Tax preparation is one of the most challenging and time-consuming tasks for businesses of all sizes. Filing requirements, strict deadlines, and constantly changing regulations make it difficult to manage tax functions in-house. Mistakes can lead to penalties, while delays may disrupt operations. To address these challenges, many companies are turning to outsourcing tax preparation. By working with professional partners, businesses gain access to expertise, reduce costs, and maintain compliance more effectively. This article explores the advantages, risks, and long-term value of outsourcing tax preparation for companies looking to improve efficiency and accuracy.

Why Businesses Choose Outsourcing Tax Preparation

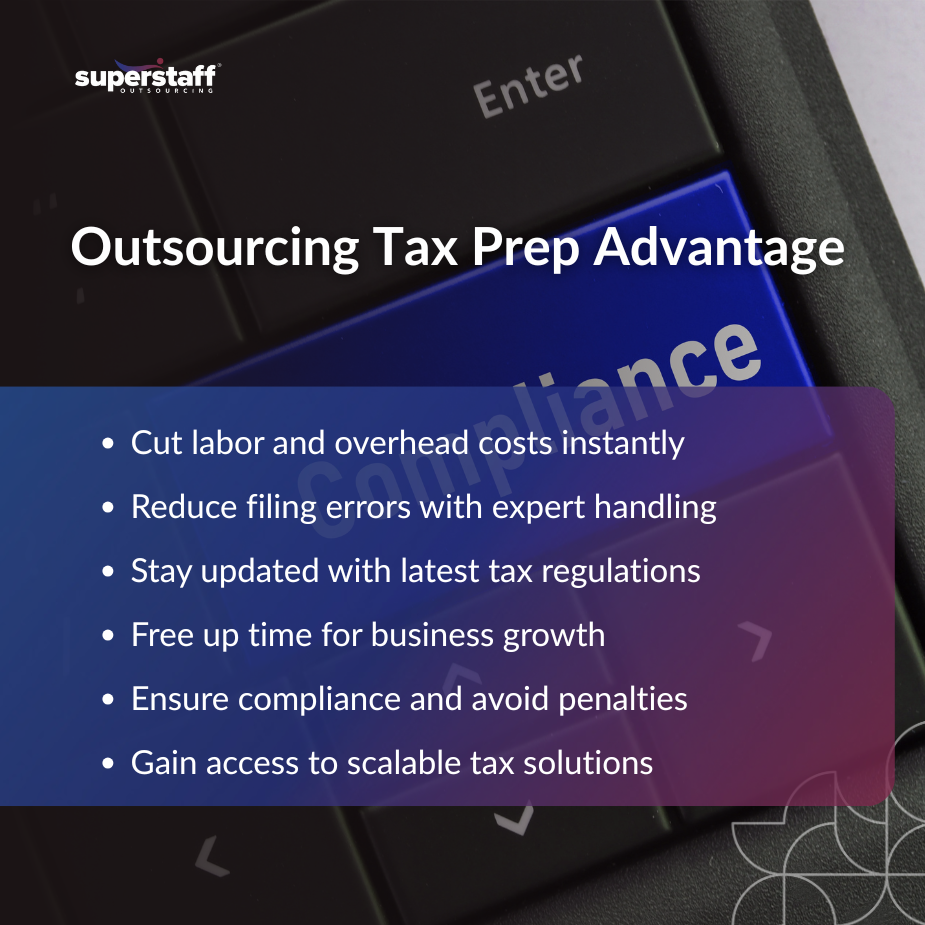

Outsourcing tax preparation has become a common solution for organizations that want to save time, reduce stress, and minimize risks associated with complex tax work. The reasons behind this trend are practical and measurable.

1. Reduce Operational Costs

Hiring and training an in-house tax team is expensive. Outsourcing tax preparation eliminates the need for full-time staff, lowering payroll and overhead costs.

2. Access to Specialized Knowledge

External providers bring expertise in tax codes, laws, and best practices. This ensures accuracy and reduces the risk of costly mistakes.

3. Better Efficiency During Peak Season

Outsourced partners are equipped to handle heavy workloads during tax season, giving businesses faster turnaround times.

4. Freeing Internal Resources

By outsourcing tax preparation, companies allow their teams to focus on growth initiatives instead of administrative tasks.

5. Leveraging Technology Without Extra Costs

Tax preparation services for businesses often use advanced software and digital tools. Outsourcing removes the need for companies to buy or maintain these systems themselves.

Cost-Saving Advantages of Outsourced Tax Functions

The cost savings and compliance benefits of outsourcing tax preparation make it a valuable strategy for both small and large companies. Cost reduction comes in many forms.

1. Lower Labor Expenses

Businesses avoid salaries, benefits, and training costs required for an in-house tax department.

2. Elimination of Penalties

Errors in tax filing can result in heavy fines. Professional outsourcing partners help businesses avoid these unnecessary expenses.

3. No Software Investments

Tax software is costly to purchase and update. Outsourced providers already have the required tools in place.

4. Transparent Pricing

Most outsourcing firms provide clear pricing models, allowing businesses to plan budgets without hidden costs.

5. Flexible Scaling

Outsourcing tax preparation allows companies to adjust services based on seasonal or annual needs without long-term financial commitments.

Compliance Benefits of Outsourcing Tax Services

Outsourcing does not only reduce expenses. It also strengthens compliance with tax regulations, which is vital for business stability.

1. Staying Current with Tax Laws

Outsourced firms remain updated on national and regional tax requirements, ensuring businesses stay compliant.

2. Reduced Risk of Errors

Accuracy is maintained through structured review processes and experienced professionals.

3. Meeting Deadlines Consistently

Missed filing deadlines can be costly. Outsourced providers ensure the timely submission of reports and filings.

4. Stronger Documentation

Outsourcing partners keep organized records that can be used for audits or future planning.

5. Professional Oversight

Having experts review all tax documents ensures compliance and prevents oversights that could lead to penalties.

Risks of Handling Tax Preparation In-House

Keeping tax functions within the company may appear convenient, but it comes with significant risks that outsourcing can help prevent.

1. High Staffing Costs

Hiring specialized tax professionals in-house is costly, especially for small and mid-sized businesses.

2. Increased Risk of Mistakes

Employees without full expertise may overlook details, leading to penalties and compliance issues.

3. Difficulty Keeping Up with Regulations

Tax laws change frequently. Internal staff may not have the resources to keep up.

4. Seasonal Workload Pressure

Tax season creates a heavy workload for in-house teams, which may result in errors and delays.

5. Limited Access to Advanced Tools

Smaller companies often lack the budget for high-level tax software, putting them at a disadvantage.

How Outsourcing Improves Accuracy and Reliability

Outsourcing tax preparation provides companies with structured systems that reduce errors and improve reporting reliability.

- Certified professionals ensure expertise across industries.

- Advanced software tools streamline tax filing and recordkeeping.

- Review systems minimize the chance of errors.

- Structured workflows guarantee timely filing.

- Compliance checks provide peace of mind.

Long-Term Benefits of Outsourcing Tax Preparation

The advantages of outsourcing tax preparation extend beyond immediate cost savings and compliance. They support broader business goals.

1. Strategic Focus

Leaders can focus on growth, operations, and customers instead of tax-related tasks.

2. Stronger Financial Planning

Accurate tax data helps businesses make smarter financial decisions.

3. Stress Reduction During Tax Season

With outsourcing, the pressure on internal teams is reduced.

4. Confidence in Compliance

Businesses gain assurance that their filings are accurate and timely.

5. Scalable Services

As companies grow, outsourced providers can adjust support to meet increased demands.

SuperStaff’s Role in Tax Preparation Outsourcing

SuperStaff understands the needs of businesses that want cost savings and compliance benefits of outsourcing tax preparation. The company provides access to skilled professionals, advanced tools, and scalable services. With a focus on accuracy, efficiency, and reliability, SuperStaff helps organizations reduce risks, lower costs, and maintain compliance with confidence.

Outsource Taxes for Savings, Accuracy, and Compliance

Outsourcing tax preparation provides a clear path toward efficiency, savings, and compliance. Businesses reduce costs, avoid penalties, and gain access to professionals who handle tax complexities with accuracy. By choosing a reliable partner, companies ensure that tax preparation services for businesses are delivered with consistency and value.

SuperStaff supports organizations by providing tailored tax outsourcing solutions that balance affordability with expertise. Partnering with SuperStaff helps businesses save time, improve compliance, and redirect resources toward growth.

Outsourcing tax preparation is not only a way to cut costs but also a strategy for improving compliance and long-term financial stability. Companies that rely on experienced outsourcing partners can focus on growth while staying confident that their tax functions are handled correctly. SuperStaff delivers reliable outsourcing solutions that help businesses achieve efficiency, compliance, and peace of mind.