’s seen in performance metrics. Businesses that outsource AP services report measurable improvements across several financial indicators.

- Faster invoice approvals: Streamlined workflows and automated systems cut approval times and accelerate cash flow cycles.

- Improved accuracy and fewer disputes: AI-driven validation and human review reduce invoice errors, resulting in fewer vendor disputes and reconciliation delays.

- Enhanced visibility and reporting: Centralized dashboards offer real-time insights into spending patterns, outstanding liabilities, and payment performance.

- Significant cost savings: Lower labor costs, automation, and optimized processes often reduce AP expenses significantly.

- Strategic reinvestment opportunities: The money saved through outsourcing can be reinvested in technology, growth initiatives, or workforce development.

Beyond financial KPIs, the intangible benefits are equally powerful. Outsourced AP teams enable in-house finance leaders to focus on strategy, forecasting, and risk management—rather than chasing invoices or troubleshooting vendor issues.

In short, nearshore outsourcing brings measurable ROI and long-term resilience, especially when done with the right partner in a high-performing market like Colombia.

Outsource AP Services to the Reliable BPO Team at SuperStaff Colombia

In today’s unpredictable economy, financial resilience isn’t optional—it’s essential. Companies that outsource AP services to Colombia gain more than just cost savings. They gain a strategic partner capable of delivering accuracy, compliance, and agility at scale.

Today, more and more businesses are balancing cost savings and operational resilience by outsourcing AP services to Colombia. By leveraging the LatAm country’s skilled finance professionals, time zone compatibility, and culture of excellence, businesses can build a resilient back office ready to thrive in any market condition.

Partner with SuperStaff to strengthen your financial backbone. Our expert teams in Colombia deliver reliable AP outsourcing solutions that combine technology, precision, and people-first service—keeping your operations efficient, compliant, and future-ready.