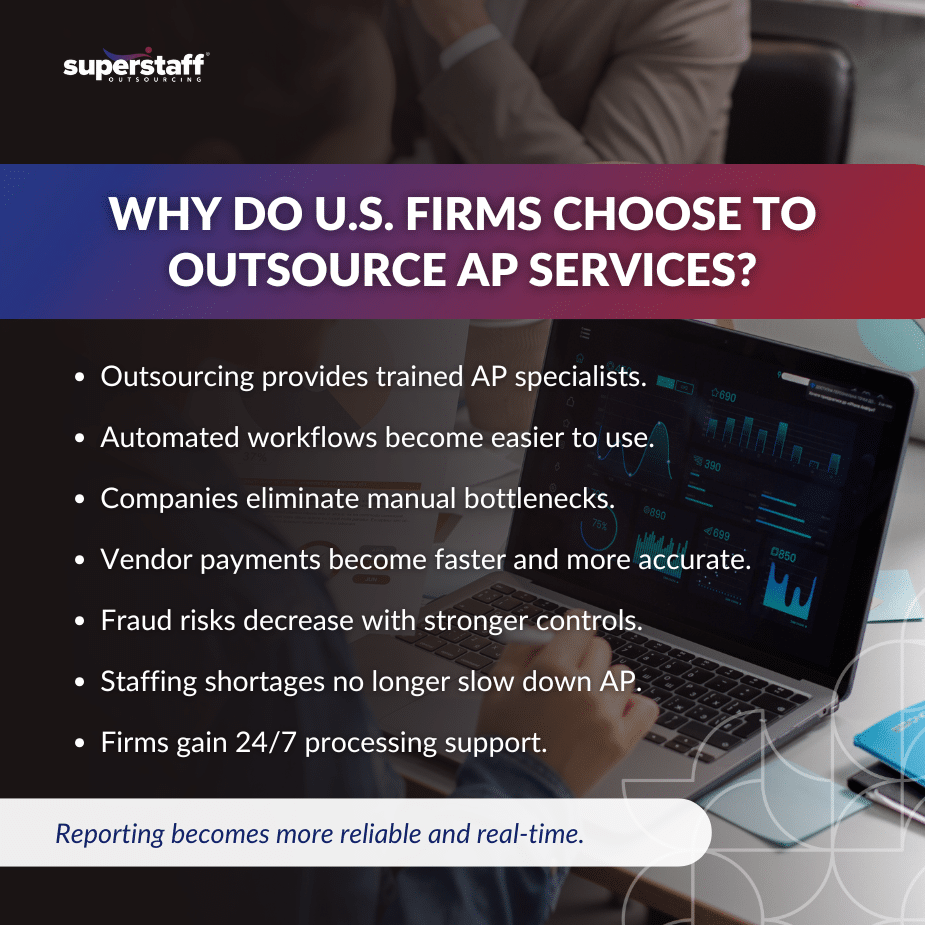

Finance teams today face a very different kind of pressure. Beyond accuracy and deadlines, they now carry the weight of rising regulatory scrutiny, complex digital ecosystems, increasing payment volumes, and the need for real-time financial visibility. The old way of doing accounts payable simply doesn’t hold up anymore. U.S. businesses are rewriting their operational playbooks, and one strategic decision appears again and again at the center: the decision to outsource AP services.

For midmarket companies, high-growth firms, and even established enterprises, the AP function has evolved from “back office task” to “critical compliance engine.” Yet hiring, training, and maintaining in-house AP specialists have become harder and more expensive. Regulatory updates move faster than internal teams can keep up. Technology systems require specialized skills. And manual bottlenecks still cost companies time, accuracy, and money.

This is why more companies are choosing to outsource AP services as their path to better compliance, higher productivity, and leaner operations. Outsourcing is no longer simply about reducing costs. It has become a way to ensure financial governance, avoid penalties, strengthen vendor relationships, and give CFOs the visibility they need to make strategic decisions.

Below is a deep dive into how accounts payable outsourcing transforms one of the most tedious functions into a modern, tech-enabled, compliant financial workflow.

The Compliance Burden Has Become Too Heavy for In-House Teams Alone

Regulatory pressure is one of the biggest drivers behind the decision to outsource AP services. Over the last five years, AP compliance has become significantly more complex. Businesses are navigating:

- More stringent IRS reporting rules

- State-level tax variations

- E-invoicing mandates

- Fraud risks heightened by digital payment expansion

- Growing SOX, HIPAA (for healthcare), and PCI compliance requirements

- Vendor due diligence obligations

- Documentation retention standards

For many companies, their AP teams were never built to handle this level of compliance. A single mistake—like incorrect vendor classification or a mismatched invoice—can lead to penalties, audits, or disrupted vendor relationships.

When businesses outsource AP services, they gain access to teams who live and breathe these regulations daily. Outsourced specialists are trained to stay up-to-date on the latest compliance changes and follow internal controls rigorously. This reduces risk, ensures consistency, and provides businesses with peace of mind knowing their payables function is built on strong governance.

Digital Transformation Has Raised the Bar for AP Productivity

Digital workflows have redefined what “fast and accurate AP” should look like. Vendors expect immediate acknowledgment. Leaders expect dashboards and real-time payment visibility. And AP teams must orchestrate:

- AI-driven data extraction

- OCR tools

- AP automation platforms

- E-payment portals

- Reconciliation software

- ERP integrations

- Multi-approval routing rules

Yet many U.S. companies fail to leverage these tools fully because:

- Their teams lack sufficient training.

- They don’t have in-house specialists to manage these platforms.

- They struggle with implementation and change management.

- They still rely on partial manual workflows.

The result: bottlenecks, errors, duplicate payments, and slow vendor processing.

To keep pace, organizations outsource AP services to teams who are already trained on AP automation tools and digital workflows. They get immediate access to specialists who know how to build a streamlined AP system—without spending months on hiring, training, or platform rollout.

This move doesn’t just reduce workload; it elevates the entire AP function.

Speed, Accuracy, and Scalability Are Now Competitive Advantages

Companies no longer view outsourced finance and accounting as a cost center. It is now a strategic contributor to business continuity and competitive advantage. Fast and accurate payments:

- Strengthen vendor trust

- Improve inventory flow

- Prevent operational slowdowns

- Reduce invoice disputes

- Support business growth

But achieving these outcomes requires reliable staffing—and staffing AP roles in the U.S. has become difficult. The accounting talent shortage continues, and AP roles have some of the highest turnover rates in finance departments.

This challenge is why many firms choose to outsource AP services instead of battling recruitment shortages. Outsourcing creates a stable, predictable workflow because it gives companies:

- Around-the-clock processing

- Error-free invoice handling

- Quick approval routing

- Built-in redundancy to prevent disruptions

- A scalable team that grows with transaction volume

- Real-time monitoring and status reports

This is how businesses eliminate bottlenecks and maintain uninterrupted financial operations—even during peak months like Q4 or tax season.

Fraud Prevention Has Become a Critical AP Priority

The rise in digital payments has also led to more sophisticated fraud attempts:

- Business email compromise schemes

- Vendor impersonation

- Invoice tampering

- ACH payment diversion

- Duplicate billing

- Identity spoofing

AP teams are now expected to prevent fraud, detect anomalies, and uphold verification protocols on top of their day-to-day responsibilities.

When companies outsource AP services, they gain a partner that enforces strict internal controls such as:

- Multi-layered vendor validation

- Segregation of duties

- Audit trails

- Approval hierarchies

- Document authentication

- Payment release verification

- Real-time fraud flagging

These functions are difficult to sustain internally, especially for midmarket companies with lean finance teams.

Outsourced AP teams operate with an “always on” fraud-prevention mindset, significantly reducing financial exposure.

The Talent Advantage: Outsourcing Gives Firms Access to Skilled AP Specialists

The skill gap is one of the most underrated reasons companies outsource AP services. AP excellence requires more than data entry. It demands specialists who understand:

- ERP management

- Invoice-to-pay cycles

- Multi-currency payments

- Vendor communication

- Compliance workflows

- Three-way matching

- Reporting and reconciliation

- Dispute resolution

- Payment scheduling

- Automation platform use

These skill sets are expensive and difficult to build internally.

Outsourcing provides immediate access to trained, certified, and experienced AP specialists who can plug into a business’s existing processes and elevate them.

This is no longer “transactional outsourcing.” It is talent acquisition—aligned with business continuity, control, and accuracy.

Cost Efficiency Is Still a Major Benefit, but It’s No Longer the Only One

Yes, outsourcing still reduces operational costs significantly—but today’s CFOs value far more than savings alone. Outsourcing allows companies to:

- Convert fixed labor costs into predictable variable costs

- Reduce overhead

- Eliminate recruitment expenses

- Avoid costly compliance mistakes

- Cut late payment fees

- Minimize payment errors and rework costs

- Improve ROI from AP automation tools

But the real ROI comes from revenue protection and operational efficiency.

When businesses outsource AP services, they no longer lose revenue due to process delays, inventory shortages, or vendor dissatisfaction. Smooth operations translate to stronger supply chains and better long-term financial outcomes.

Better Reporting Means Better Decisions

AP plays a central role in strategic planning. Cash flow forecasting, inventory planning, vendor negotiations, and procurement decisions all depend on accurate, timely AP data.

Yet many internal AP teams struggle to produce consistent, high-quality reporting because they’re overwhelmed with manual work.

Outsourcing solves this by providing:

- Real-time dashboards

- Automated reporting

- Monthly, quarterly, or on-demand financial summaries

- AP aging reports

- Vendor performance tracking

- Accrual reports

- Cash flow insights

With reliable reporting, leaders make smarter decisions—and make them faster.

This is how companies achieve a modern finance operation: through visibility, predictability, and actionable insights powered by a dedicated outsourced team.

Why U.S. Businesses Are Turning to the Philippines for AP Outsourcing

While outsourcing markets exist worldwide, the Philippines stands out as one of the most preferred destinations for AP outsourcing due to:

- A strong talent pool specializing in finance, accounting, and shared services

- High English proficiency and cultural alignment with U.S. businesses

- 24/7 operational capability

- Global-standard compliance knowledge

- Experience with top ERP systems and AP automation platforms

- Service quality focused on accuracy and speed

This makes the Philippines a reliable extension of U.S. finance teams—offering both consistency and cost efficiency.

Outsource AP Services to the Expert Team at SuperStaff

The question for U.S. businesses is no longer “Should we outsource?” but “How soon can we outsource and modernize our AP function?”

Today’s finance leaders recognize that the fastest path toward accuracy, compliance, and productivity is to outsource AP services. It is the most practical, scalable, and strategic move a company can make to strengthen financial governance and support business growth.

Outsourced AP is no longer a workaround. It is the new finance playbook. And SuperStaff is here to help U.S. companies streamline and optimize their financial operations.

Are you wondering why nearshore finance teams are ideal for AP outsourcing? Contact us to learn more about our financial service outsourcing solutions!