According to an August 12, 2024, official White House announcement, the Biden-Harris administration officially launched its response to American consumers’ growing frustration with tedious customer service systems.

The “Time Is Money” initiative encourages companies to prioritize positive customer experiences and avoid inefficient and time-consuming customer service processes and systems.

To cut down on “doom loops,” the Consumer Financial Protection Bureau (CFPB) has ruled that businesses must allow customers to reach human CS representatives with a single button push.

Other organizations, such as the Federal Communications Commission (FCC), the Department of Health and Human Services (HHS), and the Department of Labor (DOL), are looking into making similar legislation for their respective industries.

This article will dive into the White House’s crackdown on customer service doom loops and how it will impact the CX industry. Then, we’ll discuss how businesses like yours can create more personalized, humanized, and empathetic buyer experiences.

Understanding Customer Service ‘Doom Loops’

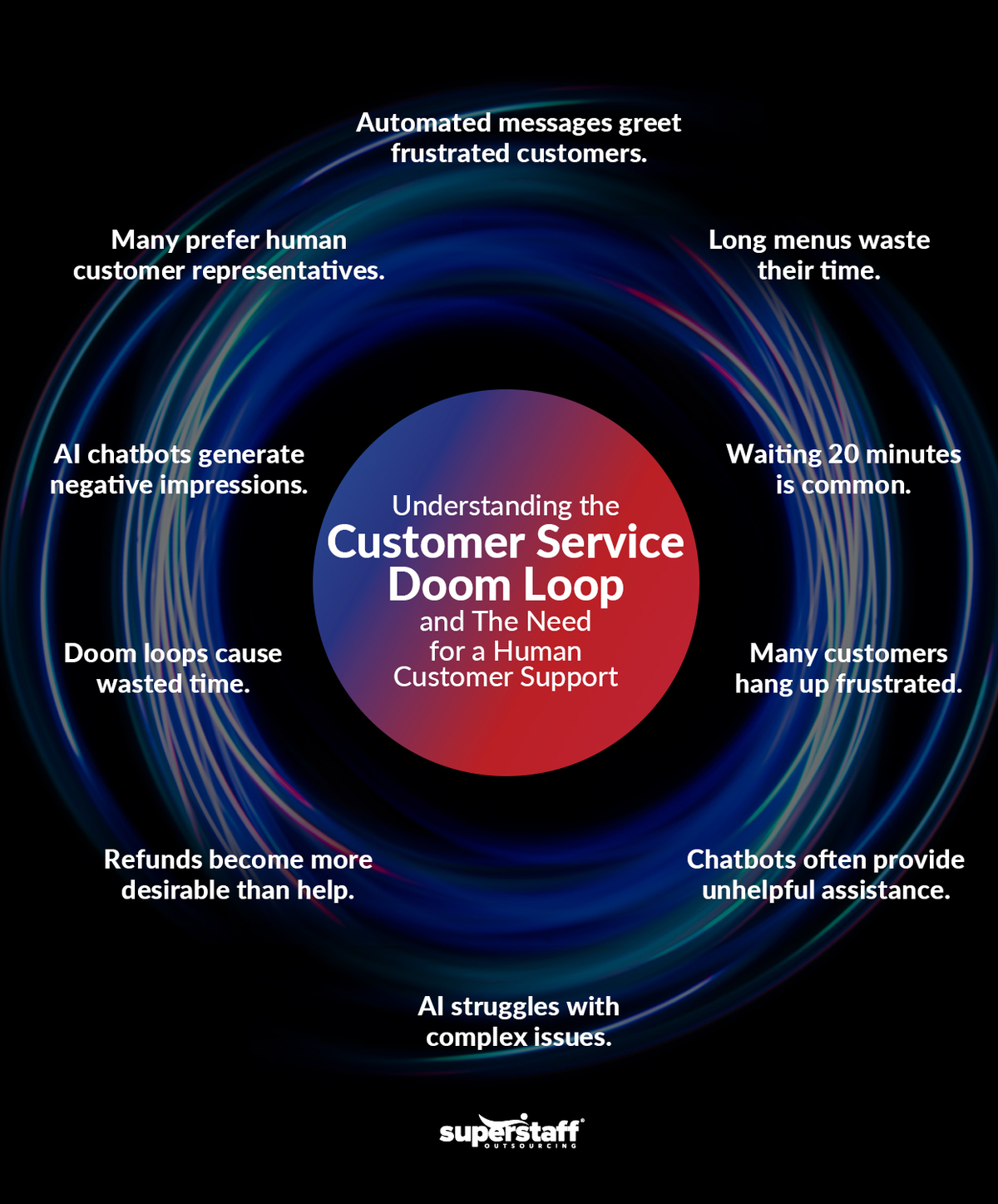

Picture this: A customer recently bought the newest gadget from their favorite consumer electronics brand. They’re excited to try it out, but they’re not very tech-savvy and struggle to operate the device’s complicated features.

Needing guidance, they decide to contact the brand’s customer service department, hoping to be connected with human tech support. However, they are instead greeted by a long and confusing automated message.

They navigate a maze of menu options, pushing numerous buttons, before they can reach the technical assistance they need.

After waiting more than twenty minutes for a live customer service representative, they get frustrated and impatient and quickly hang up the phone. They try their luck by asking for assistance through the brand website’s live chat function.

However, instead of getting connected with a human agent, they contend with an unhelpful AI chatbot that can’t answer their complex issue. Their excitement to try out the new gadget has diminished; they just want to return it to the company for a refund.

This scenario is one example of a customer service “doom loop.” It is a time-wasting and frustrating problem that plagues many of today’s consumers.

In Numbers: How Customers Feel About Customer Service Doom Loops

According to a New York University study, an overwhelming majority of customers (83%) are dissatisfied with interactive voice response (IVR) systems, with many perceiving them as difficult to use. At the same time, over 67% still prefer speaking with a human customer service representative instead of navigating the automated system.

Beyond IVRs, many customers also feel frustrated with unhelpful AI-powered chatbots. In a 2024 Statista survey, over 50% of older consumers (aged 50-54) and 30% of younger customers (aged 18-24) admitted they have a negative impression of companies using AI chatbots instead of human customer support.

With the White House’s newly launched crackdown on “doom loops,” businesses relying on these tools may need to significantly overhaul their customer experience strategies, striking a delicate balance between automation and human-centric service.

Ensuring Accountability for Companies That Provide Poor Customer Service

In addition to eliminating “doom loops,” the Biden-Harris administration’s “Time Is Money” initiative aims to hold companies accountable for their unethical or dishonest practices, particularly regarding deceptive online reviews.

The White House believes consumers have the right to make informed decisions before making purchases. This means they should be able to rely on reviews to assess whether a product is worth buying and whether a brand will provide streamlined and efficient service.

To achieve this, the Federal Trade Commission (FTC) has proposed legislation to stop businesses from using unlawful review and endorsement practices. Examples of illicit practices include suppressing negative feedback, paying for positive online posts, and even faking reviews.

The goal is to prevent deception and allow customers to find real, honest feedback on a company’s products, services, and processes.

The Powerful Role of Reviews in the Customer Experience

How critical are reviews to consumers? According to one survey, 99% of customers say they’ve occasionally read reviews before shopping online, and 98% feel that reviews are an essential resource for helping them make their purchasing decisions.

Some shoppers (79%) even actively seek out websites with the option to leave reviews to learn about the pros and cons of a particular brand, product, or service. The more reviews a product has, the more information shoppers can gather to assist them in purchasing.

Positive and negative feedback can impact a customer’s brand perception. The same study found that 96% of buyers actively seek out negative reviews because they want an honest assessment of a product or service’s quality. Meanwhile, 46% are suspicious of products with too many five-star reviews because they know that some businesses participate in illicit review practices.

FTC’s Proposed Rule on Illicit Review Practices

Having discussed the importance of online reviews in the customer experience, let’s tackle how the FTC’s proposed rule can benefit both businesses and their consumers.

In the previous section, we highlighted that today’s customers have become more suspicious of illicit review practices, impacting their trust in even honest businesses.

If the FTC’s proposal is enforced, companies that engage in these unethical practices will be held accountable, and the number of fake and misleading reviews will be significantly reduced or even eliminated entirely. Honest businesses will have a greater chance of being boosted by positive word-of-mouth.

In time, customers may also develop a more trusting and positive perception of brands, knowing that all reviews they read come from genuine buyers.

Taking on the Limitations and Shortcomings of Customer Service Chatbots

The market size for chatbots grew to $7 billion in 2024, and industry experts project it to reach $20.81 billion in the next five years. These numbers illustrate the widespread adoption of AI-powered chatbots for customer service across different industries.

Leveraging AI and natural language processing (NLP) capabilities, chatbots are helpful for processing text-based queries and giving quick responses. However, many companies may be relying too much on these virtual messenger applications to the detriment of their overall customer experience — this is what the White House’s crackdown on customer service “doom loops” aims to address.

Common Issues Customers Face With Chatbots

Although today’s customers are becoming more open to brands using chatbots, interacting with the AI-powered tool still comes with its fair share of challenges. Here are just a few common problems consumers encounter when talking to a customer service chatbot:

Struggle With Conversational Context

Human interactions are complex and nuanced, with some words or phrases sometimes having different meanings depending on the context. While AI chatbots can pick up the dictionary definition of a word with no issue, the problem starts when customers use slang terms or other speech requiring conversational context.

You wouldn’t want your customers to struggle with framing their questions and concerns just so the chatbot will understand what they’re saying. Ideally, users will have the freedom and flexibility to phrase their feedback and queries in the easiest and most comfortable way.

Lack of Personalization and Empathy

Chatbots follow a defined script, meaning they cannot respond to prompts, queries, or commands not included in their programming. Although it makes sense for companies to maintain restrictive control over their chatbots, ensuring they only answer questions relevant to their products or services, customers may find this too impersonal.

For instance, some customers may feel sad, angry, or frustrated when contacting your customer service department. A human CS representative will acknowledge that their feelings are valid, assure them that their problem will be resolved, and show compassion and understanding. Meanwhile, chatbots cannot personalize their responses depending on the customer’s feelings and tone; instead, they rely on their set script when sending replies.

Inability to Solve Complex Problems

Sometimes, a customer may come to your website’s live chat function, hoping to be connected with a human agent who can help them resolve an urgent issue. Instead, they get connected to a chatbot, which may not understand the context of their issue, leading it to provide an unhelpful response at best and actively misleading information at worst.

While these AI-powered tools are beneficial for giving prompt answers to frequently asked questions, they cannot solve novel and complex problems. This can lead to increased frustration and confusion for your customer, especially if the chatbot isn’t automatically programmed to escalate issues outside of its scope to human support representatives.

The CFPB’s Planned Crackdown on Ineffective Chatbots

As part of the Biden-Harris administration’s mission to encourage consumer-centered business practices, their crackdown on “doom loops” includes addressing the shortcomings of AI chatbots. The Consumer Financial Protection Bureau (CFPB) plans to issue legislation targeting ineffective or time-wasting chatbots, particularly those used by banks and other financial institutions.

Additionally, they plan to identify unlawful uses of automated AI voice recordings and chatbots, particularly in situations where customers think they’re speaking to a human being. The CFPB wants to prevent potential deception and confusion by ensuring that users always know when they’re interacting with AI.

The Road Ahead for the CX Industry: Reclaiming Empathy in Customer Experience

As the White House cracks down on “doom loops,” now is the perfect time for you to reinvent your customer experience strategies. These regulatory changes have highlighted the increasing importance of empathetic, personalized, and humanized customer service.

You now have the opportunity to strengthen your competitive edge by prioritizing human connections and building customer trust. Here are the changes you should anticipate from the latest regulatory developments and how you can leverage them to your advantage:

Navigating the Shift to Human-Centric Service Models

With the “Time Is Money” initiative, the U.S. government encourages companies to embrace a customer-first approach to doing business. This means recognizing the importance of human-centric service models in enhancing overall customer experience.

Despite the growing adoption and acceptance of automated systems and tools, studies have found that people still overwhelmingly prefer talking to other people. As such, CX leaders like you must continually invest in the training and upskilling of human support representatives, teaching them to tailor their approach to each customer and provide the empathetic and engaging service they need and expect.

Building Trust Through Authentic Feedback and Reviews

As mentioned in previous sections, most customers read online reviews before making purchase decisions. Many companies have also destroyed consumer trust by publishing fake positive posts, suppressing honest feedback, and engaging in other unethical and misleading review practices.

To win back customers, honest businesses will benefit from pushing back against these deceptive practices and complying with the FTC’s proposed ruling. Doing so will help build more positive and meaningful customer relationships while boosting word-of-mouth.

Striking a Balance Between AI and Human Interaction

Finally, the future of CX will involve perfecting the balance between automation and human interaction. Leveraging AI tools can help customer service teams streamline and optimize basic tasks, such as compiling data for frequently asked questions and creating customer self-service resources. Chatbots are also helpful for responding to common problems and concerns.

Meanwhile, human agents will still take on complex and nuanced cases, showing customers empathy and compassion while dealing with frustrating problems. In a nutshell, the most effective way to fortify your CX strategy is to use AI to support and strengthen your human customer service teams rather than see the tool as a potential replacement for them.

Stay Updated on the Latest Industry News and Developments With SuperStaff

With the “Time Is Money” initiative, the White House plans to cut down customer service “doom loops” and encourage businesses of all sizes and industries to prioritize positive CX. This regulatory change can potentially empower companies like yours to build consumer trust and enhance overall buyer satisfaction.

At SuperStaff, we are committed to helping our clients provide top-notch customer service outsourcing. Through our comprehensive and scalable call center outsourcing solutions, we can help you strike a perfect balance between automation and human-centric customer support.

Follow us on LinkedIn or browse our website to stay updated on the latest business news, trends, and innovations. If you’re ready to take your outsourcing journey to the next level, contact us for a quick consultation!