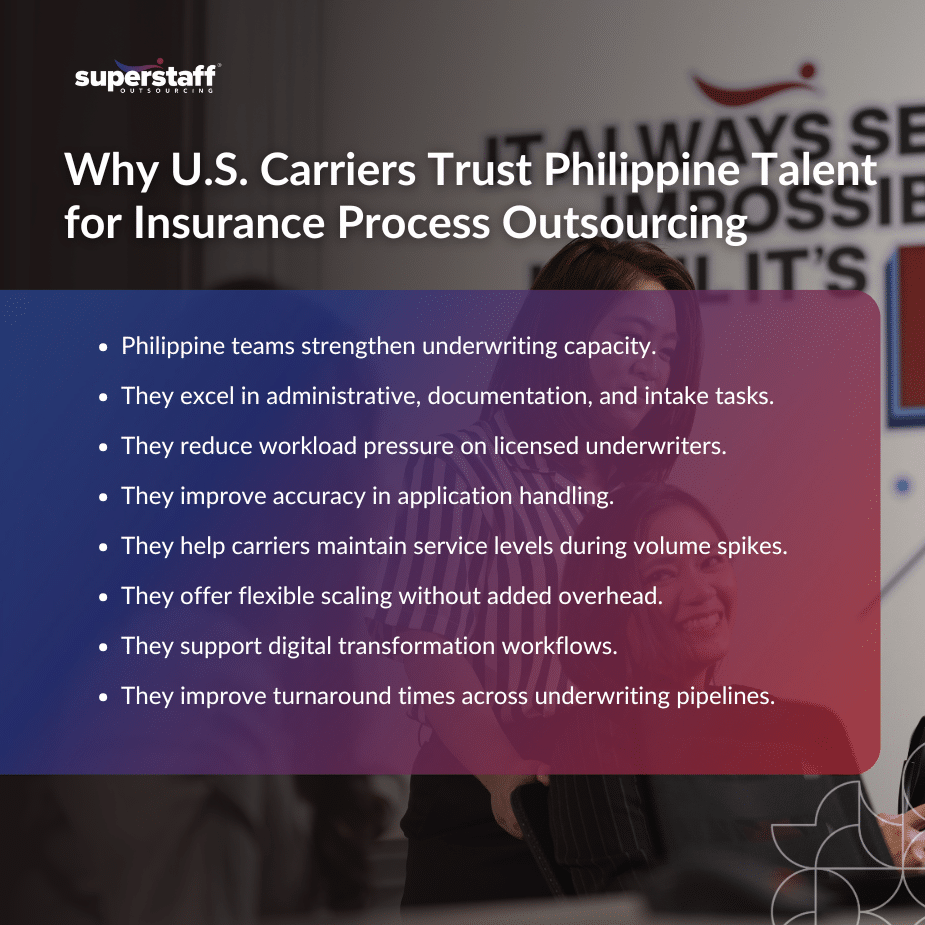

Underwriting teams across the United States are navigating higher workloads, tighter SLAs, and growing customer expectations. Competitive pressure within the industry has made efficiency a core priority for carriers that want to protect margins and deliver faster decisions. At the same time, the administrative load tied to policy setup, document handling, and application review continues to rise. Many insurers now find that their licensed underwriters spend too much time on tasks that do not require licensure but are essential to moving cases forward.

These operational realities have pushed carriers to look for smarter, more sustainable staffing strategies. The Philippines has become a preferred destination for underwriting support because it offers a reliable, skilled workforce that strengthens capacity without inflating fixed labor costs.

As carriers shift toward more flexible service models, insurance process outsourcing is emerging as a strategic tool that improves continuity, accuracy, and speed across underwriting operations. The result is a support structure that keeps teams productive while helping organizations stay competitive in a demanding environment.

Why Insurance Leaders Look to the Philippines

Carriers today face a familiar challenge. Talent shortages push workloads higher. Compliance standards grow more complex. Customers want fast, accurate decisions with no delays. Philippine teams help fill these operational gaps with trained support specialists who work seamlessly with U.S. underwriting units.

Nearshore and offshore models assist with manual, time-sensitive, and documentation-heavy tasks that often pull licensed underwriters away from core decision-making. Delegating these functions restores balance and lifts overall productivity. It also creates a predictable cost model that helps companies avoid overhead expansions.

Strengthening Underwriting Capacity With Specialized Support

High-performing teams do more than execute tasks. They keep underwriting pipelines moving. This is where Philippine support teams excel. Their training, communication skills, and service-oriented work culture align well with carrier needs.

Common workstreams supported through insurance process outsourcing include:

- Application intake and data verification

- Document collection and follow-through

- Eligibility checks and policy setup

- Risk screening and preliminary assessments

- Quote preparation and referral coordination

- CRM updates and case progress tracking

These underwriting support services help firms stay focused on complex evaluations rather than administrative tasks. When these workflows are consistent, carriers reduce bottlenecks during peak periods and maintain accuracy across teams.

Reducing Operational Overhead Without Losing Control

One of the strongest advantages of insurance process outsourcing is the ability to scale without adding new layers of management or increasing facility costs. Insurance operations outsourcing teams work within existing carrier structures, making it easy to expand or reduce headcount based on policy volume.

This flexibility matters in an industry where demand often fluctuates. Seasonal spikes in auto, home, or specialty lines can put heavy pressure on in-house teams. Outsourcing creates a buffer that absorbs these surges without long-term commitments.

Carriers also maintain full oversight. Workflows stay aligned with their guidelines, documentation standards, and risk frameworks. The model gives leadership control over process quality while easing the administrative burden on internal managers.

Improving Accuracy Across Underwriting Pipelines

Are you wondering why insurance carriers outsource underwriting to the Philippines? Accuracy affects claim outcomes, customer satisfaction, and compliance readiness. Philippine teams are known for strong attention to detail and consistency. When they work within a structured insurance process outsourcing model, quality improves across multiple touchpoints.

Accuracy benefits show up in scenarios such as:

- Understanding required documents for a specific policy type

- Identifying incomplete submissions and communicating next steps

- Ensuring application data is clean before it reaches licensed underwriters

- Preventing rework caused by missing or misfiled information

These gains may seem incremental, but they have a significant compound effect across daily operations. The stronger the foundational work, the faster and more accurate the underwriting decision becomes.

Maintaining Service Levels Without Hiring Pressures

Many carriers struggle to expand support teams quickly, even when budgets allow. Competition for talent, training requirements, and compliance expectations can extend hiring timelines. Insurance process outsourcing helps companies skip these barriers.

Philippine outsourcing partners provide trained staff who understand insurance workflows and work within strict operational standards. This reduces onboarding timelines and allows carriers to maintain SLA performance during volume surges, staffing gaps, or transitions.

The model is especially useful for midmarket carriers that want enterprise-level support but lack the scale for large internal teams.

Supporting Digital Transformation Efforts

Many insurance companies are improving their technology stacks. Automation, cloud platforms, and customer-facing portals all help enhance service speed. Philippine teams complement these investments by supporting the human work that technology does not fully replace.

Insurance process outsourcing aligns well with digital modernization strategies because it:

- Supports data cleansing, verification, and enrichment

- Manages tasks that require critical thinking and manual review

- Enhances turnaround times for automated underwriting systems

- Ensures process continuity during tech transitions

Technology and outsourcing work together to strengthen efficiency and reduce manual bottlenecks.

Enhancing Customer Satisfaction Through Faster Response Times

Customers expect decisions quickly. Delays in underwriting directly affect retention and acquisition. Philippine support teams help shorten turnaround times by accelerating the front-end work that often slows down case movement.

Tasks such as application setup, document validation, and follow-ups ensure underwriters receive complete files earlier in the process. This helps carriers provide faster responses to brokers, partners, and policyholders.

Insurance process outsourcing also supports multichannel communication efforts, ensuring inquiries move to the right teams without delay. The result is a more reliable customer experience.

Strengthening Compliance Through Consistent Execution

Compliance in insurance is built on discipline. Every document, form, and update must follow internal guidelines. Outsourcing brings structure and consistency to these processes.

Philippine teams follow standard operating procedures aligned with carrier rules. This helps maintain documentation quality and readiness for internal audits. Insurance process outsourcing creates predictable workflows that reduce risk exposure while supporting the organization’s operational integrity.

Why Philippine Talent Continues To Earn Trust

The Philippines remains a preferred location for carriers due to its strong English proficiency, familiarity with U.S. business culture, and stable outsourcing infrastructure. The country has decades of experience supporting financial, legal, and insurance operations for global organizations.

Service consistency, reliability, and a strong customer focus make Philippine teams natural partners for underwriting operations. Carriers gain access to a workforce that understands service-driven environments and handles complex support tasks with precision.

Trust SuperStaff for Reliable Insurance Process Outsourcing

Insurance carriers need ways to scale responsibly, improve accuracy, and streamline underwriting workflows. Strategic insurance process outsourcing helps them accomplish all three goals while controlling overhead and maintaining operational consistency. Philippine teams continue to prove that high-quality support can strengthen underwriting performance without adding internal burden.

SuperStaff helps carriers build reliable, scalable underwriting support teams that fit seamlessly into their existing operations. To explore how our Philippine talent can strengthen your insurance workflows, connect with us today and learn more about our outsourcing solutions.