Accurate budgeting and forecasting have become essential for companies that want stability and resilience. Leaders need visibility they can trust. They need a decision-making engine that helps them move fast without unnecessary risks. Many have found that the most practical way to achieve this clarity is to outsource financial planning. Doing so gives teams access to deeper expertise, broader analysis, and a consistent framework for financial discipline.

Strong budgeting and forecasting are no longer reserved for large enterprises. SMEs and midmarket companies now treat them as core operational requirements. High-quality support ensures every plan is informed, consistent, and aligned with long-term strategy.

The New Pressures Shaping Modern Financial Planning

Companies live in a more complex environment. Markets move faster. Customer expectations shift quickly. Teams must make financial decisions with less room for error. These new pressures create a demand for stronger planning models and disciplined financial processes.

Traditional internal workflows often cannot keep up. Many finance teams are already stretched thin. They juggle forecasting, reporting, variance analysis, cash flow modeling, and scenario planning at the same time. As the workload grows, so does the risk of oversight.

This is why leaders turn to outsourced FP&A. They gain structured support and access to seasoned analysts who understand how to build sustainable financial disciplines. They also gain operational continuity, which is increasingly important for smaller teams.

Why Outsourcing Strengthens Analytical Rigor

Teams that outsource financial planning benefit from analysts trained to look at trends, cost centers, and performance drivers differently. Outsourced FP&A teams evaluate risks and opportunities with more consistency and independence. They apply best practices across sectors, helping companies avoid operational blind spots.

These teams understand how to interpret signals buried in day-to-day data. They build forecasting models that adapt as conditions change. Their inputs are objective. Their insights help leaders move from reactive decisions to proactive planning.

Remote financial planning support also allows companies to expand analytical capacity without expanding payroll. Instead of stretching a small in-house team thin, leaders partner with specialists who can perform deep-dive evaluations at scale.

How Outsourcing Improves Forecasting Accuracy

Accuracy improves when workflows are clear, data is clean, and the process is consistent. This is where financial outsourcing adds measurable value. External FP&A teams establish a predictable rhythm for reporting, reconciliation, and review. They help companies remove guesswork from budgeting.

Here is how accuracy strengthens when organizations outsource financial planning.

- Analysts validate assumptions instead of recycling old templates

- Forecasts are updated more frequently and reflect real conditions

- Trends are examined over longer timelines to reduce bias

- Scenarios are tested with greater discipline

- Leadership receives concise, decision-ready financial insights

This structured foundation gives companies a more reliable planning environment. The result is confidence in both short-term decisions and long-term strategy.

Building Budgets That Respond to Reality

Budgeting often becomes outdated because it relies on static assumptions. Markets, operations, and customer behavior rarely stay still. Outsourced FP&A teams help companies transition to budgets that respond to real-world conditions.

These teams track operational indicators, evaluate variances, and refine spending plans based on performance. They help leaders fund the right priorities instead of pushing through outdated allocations. They also strengthen accountability across business units by providing transparent and timely financial insights.

This dynamic approach helps companies create budgets they can trust throughout the year, not just during the initial approval cycle.

A Smarter Path to Long-Term Financial Strategy

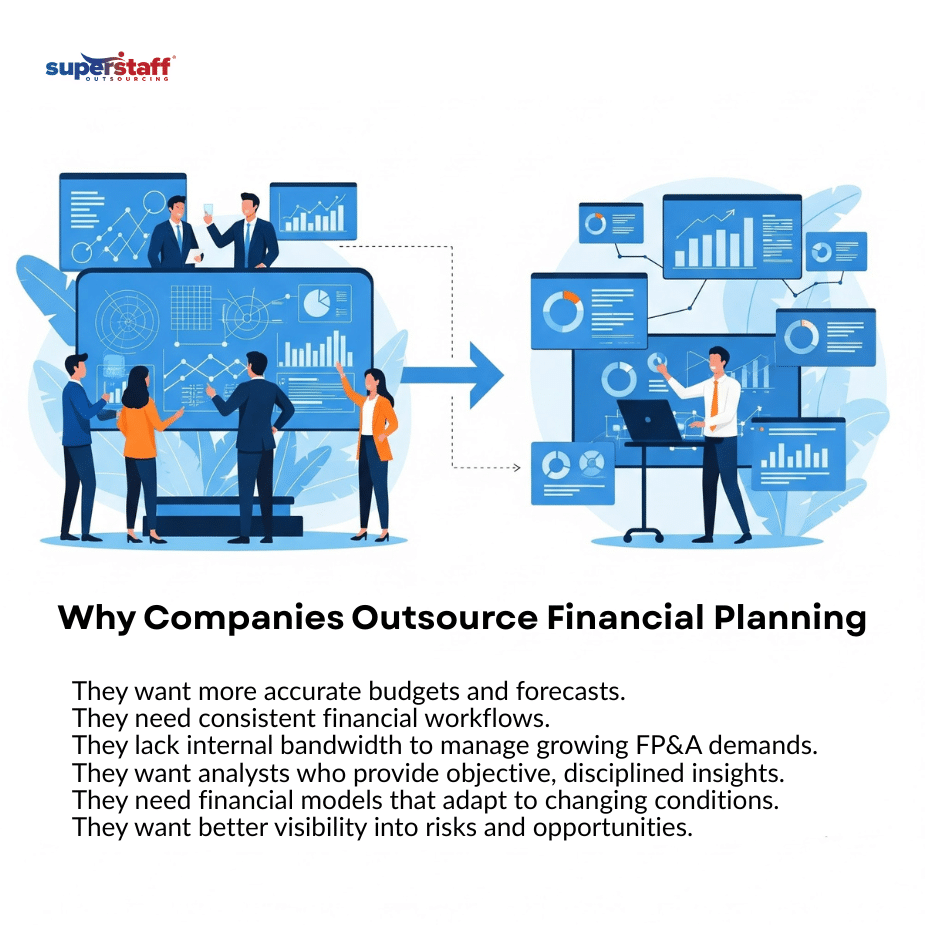

Companies outsource financial planning not because they lack internal capabilities but because they want a more strategic financial system. Outsourcing allows them to build a planning environment that is structured, repeatable, and aligned with growth objectives.

Here is where the impact becomes clear.

- Leaders gain a broader view of risks and opportunities

- Decisions are anchored on analysis, not instinct

- Teams reduce operational friction by removing manual workloads

- Financial models become more accurate as data quality improves

- Forecasts support long-term planning instead of short-term firefighting

Companies also benefit from the operational flexibility that remote financial planning makes possible. They scale support as conditions change. They access specialized skills without increasing fixed costs. This stability helps them navigate periods of growth or uncertainty with more control.

Why More Midmarket Firms Choose Offshore FP&A Teams

Offshore FP&A support gives companies access to high-quality financial talent while maintaining cost efficiency. These teams work in synchronized workflows that fit U.S. time zones and business cycles. They also bring experience supporting diverse industries, which helps them offer broader insight into financial performance.

For smaller finance teams, offshore specialists help ensure reports, forecasts, and models are delivered consistently. For larger teams, they take on recurring analytical tasks so senior leaders can focus on strategy. This creates a more balanced financial ecosystem that supports growth at every stage.

Leaders also value cost-effective financial planning and forecasting outsourcing solutions that enable better accuracy without unnecessary overhead. The ability to scale up during growth cycles and down during slow seasons is especially valuable to midmarket firms that need flexibility.

The Operational Advantages Companies Gain

When companies outsource financial planning, their entire operational rhythm improves. Meetings become more productive because leaders receive clear, concise insights instead of raw spreadsheets. Reporting becomes faster. Decision-making becomes easier.

Companies gain advantages such as:

- More accurate, timely forecasts

- Stronger cash flow visibility

- Clearer operational performance indicators

- Deeper scenario planning

- Better alignment across departments

This structure helps organizations build a forward-looking financial culture.

A Reliable Partner for Growing Companies

Companies that choose to outsource financial planning build stronger internal financial systems. They gain access to specialized analysts who refine their models, streamline reporting, and support smarter decisions. They also free their internal teams from repetitive tasks so they can focus on strategy.

SuperStaff delivers this type of support with a disciplined FP&A framework designed for SMEs and midmarket companies. Our global teams help leaders establish a planning environment that supports growth, strengthens confidence, and creates financial predictability.

Outsource Financial Planning to the BPO Professionals at SuperStaff

Leaders who outsource financial planning gain the accuracy, visibility, and structure they need to move forward with confidence. As market conditions shift, they rely on experienced analysts who help them refine strategy, improve financial discipline, and strengthen decision-making.

SuperStaff provides trusted FP&A support that aligns with long-term goals and adapts to business needs. Talk to our team today to learn how outsourcing can enhance your financial operations and support your next stage of growth.